- Glassnode points out the movement of wealth from enduring holders to traders within the ongoing bull market for Bitcoin.

- The examination by Glassnode uncovers recurring trends of Bitcoin’s cycles, underscoring the interactions among supply, demand, and pricing.

Glassnode, has noticed a change in wealth allocation in the Bitcoin network, seeing assets transition from persistent holders to fresh speculators aiming to capitalize on the present bull market.

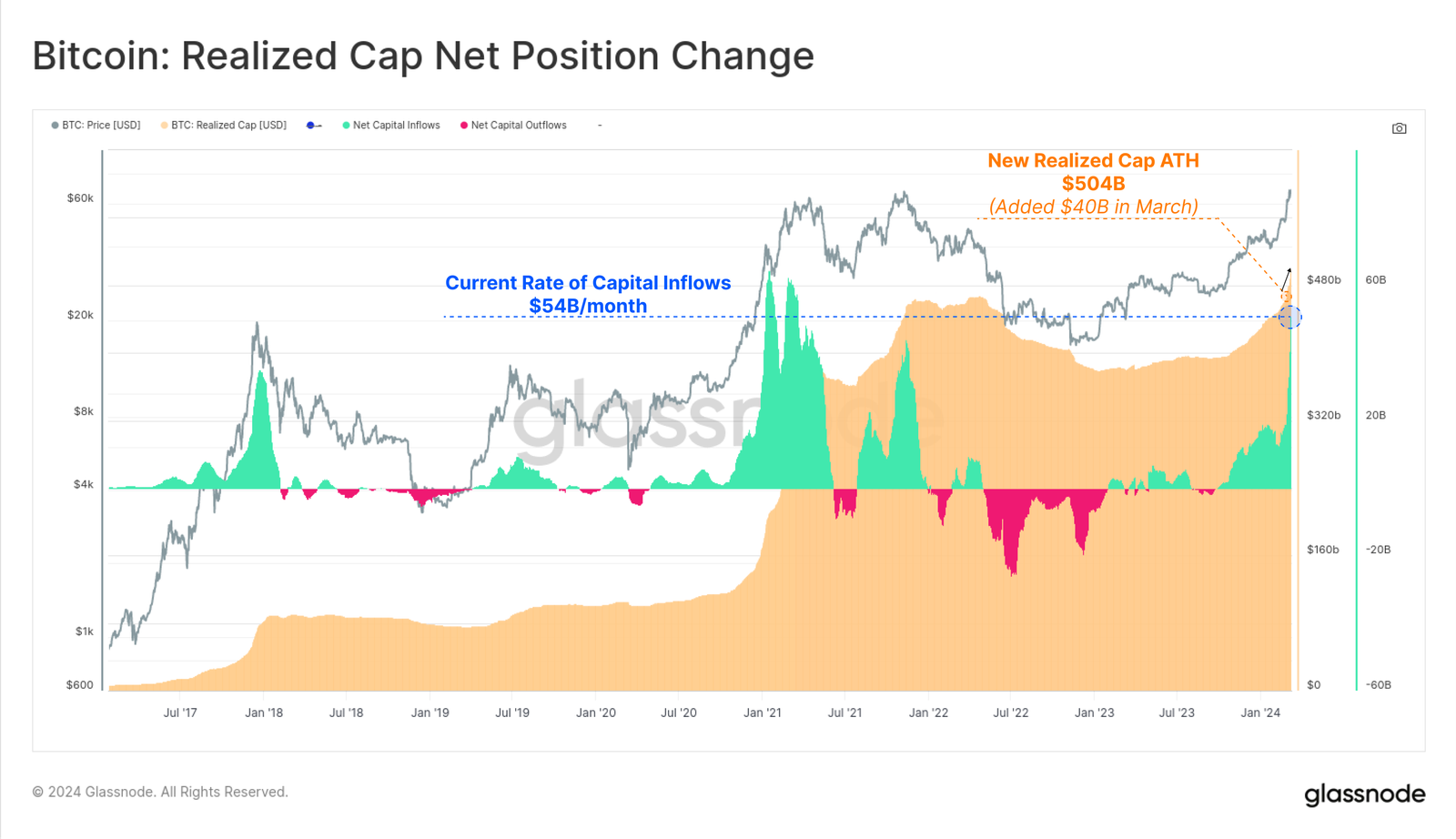

Glassnode’s latest examination shows that as Bitcoin hits unprecedented peaks, speculators join the fray, initiating leveraged futures contracts and mainly purchasing BTC from long-standing investors who have maintained their stakes through the bear market.

