- Volatility Shares launches 2x Ether ETF, doubling Ether’s daily performance without direct investment in the cryptocurrency.

- The 2x Ether ETF targets price gains via Ether Futures Contracts, with an 80% capital investment strategy.

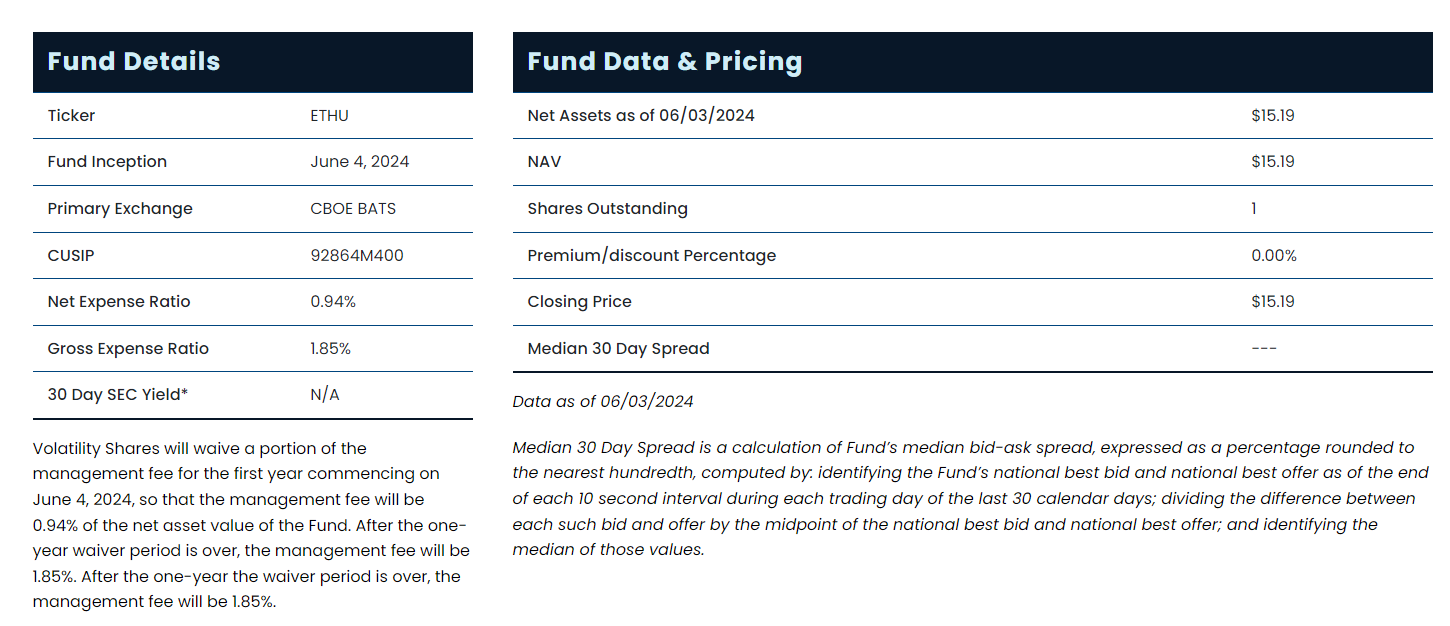

Investment manager Volatility Shares has launched its 2x Ether ETF (ETHU), providing a new way for investors to gain exposure to Ethereum. This product was released following the approval of eight spot Ethereum ETFs by the United States Securities and Exchange Commission (SEC) last month.

The ETHU aims to achieve twice the daily performance of Ether, as stated in its recently released Prospectus.

“The Fund does not invest directly in ether. Instead, the Fund seeks to benefit from increases in the price of Ether Futures Contracts in its pursuit of seeking to produce 2x the performance of ether.”

The ETHU is unique as it does not invest directly in Ethereum. Instead, it seeks to capitalize on the price movements of Ether Futures Contracts. By targeting twice the performance of Ether, the fund offers a leveraged investment approach.

Additionally, the fund may engage in reverse purchase agreements and invest in shares of other companies with similar products. It plans to allocate 80% of its capital to these investments, offering a measure of security for its investors.

Volatility Shares has experience in the cryptocurrency market, having previously introduced an Ethereum Futures ETF in the third quarter of 2023. This was part of a broader trend that contributed to the eventual approval of spot Ethereum ETFs.

However, the introduction of spot Ethereum ETFs presents a competitive challenge to existing Ether-linked ETF products.

Historical trends suggest that spot ETFs can impact futures-based ETFs. For example, ProShares Futures ETF saw a decline in inflows following the launch of spot Bitcoin ETFs earlier this year. With varying sponsor fees, competition is expected to be fierce.

Volatility Shares has set its sponsor fee at 0.94%, while other potential spot Ethereum ETF issuers, such as Franklin Templeton, propose lower fees, like 0.19%.

The 2x Ether ETF is expected to influence the price of Ethereum positively over time. Currently, Ethereum is trading at $3,810.92, which is a 0.87% increase in the last 24 hours.

As the market anticipates the SEC’s decision on spot Ethereum ETFs, the performance and acceptance of the 2x Ether ETF will be closely observed.

About Volatility Shares

Volatility Shares is an investment management firm known for launching innovative crypto-related products in the US market. The firm’s introduction of the 2x Ether ETF reflects its ongoing efforts to provide diverse investment opportunities in the cryptocurrency sector.