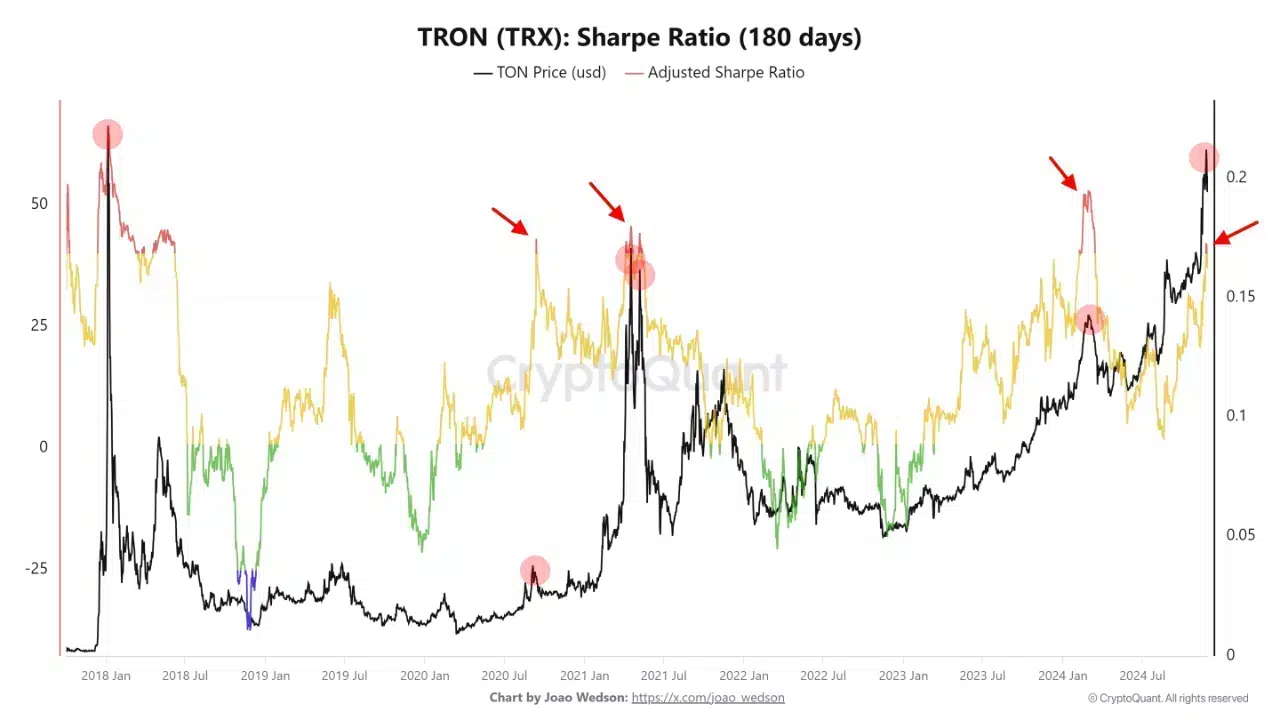

- Tron’s 180-day Sharpe Ratio signals high risk, reaching levels traditionally associated with market peaks and reversals.

