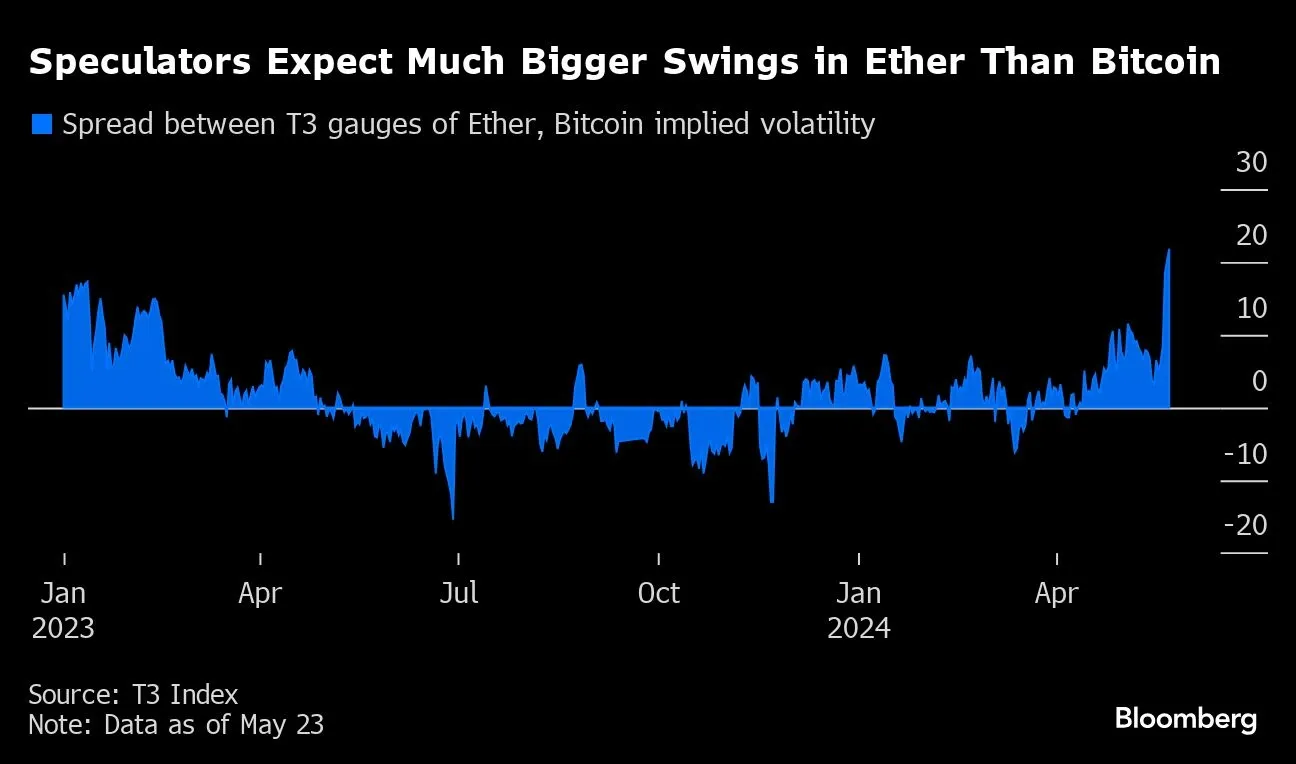

- The T3 Ether Volatility Index shows Ethereum’s higher volatility compared to Bitcoin, attracting more speculators.

- Challenges persist in attracting older investors, as Ethereum lacks a simple, resonant slogan like Bitcoin’s “digital gold.”

Recent regulatory developments in the United States have positioned Ethereum in the spotlight, as traders anticipate the potential approval of Ethereum-specific exchange-traded funds (ETFs). This prospect has led to an increase in Ethereum’s price, which has risen by over 20% in recent weeks, moving past several resistance markers.

This increase parallels the enthusiasm observed with the introduction of U.S. spot Bitcoin ETFs in January, which rapidly accumulated over $50 billion in assets. Analysts suggest that Ethereum may follow a similar path, energized by speculative trading and heightened market interest.

Market analysts such as Chris Weston from Pepperstone Group observe that Ethereum’s price is likely to continue its upward trajectory, despite potential market fluctuations.

