- The ETH/BTC ratio shows improvement, indicating an uptick in altcoin activity with Ethereum leading.

- The Altcoin Season Index, at 37, suggests fewer than 75% of altcoins outperform Bitcoin currently.

The introduction of Ethereum ETFs is observed by market analysts as a possible influence on the altcoin market. Predictions suggest a potential rise in the ETH/BTC ratio, but the impact on various altcoins might differ.

The ETH/BTC ratio, a metric that compares the value of Ethereum to Bitcoin, currently stands at approximately 0.055, showing an increase. This ratio’s growth often coincides with general gains in the altcoin market, according to crypto analyst.

Michael van de Poppe, another analyst, supports this outlook, stating,

“As long as Ethereum maintains a level above 0.05 BTC, an upward trend may be starting.”

This indicates that a stable or increasing ETH/BTC ratio could forecast a positive movement for altcoins.

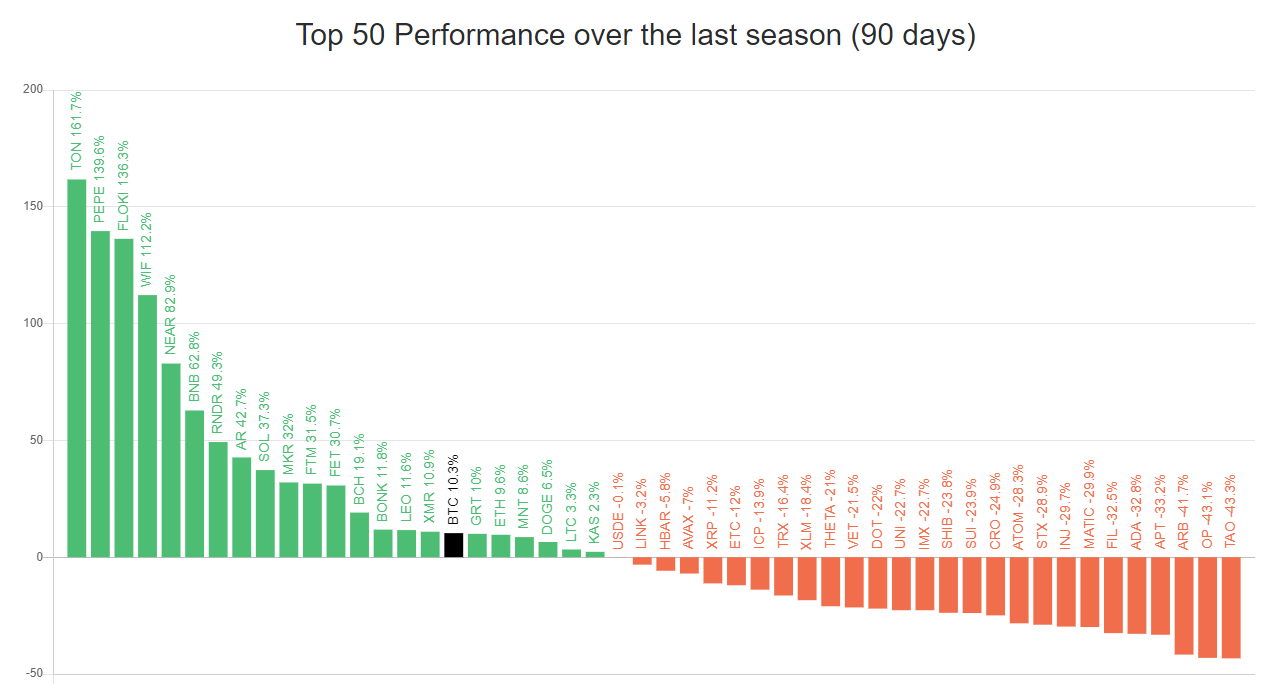

Conversely, the Altcoin Season Index, which measures how altcoins perform against Bitcoin, presents a score of 37 out of 100. This score implies that fewer than 75% of altcoins have outperformed Bitcoin in the past 90 days, suggesting that a comprehensive altcoin rally is not currently underway.

The performance among different altcoins is inconsistent. For instance, memecoins such as Pepe (PEPE) have significantly increased, with a 950% rise year-to-date. On the other hand, Ethereum’s Layer 2 solutions like Optimism (OP), Polygon (MATIC), and Arbitrum (ARB) have decreased in value by 33%, 26%, and 24% respectively.

The market also faces challenges like token oversupply, which has affected prices. A notable instance is the recent unlocking of $82 million worth of Optimism tokens, which has impacted the market price.

In conclusion, while an increase in the ETH/BTC ratio due to ETH ETF might suggest a positive outlook for some altcoins, the overall market response remains mixed. The success of such ETFs might selectively benefit certain sectors of the altcoin market, but not all.