- Despite increased platform activity, Uniswap’s native token, UNI, has decreased by 5.32%, currently trading at $7.08.

- Large UNI token sales following an SEC Wells Notice contributed to a 15% price drop, affecting investor sentiment.

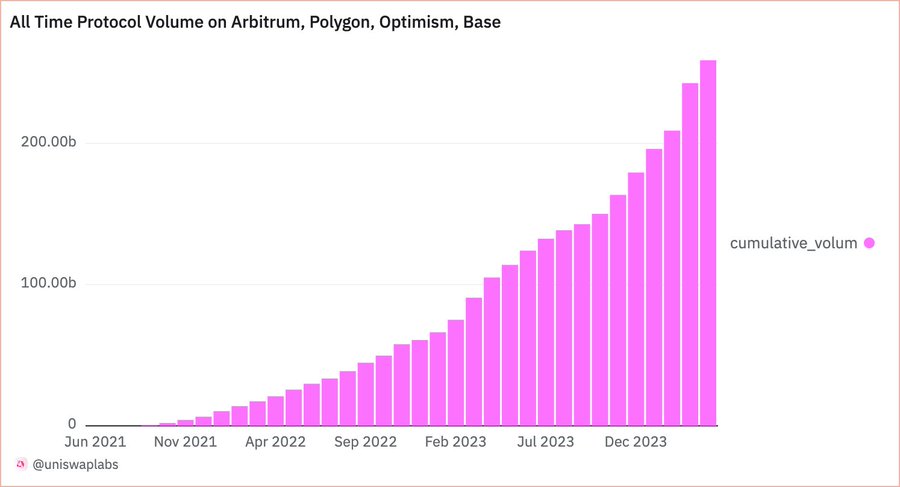

Uniswap, has reached a new record in its Layer-2 trading volume, surpassing $250 billion. This marks a substantial increase from the previous year, when the volume was slightly more than $70 billion.

L2 volume on Uniswap has officially passed $250B

Next stop: $1T 🫡 pic.twitter.com/P6NFi3D55e

— Uniswap Labs 🦄 (@Uniswap) April 16, 2024

According to data from the crypto analytics platform Dune, this growth includes transactions on protocols such as Arbitrum, Polygon, Optimism, and Base, all of which have exceeded their previous highs.

Related: Uniswap Responds to SEC Pressure: Trading Fees Hiked to 0.25%

As of the end of last year, Uniswap’s Layer-2 transaction volume had not surpassed $200 billion. However, by February this year, the volume reached $208.11 billion, showing a year-over-year increase of 280%. In just one month following, an additional $40 billion was recorded, indicating rapid growth in transaction activity.

Despite this increase in transaction volume, the price of Uniswap’s native token, UNI, has not reflected this growth. Currently, the token’s price has fallen by 5.32%, trading at $7.08. This is a decrease from the $13.08 high reached in February.

Additionally, the token’s value was impacted by sales from large investors following the issuance of a Wells Notice by the U.S. SEC to Uniswap on April 10, which preceded a 15% drop in UNI’s price. Reports indicate that large holders sold about 2.03 million UNI tokens valued at $20 million.

Read more: Uniswap Faces SEC Heat: Wells Notice Issued, Ripple Case Draws Attention

The recent surge in transaction volume might influence UNI’s price positively in the future, as Uniswap continues to expand and potentially aims for a trading volume milestone of $1 trillion. However, the immediate effect has been a decrease in token price, despite the platform’s operational growth.