- Bitcoin reaches a new all-time high, buoyed by significant ETF inflows and institutional interest.

- Economic indicators and market sentiment continue to influence Bitcoin’s price dynamics, underscoring its integration into the broader financial landscape.

Bitcoin (BTC) has once again captured the spotlight, extending its winning streak to an impressive seven sessions. The digital currency experienced a surge that marked a new all-time high, as BTC surged above $73,000, sending waves of excitement throughout the crypto community, according CoinGecko.

#Bitcoin hits new ATH above $73K pic.twitter.com/2BH7ql7uuT

— CoinGecko (@coingecko) March 13, 2024

The ETF Influence

Central to this rally were the notable inflows into BTC-spot Exchange-Traded Funds (ETFs) on March 11. The iShares Bitcoin Trust (IBIT) led this surge with a staggering $562.9 million in net inflows. Not far behind, the Fidelity Wise Origin Bitcoin Fund (FBTC) witnessed its net inflows jump from $130.3 million to $215.5 million.

This influx of capital underscores the growing confidence and interest from institutional investors in Bitcoin, as formerly reported by ETHNews.

An equally noteworthy development was observed with the VanEck Bitcoin Trust (HODL), which experienced a surge in net inflows from $7.8 million to $118.8 million. This spike can be attributed to VanEck’s strategic decision to waive fees until 2025, a move that has evidently resonated well with investors.

Despite the positive inflows, the BTC-spot ETF market faced a significant challenge from the Grayscale Bitcoin Trust (GBTC), which reported net outflows of $494.1 million. Yet, the overall net inflows to the market from March 8 to March 11 rose from $223.0 million to $505.5 million, showcasing the robust demand for Bitcoin amongst investors.

Macro Factors at Play

The trajectory of Bitcoin was also influenced by broader economic indicators, particularly the U.S. inflation data. A hotter-than-expected U.S. CPI report momentarily dampened the bullish sentiment, causing BTC to drop to a session low of $68,241 on March 12. However, the resilience of Bitcoin was on full display as it quickly regained its footing, climbing back over the $71,000 mark.

Supporting this recovery was the performance of the Nasdaq Composite Index, which rallied 1.54% on Tuesday, ignoring the inflation concerns.

This rally was fuelled by the anticipation of a potential interest rate cut by the Federal Reserve in June, highlighting the interconnected nature of financial markets and the crypto ecosystem. To explore this development in more depth, you can watch the YouTube video below.

Institutional Interest and Market Dynamics

Eric Balchunas, Senior ETF Analyst at Bloomberg Intelligence, highlighted the significant impact of the BTC-spot ETF market on this latest rally, drawing attention to the growing institutional footprint in the crypto space.

Second biggest volume day for the ten and best day in the past five w/ $8.5b (only five stocks traded more). $IBIT went crazy again (double $GLD volume) but the middle of pack really seeing pick-up, $HODL and $BTCO did 150m and 250m, huge for them pic.twitter.com/BsGImq1xeq

— Eric Balchunas (@EricBalchunas) March 12, 2024

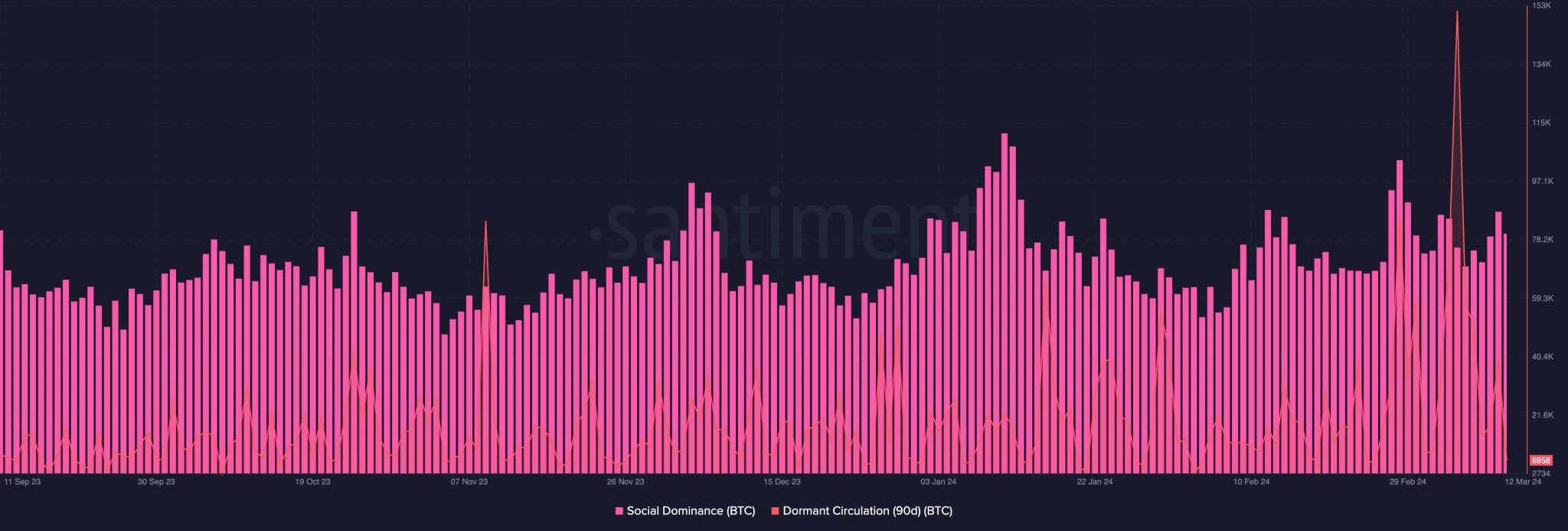

An interesting trend emerged from the analysis of dormant Bitcoin circulation, indicating a rekindled interest from long-term holders. This pattern is traditionally viewed as a confirmation of a bull market.

