- Chun Gan and Ke Tang, founders of the platform, are facing conspiracy charges and are currently fugitives.

- The legal action stems from KuCoin’s failure to register its futures and options trades with the regulator.

Federal prosecutors in Manhattan filed charges against KuCoin for alleged money laundering practices, and simultaneously, the U.S. Commodity Futures Trading Commission filed a legal action against KuCoin.

The charges stem from the failure to register its futures and options trades with the appropriate regulatory authority.

The document claims that the exchange, failed to perform the necessary verifications to its customers, allowing the transfer of billions of dollars in illicit funds since its founding in 2017.

Related: SEC Investigation into Ethereum: 3 Theories Explored by a Crypto Legal Expert

According to prosecutors, KuCoin sought business from U.S. customers without proper registration with the Treasury Department, nor did it implement adequate procedures to verify the identity of its customers, as required by U.S. law .

Despite the allegations, KuCoin assured via social network X that customers’ assets are safe and that its lawyers are investigating the allegations.

“KuCoin respects the laws and regulations of various countries and strictly adheres to compliance standards,” the company stated.

In December, KuCoin agreed to block New York users on its platform and pay $22 million to settle the state’s lawsuit, which accused the company of operating without proper registration.

U.S. Attorney General Damian Williams announced the criminal charges against KuCoin and two of its founders, sending a clear message to other crypto industry players about the need to comply with U.S. laws.

You can also read: Binance launches investigation into Solana’s insider trading at BOME and offers $5 million reward

Williams noted in a statement that KuCoin:

“leveraged its sizable U.S. customer base to become one of the largest cryptocurrency derivatives and spot exchanges in the world, with billions of dollars in daily trades and billions of dollars in annual trading volume.“

This case highlights the increasing attention and effort by U.S. regulators to enforce their laws in the cryptocurrency sector, possibly foreshadowing a period of increased regulation for crypto exchange platforms.

🚀 #Bitcoin defies the odds, soaring at $70,000 amidst the storm! 🌪️ While KuCoin grapples with legal battles and AML issues, BTC stands tall as a beacon for crypto believers. A wild ride in the crypto world, but Bitcoin's resilience shines through! 💪 #CryptoUpdate #BTCStrength… pic.twitter.com/JH3NxEG8kR

— Marcel Knobloch aka Collin Brown (@CollinBrownXRP) March 27, 2024

How did this affect bitcoin?

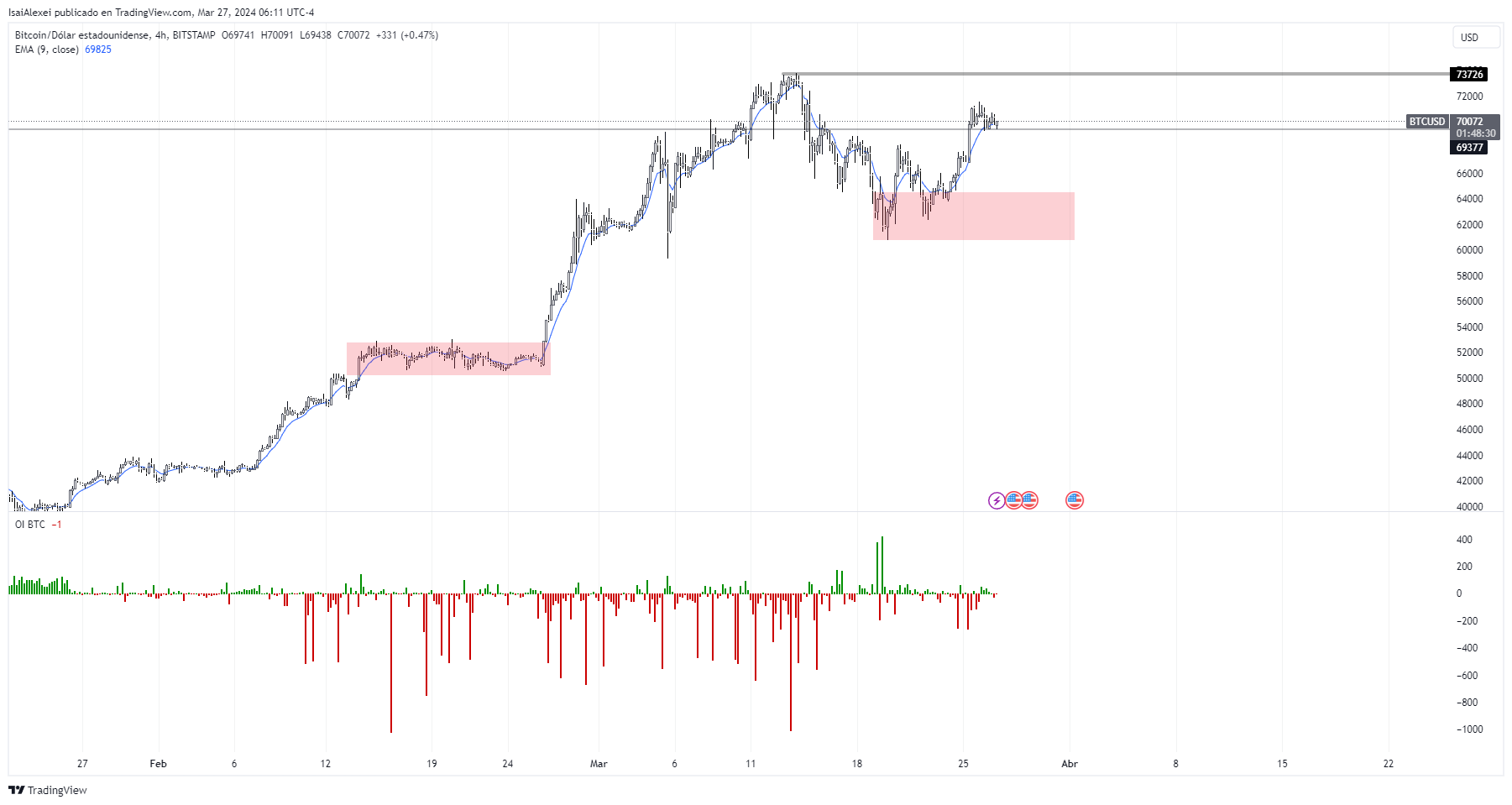

In theory, the actions against Kukoin did not affect Bitcoin to some extent, as it has remained within appreciated ranges in recent weeks, with support at $74,000. But after five days of consecutive net outflows, there was a return of capital to these financial instruments.

Data provided by Farside Investors reveals that ten recently approved Bitcoin ETFs, led by solid inflows into funds from Blackrock and Fidelity, accumulated a combined net inflow of $418 million on March 26.

Fidelity’s fund added about 4,000 Bitcoins making it the second consecutive day the fund recorded inflows in excess of $260 million.

On the other hand, BlackRock’s fund took in $162.2 million in inflows, although these daily figures remained low compared to the daily averages above $300 million recorded earlier in the month.

However, this interest in Bitcoin ETFs could precede a potential pullback in price. In a highly optimistic scenario, the value could decline to $64,800. If sellers fail to reverse the price, there could be a rally towards $74,000.

In addition, there was a drop in open interest (OI) to $5.60 billion, suggesting that market participants are reducing their net positioning and sellers are gaining aggressiveness.

With the price rising and the OI falling, the strength of the uptrend could weaken, potentially leading to a retracement in Bitcoin’s price. Another indicator analyzed was the ratio of Market Value to Realized Value (MVRV), the increase in which signals a greater willingness to sell.

If traders decide to materialize recent gains, Bitcoin could experience a downturn.