Glassnode describes this situation as a “classic transfer of wealth” from long-term holders to speculators, something we have previously discussed on ETHNews. The firm highlighted that bull markets typically peak when young coins – those held for less than three months – account for more than 60% of Bitcoin’s realized market cap. Currently, these coins are below 40%.

Glassnode’s analysis further explains that individuals who acquired BTC at reduced rates several months or years earlier are likely to intensify their selling activities when fresh record highs are established.

This redistribution of assets has resulted in a 138% rise in the share of assets represented by ‘young coins’—those transacted within the past three months—since October 2023, indicating significant expenditures by long-standing investors who had retained their coins for a minimum of three months.

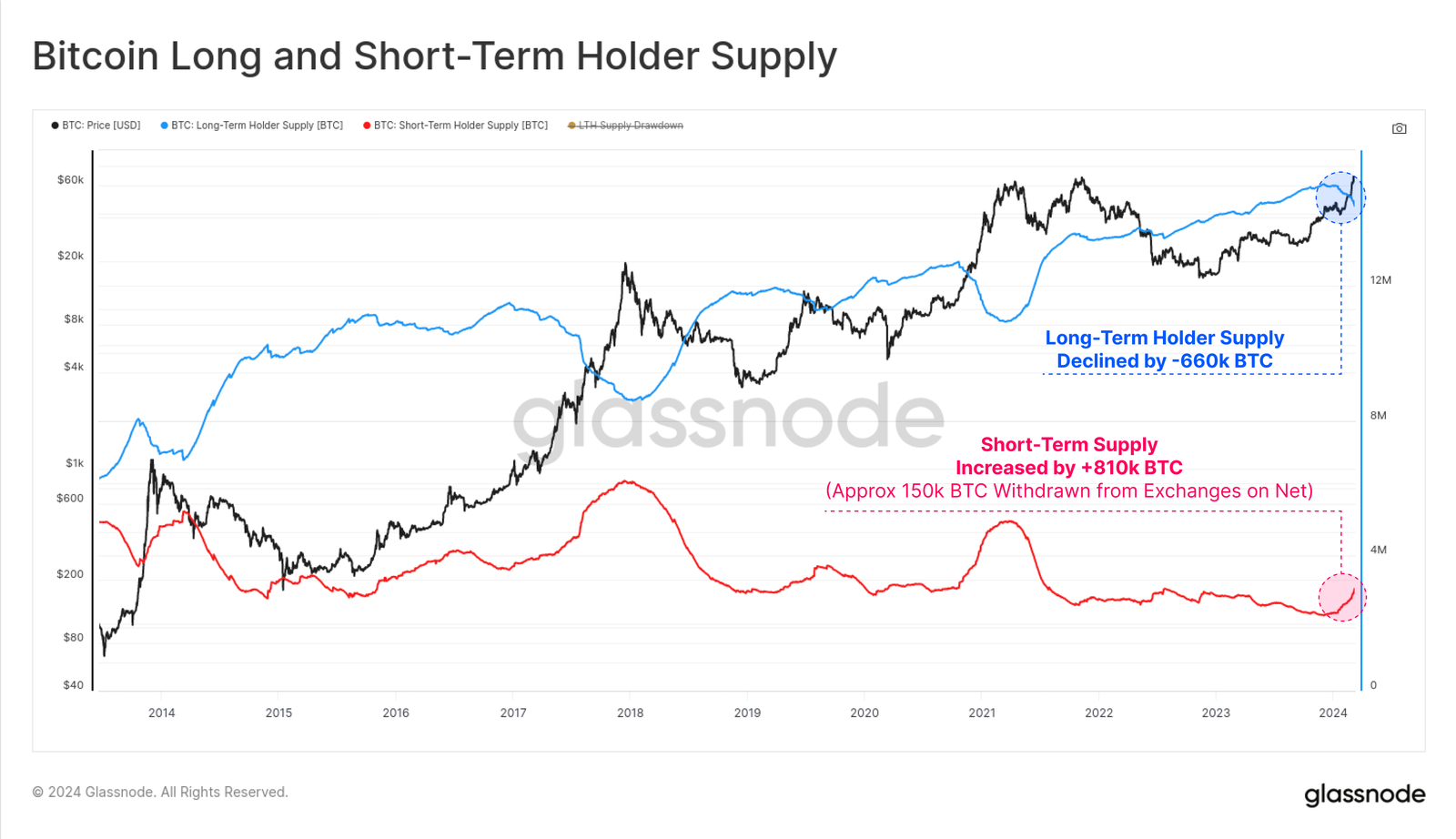

The analytical firm observed that, in line with past market trends, there’s been a significant movement of coins from individuals holding them for extended periods to those holding them briefly, starting from the end of last year.

