- A sharp decline in network activity and trading volume contributed to BNB Chain’s revenue, which on April 15 was only $62,500.

- the launch of a $1 million meme token reward scheme and the current $537.22 price of Binance Coin, which is associated with pessimistic market sentiment.

Notable for enabling decentralized apps (dApps) and smart contracts, BNB Chain has revealed a sharp decline in revenue. According to data from Artemis, revenue dropped to $62,500 on April 15th, the lowest level since February, indicating a concerning trend.

Issues with Revenue in the Cryptocurrency Industry

The main sources of income for the BNB Chain are trading fees, which directly depend on network activity levels and transaction volumes.

The volume of the decentralized exchange (DEX) has dropped below $1.5 billion, which is troubling observers as it was $2 billion in prior months. This decline is in line with the decentralized protocol’s declining trading activity.

The native cryptocurrency of the Binance exchange, Binance Coin (BNB), has seen a decline in price, which has made the chain’s financial problems even worse.

According to the most recent data from CoinMarketCap, BNB is currently trading at about $537.22, which represents a minor decrease of 0.70% over the previous day and a more notable 6.82% reduction over the previous week. The market’s general gloomy sentiment, which has significantly affected the coin’s demand, is reflected in this fall.

On the other hand, BNB Chain has introduced a $1 million fund as part of an incentive scheme designed to entice developers to produce meme-based cryptocurrency tokens.

This project, which ETHNews brought to light, suggests taking a calculated turn toward utilizing meme tokens’ contagious properties to increase network activity.

Volatility of the Market

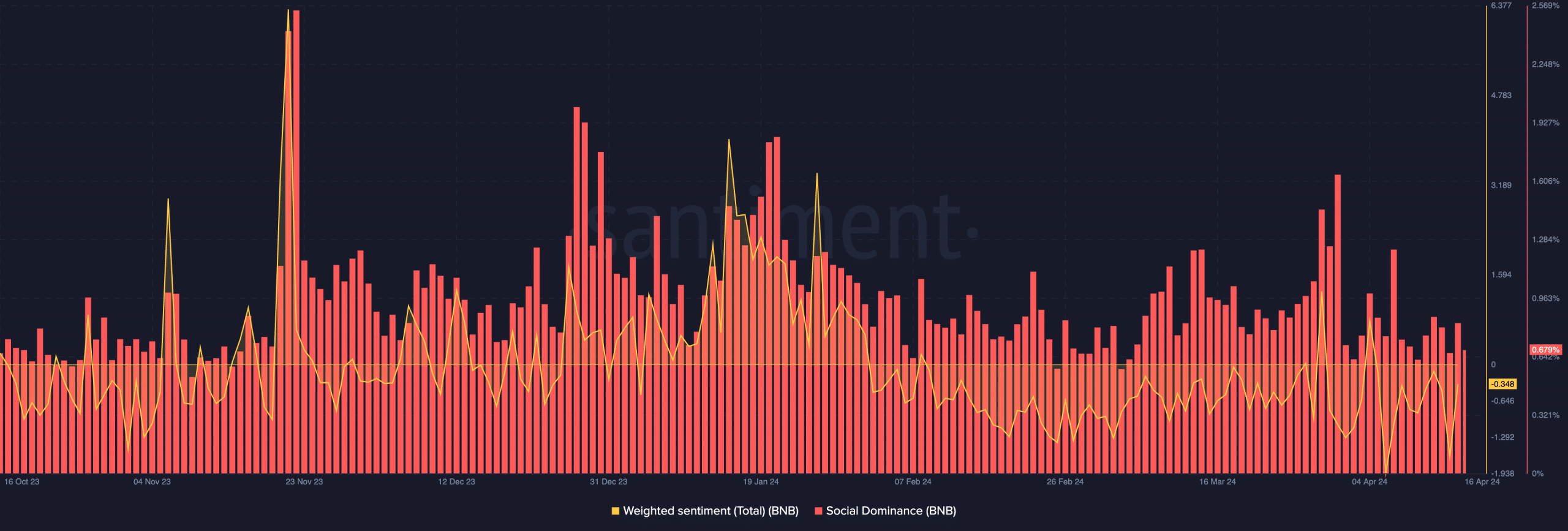

Also, with a current metric rating of -0.34, weighted on-chain data further demonstrates the negative outlook surrounding Binance Coin. Though sentiment has slightly improved, things are still generally cautiously negative.

In terms of social media, Santiment notes a drop in BNB’s dominance, suggesting that conversations about the coin aren’t as prevalent as they are for other top 100 cryptocurrencies.

This pattern can indicate that Binance Coin’s market bottom is approaching, which would provide a buying opportunity for astute investors. To explore more details about this development, you can watch the following YouTube video:

Prospects for the BNB Chain in the Future

Notably, if prices rise to between $540.64 and $544.20, the well-known cryptocurrency trader Cryptoninja.eth has indicated interest in taking a short position on BNBUSDT, with a target drop of $528. He saw a bearish trend on this pair.

SHORT: #BNBUSD.P by @mrsignalll

Waiting for BNBUSDT price to reach $540.64 – $544.20 to open a SHORT position with a target of $528.

Engage: https://t.co/tGuOD3AuYD#trading #cryptocurrency #tradingopportunity pic.twitter.com/qquiVEvYPw

— Cryptoninja.eth (@DrCryptoNinja) April 17, 2024