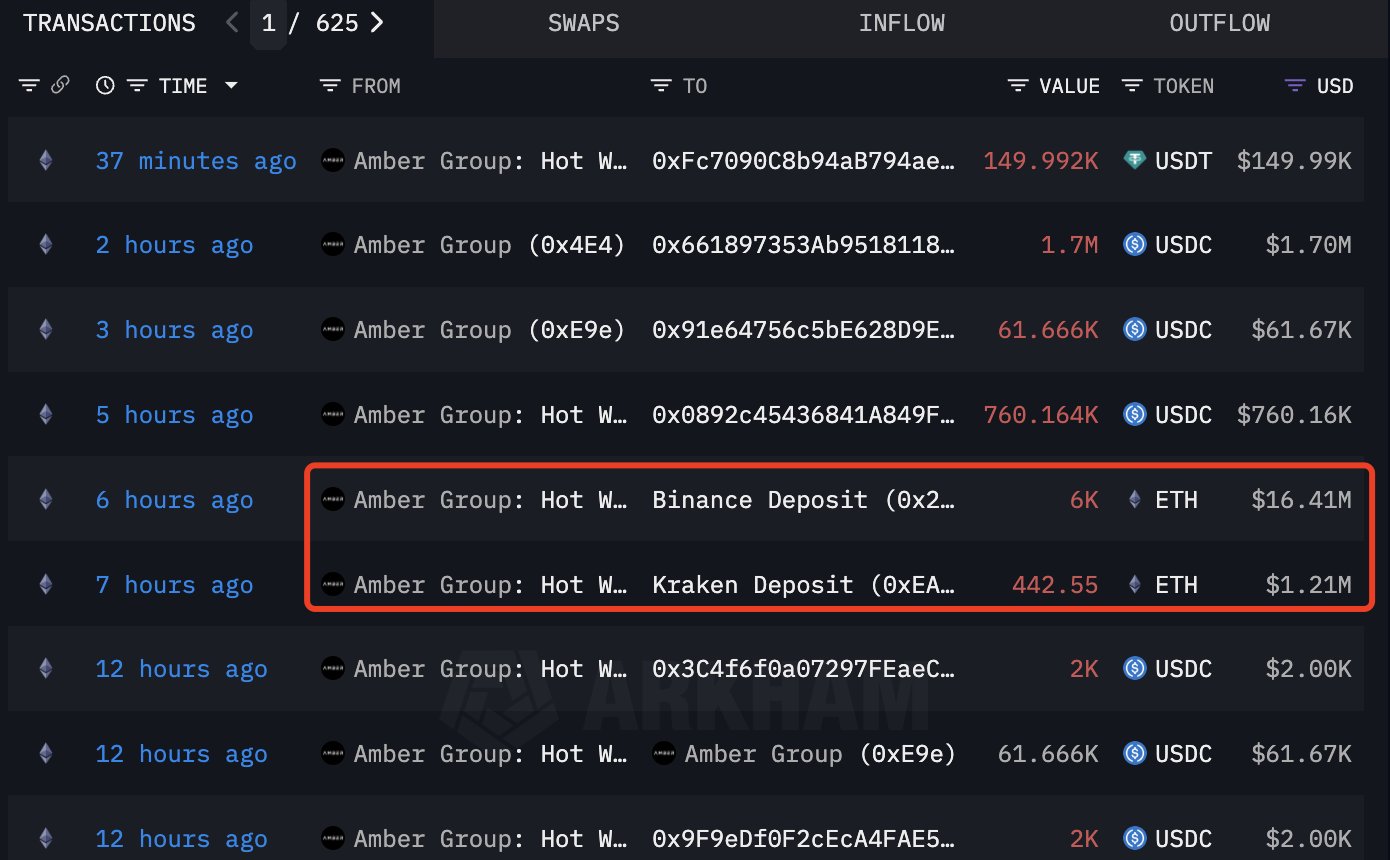

- Large deposits from Amber Group and Cumberland on Binance and Kraken stir concerns over potential price shifts.

