- World Bank recognizes XRP as a stablecoin, driving its use in faster and more efficient cross-border payments.

- Ripple explores lending functionality in XRPL, boosting access to decentralized financial services without smart contracts.

The focus of the crypto community has come to rest on XRP’s classification as a stablecoin by the World Bank, a fact that not only highlights its usefulness in the payments landscape but also raises questions about its future .

What does this recognition imply for XRP and how does it position itself against growth expectations in the market?

Between speculations and strategies

At theepicenter of the discussions, we find Ripple, whose strategic moves, including recent acquisitions, have fueled speculation about the possible issuance of its own stablecoin .

The controversy surrounding the WB’s stance, influenced by XRPL (XRP Ledger) long-term plans to introduce a stablecoin, does not diminish the positive impact this validation has for Ripple.

The fact that an institution as prestigious as the World Bank recognizes XRP significantly increases Ripple’s credibility and XRP’s utility within the financial ecosystem, pointing towards the possibility of XRP evolving into a stablecoin in the future.

The ever-watchful crypto community wonders whether this will mark a new chapter for XRP or instead reaffirm its value as an efficient and stable cross-border payment currency.

Thoughts on XRP’s stability and usefulness

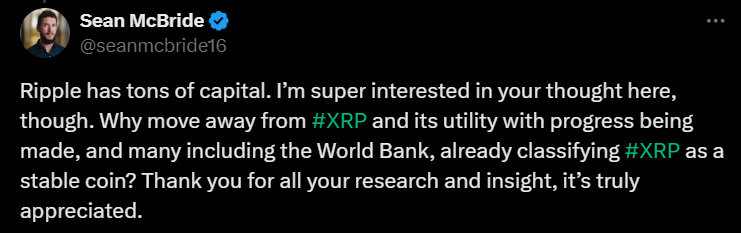

While some members of the crypto community debate XRP volatility and its suitability as a stablecoin, prominent industry figures, such as Sean McBride, former Head of Global Talent Acquisition at Ripple, reiterate confidence in the currency, questioning the need to distance itself from its already recognized utility .

This discussion is amplified by proposals such as WrathofKahneman’s, who suggests using XRP in liquidity pools of AMMs, not to displace its function, but to enhance it.

Automated market makers (AMMs) facilitate the exchange of cryptocurrencies using liquidity pools instead of conventional order books. Participants who contribute their tokens to these pools are rewarded with a fraction of the fees generated for each trade made.

However, this mechanism involves the risk of incurring non-permanent losses. To function properly, AMMs require assets to trade, and this is where XRP can come in.

Users must supply these assets, thus lending to the system, by depositing them in the liquidity pools of AMMs. As compensation, they are issued liquidity tokens.

XRP Between speculation and analysis

XRP price projections generate lofty expectations, with predictions suggesting explosive growth potential based on technical analysis, which is supported by comparisons to previous bull run patterns and Fibonacci analysis, placing XRP on target for a rise in the current market cycle.

Technical analysis of XRP over the past week indicates a slightly bearish trend with a-0.71% decline in value. However, looking at a broader range, XRP has shown a 6.23% increase in the last month and an impressive 44.01% increase in the last year, evidencing an overall positive long-term trend. Currently, XRP is priced at $0.54567 USD.