- MicroStrategy increases its convertible note offering to $700M, reflecting confidence in Bitcoin and signaling a bullish future.

- Despite a recent massive sell-off and price correction, the market shows resilience and long-term optimism.

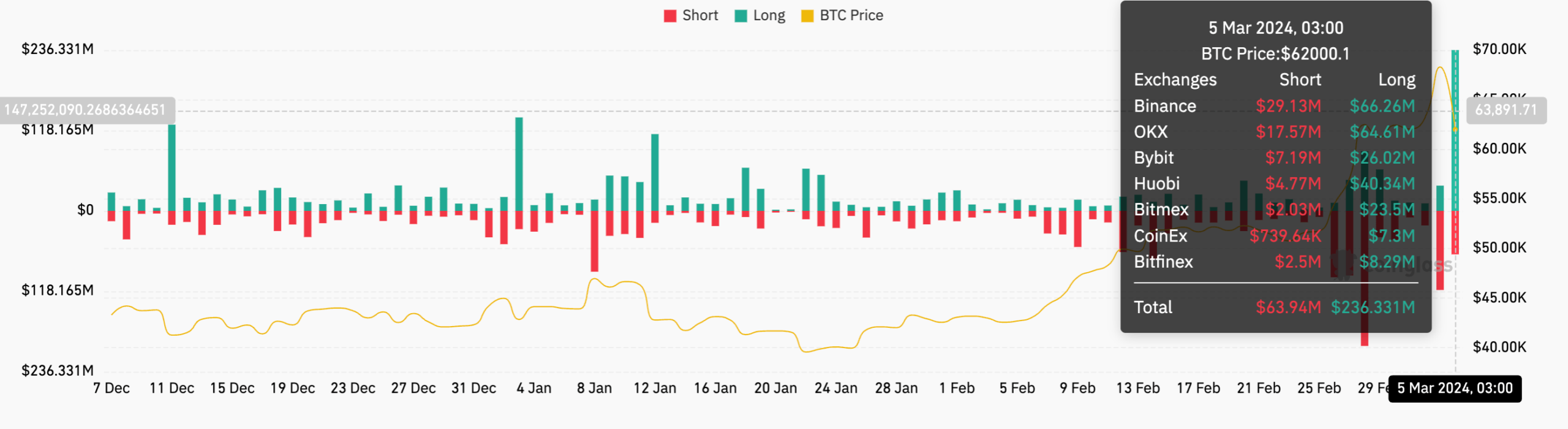

A recent selling event by an anonymous wallet, which unloaded a considerable amount of BTC mined since 2010, introduced a correction in the market. Such events emphasize the volatile nature of this space.

As noted above by ETHNews, it is prudent to remain calm in the face of these fluctuations, considering them part of the normal dynamics of the cryptocurrency market.

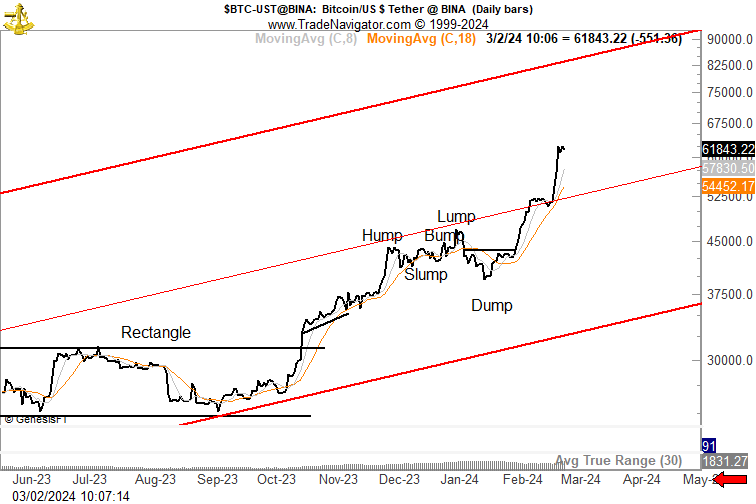

This indicator, has proven to be effective in predicting Bitcoin ($BTC) price trends since the beginning of the year. First, this indicator issued a buy signal in early January, which was followed by a 34% increase in the Bitcoin price.

Then, in mid-February, the indicator gave a sell signal, which preceded a 4.44% decline in Bitcoin’s value. This suggests that the indicator has been a useful tool for anticipating Bitcoin market movements with some accuracy over the aforementioned periods.

But not everything in the cryptocurrency market is a bed of roses. Recently, an unknown wallet decided to sell a significant amount of BTC mined since 2010, triggering a correction in the market. These moves are timely reminders of the volatility inherent in this space.

While these liquidations may raise short-term concerns, they also offer opportunities for a correction that may facilitate more organic Bitcoin price growth, as ETHNews previously reported.

MicroStrategy Announces Pricing of Offering of Convertible Senior Notes $MSTR https://t.co/GBR4yG4Ebk

— Michael Saylor⚡️ (@saylor) March 6, 2024

On another note, MicroStrategy, in a financial maneuver, has raised its offering to sell convertible notes from $600 million to $700 million, with the strategic goal of increasing its Bitcoin holdings.

This action reflects a strong belief in the future value of Bitcoin, sending a powerful signal to the market about the strength and growth potential of cryptocurrencies as financial assets.

As ETHNews had previously reported, these types of financial strategies act as indicators of market sentiment, generating potential contagion effects throughout the crypto ecosystem.

Thus, the expansion of MicroStrategy’s investment in Bitcoin not only reinforces the company’s vision for the financial future of cryptocurrencies but also marks a significant point on the road to mass adoption of these financial technologies.