- Positive technical indicators and a sizable trading volume have supported Litecoin’s (LTC) resiliency with a notable price increase.

- LTC has difficulties competing with Bitcoin and is seen as a “legacy token” in a market that favors more recent cryptocurrencies, despite its upward trend versus USDT.

In the cryptocurrency market, Litecoin (LTC) has emerged as a key player thanks to its remarkable durability and upward trajectory.

Due to an extraordinary spike in trading volume on April 7, Litecoin led an amazing rise, rising in value to around $103 in a matter of hours, an increase of about 5%. This gain, though, was fleeting as the price later in the day reversed most of its upward advance.

Technical Data Suggests a Bullish Trend for LTC

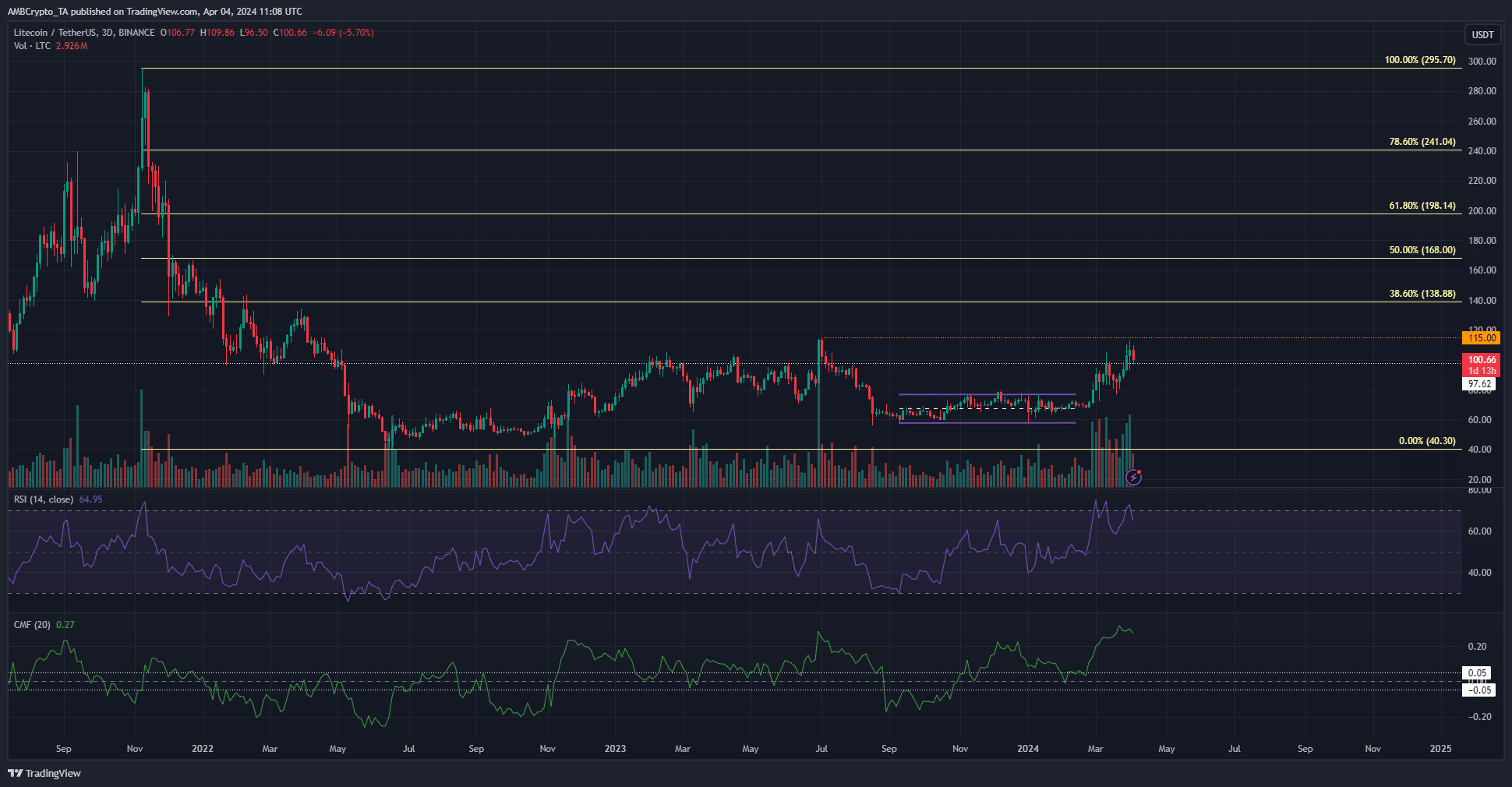

In spite of this volatility, the market structure has changed to a bullish outlook, with the breakout above the Q4 2023 range highs at $79.5. With the exception of June 30th, the trading volume has continuously exceeded the remainder of the year, bolstering the strong technical signs displayed on the 3-day chart.