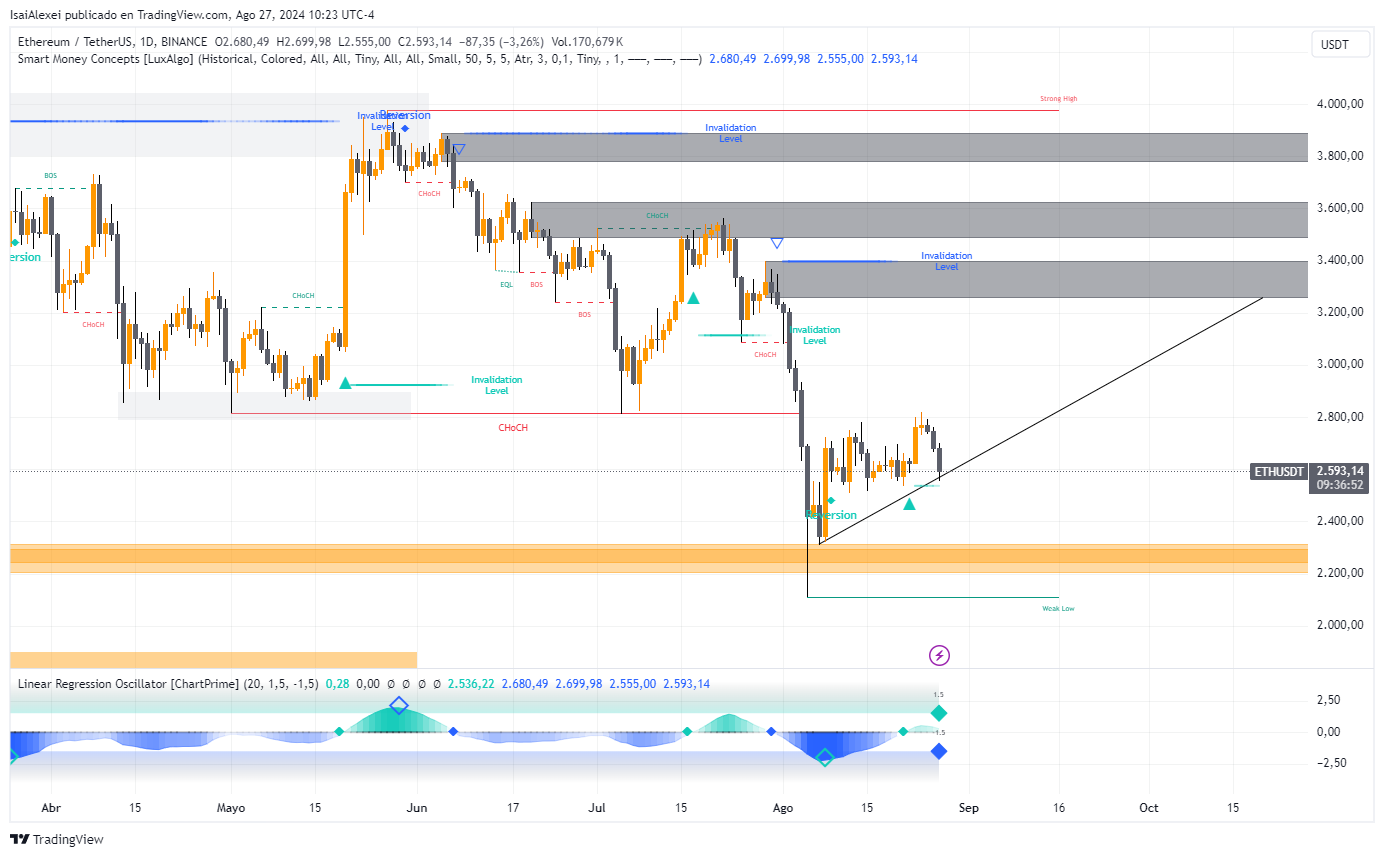

- Despite recent drops, Ethereum’s position above $2,720 could lead to a rebound towards the $3,000 mark soon.

Recently, over $35 million in Ethereum (ETH) was transferred to exchanges, suggesting a potential market shift. Institutional entities, including Amber Group and Cumberland, deposited 6,443 and 6,439 ETH into Binance and Kraken, respectively.

Ethereum’s Current Market Position

Ethereum is currently testing a support level at $2,720. This level has been pivotal throughout the year, and its stability is crucial for Ethereum’s potential rise to the $3,000 mark.

[mcrypto id=”12523″]Conversely, a failure to maintain this support could result in a decline towards $2,500.

Despite recent reductions in price, Ethereum remains within reach of $3,085, contingent on overcoming recent losses.

The weekly charts indicate a retesting of crucial levels, suggesting that a foundation for price stabilization may be forming. The outcome over the next ten days will be decisive for Ethereum’s short-term price trajectory.