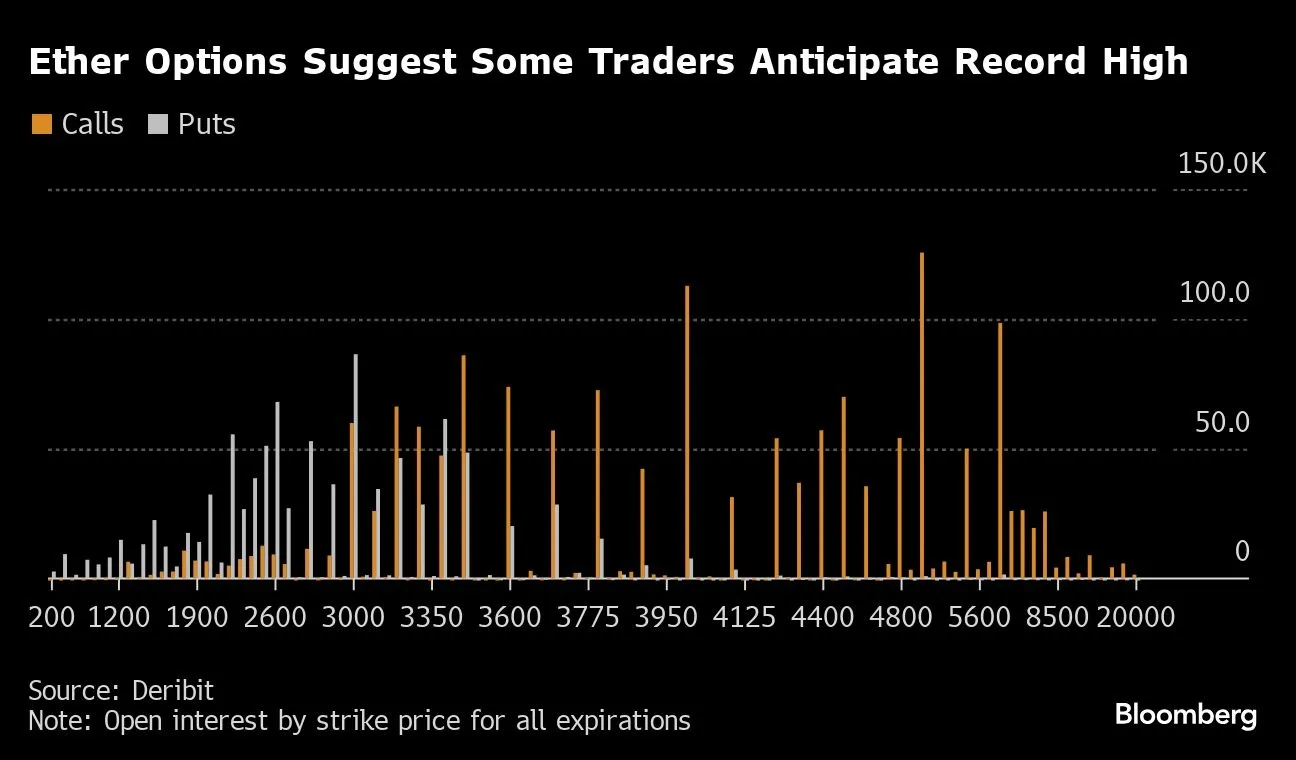

Trading data from platforms like Deribit indicate that traders are speculating about Ethereum reaching new highs, potentially surpassing its previous high of $4,866 set in November 2021.

Additionally, reports indicate that Ethereum experiences greater volatility than Bitcoin. The T3 Ether Volatility Index, which predicts price movements over the next 30 days, shows that Ethereum has larger fluctuations than Bitcoin. This heightened volatility attracts speculators expecting more significant price movements in Ethereum compared to Bitcoin.

The level of institutional engagement, as seen in the activity in CME Ether futures, shows a cautious but growing interest from large investors. This trend suggests a recognition of Ethereum’s potential, particularly with the anticipated introduction of Ethereum spot ETFs.

Noelle Acheson, author of the “Crypto Is Macro Now” newsletter, however, cautions that initial inflows into Ethereum spot ETFs might be lower than expected, based on current institutional participation.

Furthermore, Ethereum faces particular challenges in attracting older investors, aged between 60 and 80. Eric Balchunas, a Bloomberg ETF analyst, points out that the complex nature of Ethereum’s technology may deter this demographic.

One of the challenges for Ether ETFs in penetrating the 60/40 Boomer world is distilling its purpose/value into an easy-to-understand sound bite a la "bitcoin is digital gold" Does a simple one-liner like that exist for ether? If so, what is it?

— Eric Balchunas (@EricBalchunas) May 24, 2024

Unlike Bitcoin, which is often summarized as “digital gold,” Ethereum lacks a similarly straightforward slogan that could resonate with older investors, representing a significant hurdle in market acceptance.