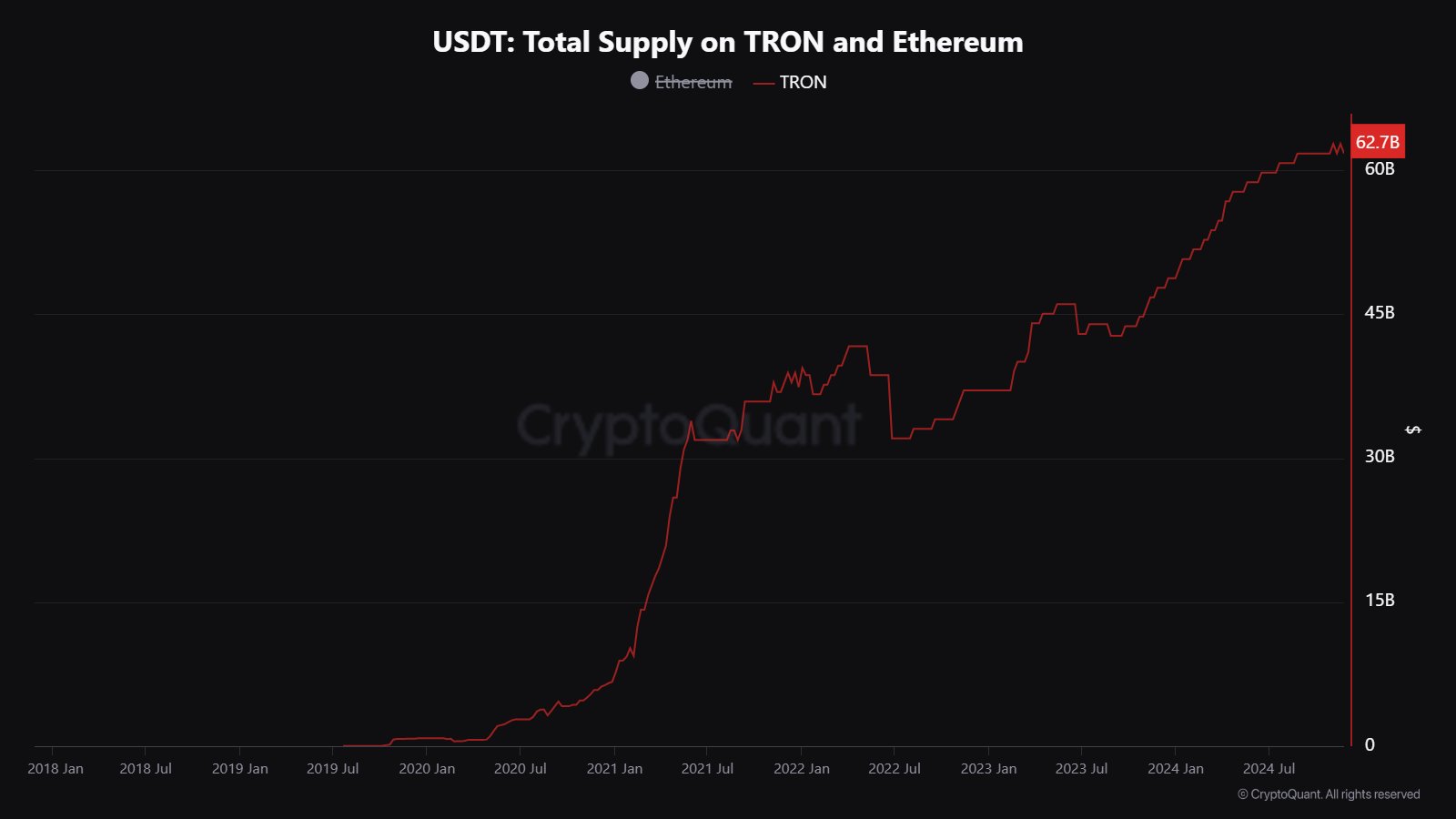

- Substantial growth in USDT supply on Tron, increasing by 37% year-over-year, influences liquidity and market volatility.

The Tron network is currently displaying significant signals of risk according to its Sharpe Ratio, a key metric used by traders to evaluate the return on an investment relative to its risk.

As detailed in a recent analysis by CryptoQuant, the 180-day Sharpe Ratio for Tron has escalated to a zone traditionally associated with heightened risk.

This financial metric, the Sharpe Ratio, is determined by taking the difference between the asset’s expected return and the risk-free rate, then dividing by the asset’s volatility. This formula is crucial for determining whether the potential returns of an investment are justified, given the risks involved.

While TRX may continue its upward trend in the short term, holding positions in a high-risk zone like this can be detrimental. The potential for gains becomes limited compared to the increased likelihood of a sharp pullback, making this an unfavorable situation for long-term strategies.

Recent trends have shown Tron’s ratio to ascend into what is often referred to as the ‘red’ zone, indicating a potentially precarious market condition.

Historically, when Tron’s Sharpe Ratio reaches these levels, the asset typically approaches a peak in its market price, suggesting an imminent reversal or leveling off may follow.

Despite the current ratio not reaching the peaks observed in previous cycles, its presence in this high-risk zone warrants caution among investors.

The scenario is further complicated by the substantial increase in USDT supply on the Tron network, which has risen from $47.75 billion to $65.7 billion over the past year, marking a 37% increase.

This escalation reflects a growing interest in utilizing this stablecoin within the Tron network, which can impact market dynamics by increasing liquidity and potential volatility.

Investors and traders should consider the implications of this heightened Sharpe Ratio combined with the increased USDT circulation. While Tron might still offer short-term growth opportunities, the elevated risk indicated by the Sharpe Ratio suggests that long-term holdings could be exposed to significant volatility, with a heightened possibility of a downturn.

[mcrypto id=”12515″]TRON (TRX) is currently trading at $0.20499 USD, reflecting a daily increase of 0.59%. Over the past month, TRX has risen by 22.61%, and over the past six months, it has surged by 80.46%, showcasing strong bullish momentum.

Year-to-date, TRX has gained 89.27%, and its annual growth stands at 97.49%, reinforcing its upward trajectory in the cryptocurrency market.

Key Metrics:

- Market Capitalization: $17.62 billion USD

- 24-hour Trading Volume: $602.38 million USD

- All-Time High: $0.35056 USD

- Support Levels: $0.20 USD, a critical level for maintaining the bullish trend.

- Resistance Levels: $0.22 USD, a significant barrier for further upward movement.

Technical Outlook:

TRON has been showing consistent gains, supported by its robust ecosystem focusing on decentralized applications, DeFi, and stablecoin settlements. The current trading range near $0.20 suggests consolidation before a potential breakout.

TRON’s unique fee model, which eliminates traditional gas fees for large transactions, continues to drive adoption and network usage.

For traders, a sustained breakout above $0.22 USD could open the door to higher targets near $0.25 USD. However, caution is advised as failure to hold support at $0.20 USD may result in a pullback toward $0.18 USD or lower.