Market Influences and Whale Activity

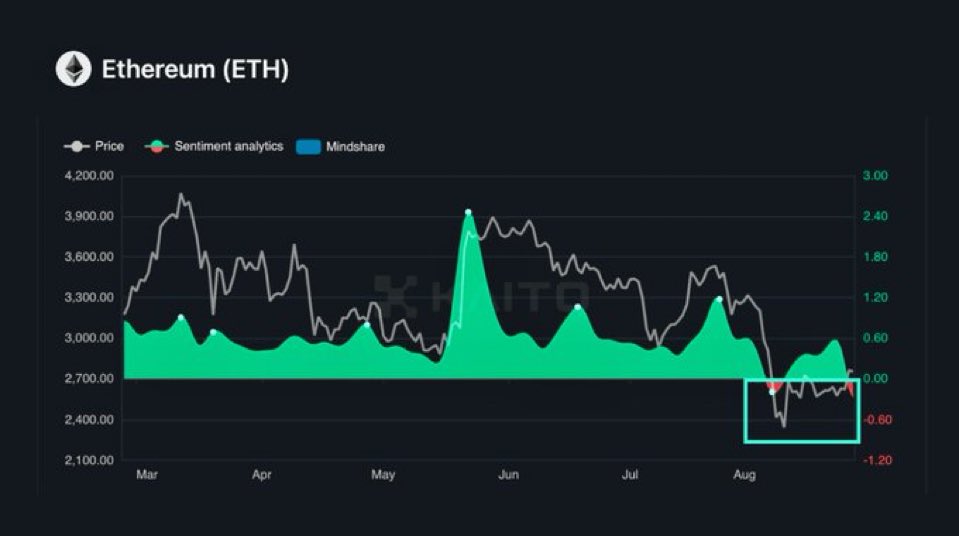

The market predicts a resurgence in altcoin dominance, which historically benefits leading cryptocurrencies like Ethereum. These periods often follow support level tests, suggesting a forthcoming rally for Ethereum.

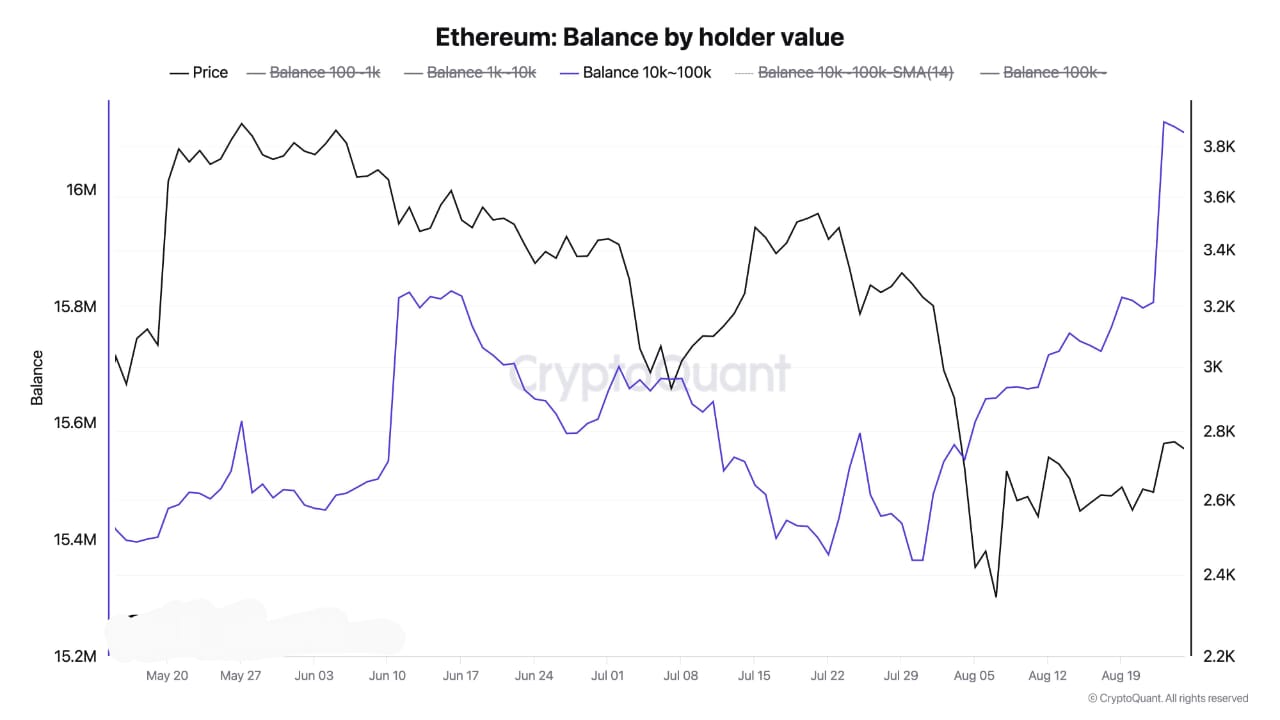

Additionally, whale activity remains robust, demonstrating continued accumulation of Ethereum. Despite the recent institutional sell-offs, over 200,000 ETH have been added to whale holdings in the past few days, suggesting strong confidence in Ethereum’s long-term value.

Fundamentals and Market Outlook

Fundamentally, Ethereum continues to show strength, bolstered by the adoption of Layer 2 solutions and increasing interest from large-scale investors. These elements position Ethereum favorably for a potential breakout.

The recent institutional transfers to exchanges introduced volatility, yet the foundational market indicators and whale confidence highlight a positive outlook. Ethereum’s ability to maintain critical support levels and the ongoing accumulation by whales could mitigate short-term selling pressures.