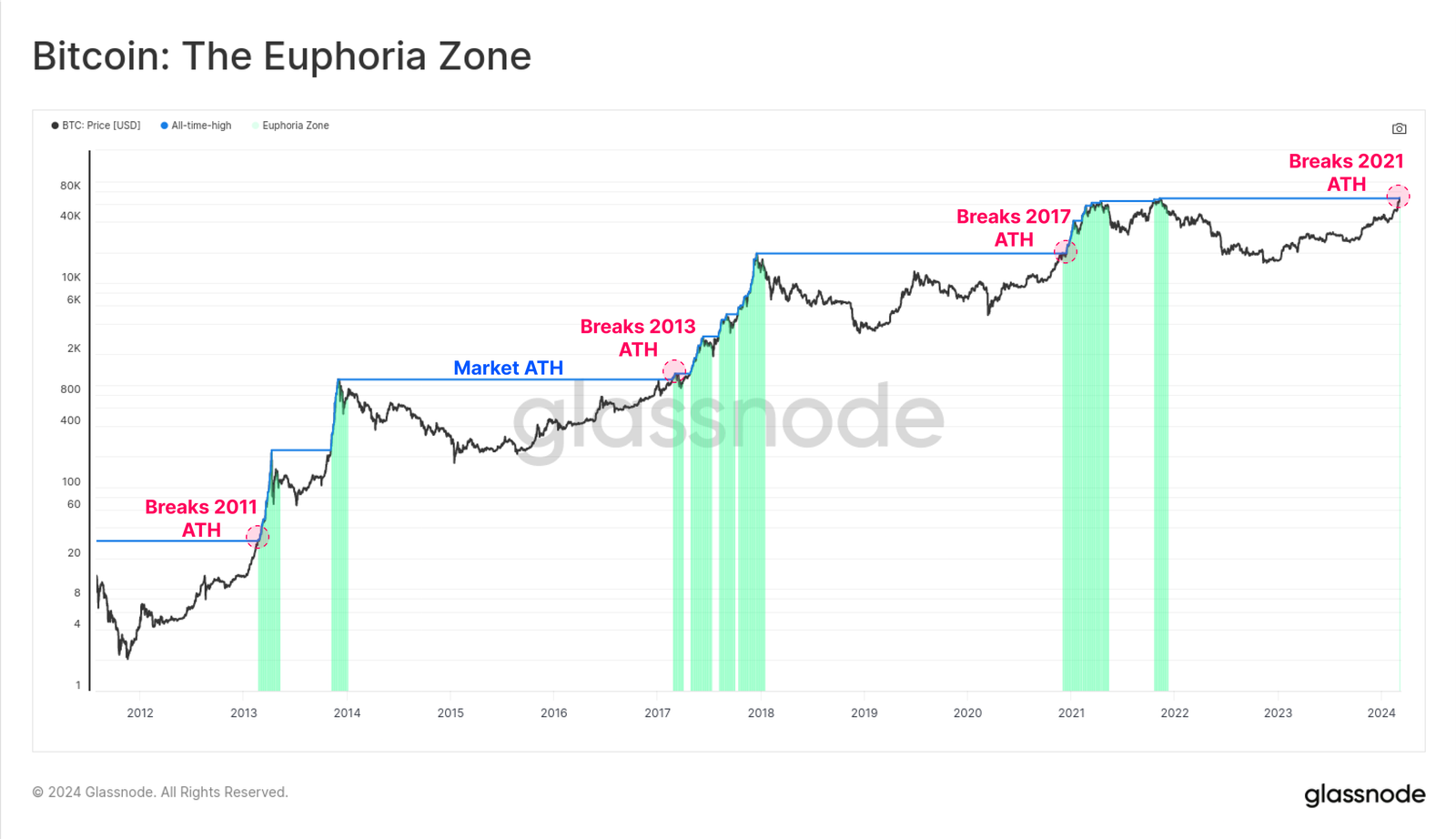

#Bitcoin has broken to its fourth cycle all-time-high, rallying above $72k, and pushing sentiment one step closer to Euphoria.

The classic wealth transfer from the HODLer cohort to speculators is now well underway, with significant upticks in spot profit taking, and demand for… pic.twitter.com/R11kE90W89

— glassnode (@glassnode) March 12, 2024

Since reaching a high in November 2023, the quantity of BTC retained by long-standing holders has decreased by 660,000, whereas short-term holders have acquired an additional 810,000 coins during this period.

This continuous redistribution of assets mirrors trends seen in every past cycle of Bitcoin, indicating not just a shift in the composition of ownership but also the active relationship among supply, demand, and pricing.