Both the Chaikin Money Flow (CMF) and the D3 Relative Strength Index (RSI), which show a large inflow of money into the LTC market, further supported the strength of the bullish trend in March. Because of this, prices have increased in recent weeks, inspiring fresh hope among investors.

When the $80 level was retested as support in early March, a crucial milestone was reached. The bulls’ ability to hold this level suggested that there was significant demand for purchases, demonstrating the market’s confidence in Litecoin.

At the time this article was written, the price of the LTC token was hovering around $103.31, up 3.36% from the day before and an astounding 1.5% from the previous week.

This recent spike suggests that there may be a consolidation period ahead of a larger bull run, particularly if LTC is able to maintain a move over $115 on the weekly chart.

Though Litecoin’s structure is optimistic when compared to USDT, it’s crucial to recognize that it has been declining when compared to Bitcoin (BTC) since the beginning of 2023. Fibonacci levels indicate that the LTC/BTC pair may see more losses, which would support the idea that Litecoin is a “legacy token” that is pushed to the back burner in favor of more recent and dynamic cryptocurrencies.

Highlights of Santiment Indicators Positive Trends

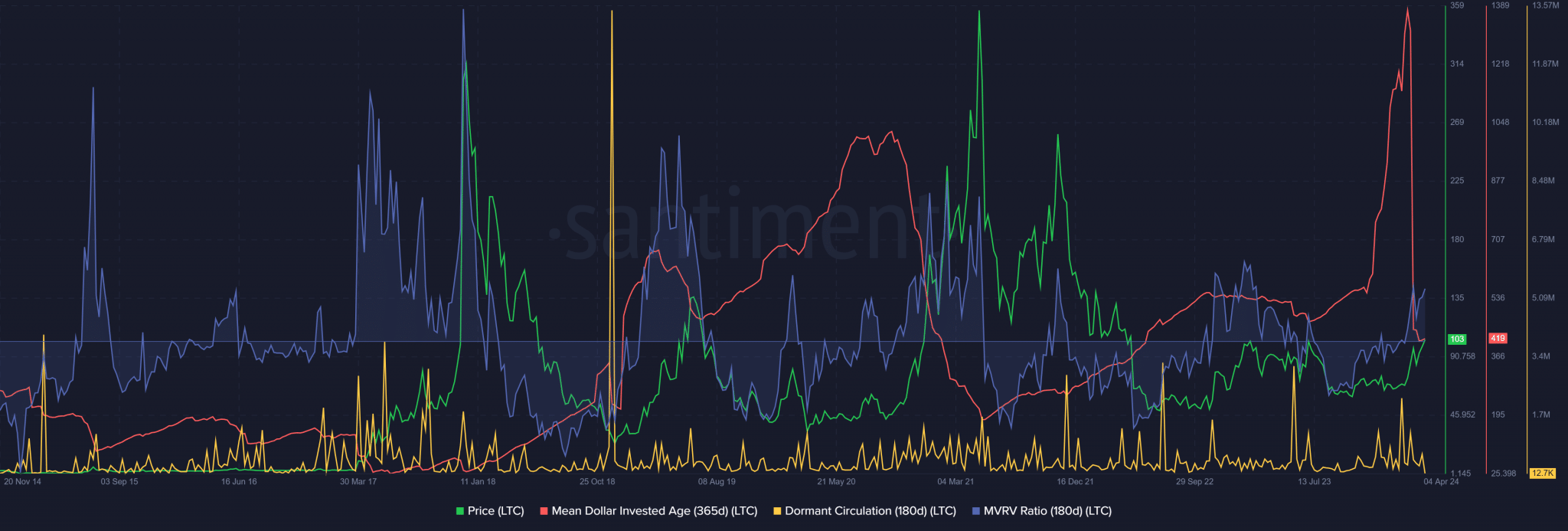

Interestingly, a bullish pattern can be seen when Santiment indicators are examined; as Litecoin prices increased, the Mean Dollar Invested Age (MDIA) decreased. This suggests that older coins are starting to circulate again, a behavior that has been seen during notable uptrends, including the period from May to August 2020.

Positive indicators notwithstanding, difficulties still exist. The large increases in dormant circulation under the $80 resistance in February demonstrate the persistent selling pressure. However, recent market behavior points to a trend toward lessening this kind of pressure.

In the meantime, as ETHNews previously reported, the CFTC has classified Ethereum and Litecoin as commodities in the KuCoin case, marking a significant regulatory development for these cryptocurrencies.