Furthermore, the Social Dominance metric suggested that despite the current price levels, there is room for further growth, as historical data shows low correlation between Bitcoin’s price and social media discussion in the early stages of bull markets.

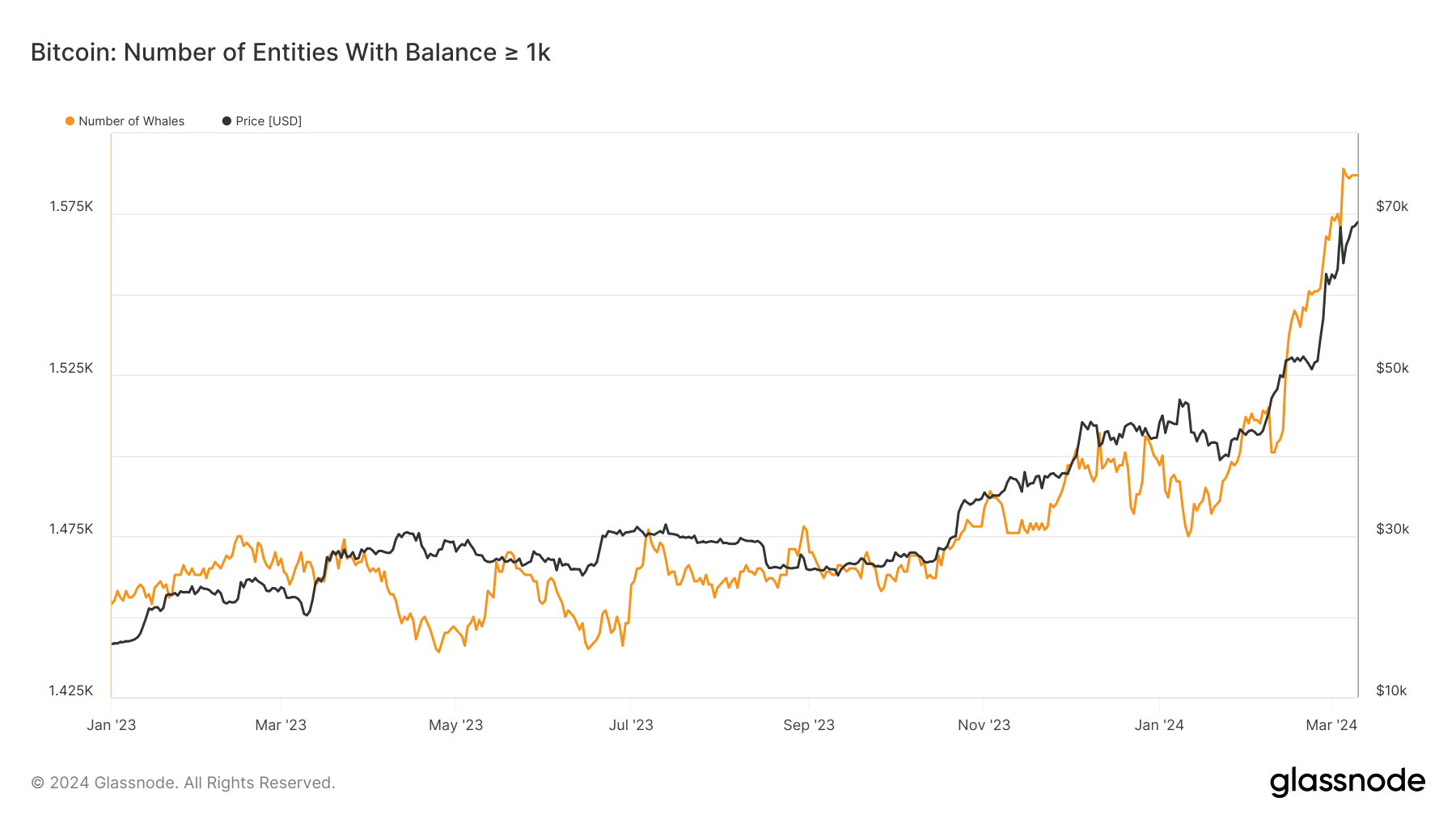

Institutional interest was further evidenced by the steady increase in whale holdings. According to Glassnode data, entities holding at least 1,000 coins grew by 6% year-to-date. This accumulation trend is a strong indicator of confidence in Bitcoin’s future trajectory.

Moreover, data from Hyblock Capital revealed that approximately 60% of all whale positions on Binance were long, signifying a bullish outlook among institutional investors regarding Bitcoin’s potential for further price appreciation.

However, despite the current bullish trend, a recent analysis predicts a potential ‘liquidity crisis’ for Bitcoin ETFs within the next six months due to surging demand outstripping supply, as previously reported by ETHNews.