- TRON (TRX) sees 20% price drop, with trading activity decreasing and Relative Strength Index (RSI) stabilizing at 60.

- Shift in 7-day RSI from 84.6 to 60.8 indicates TRX transitioning into a consolidation phase with stable market sentiment.

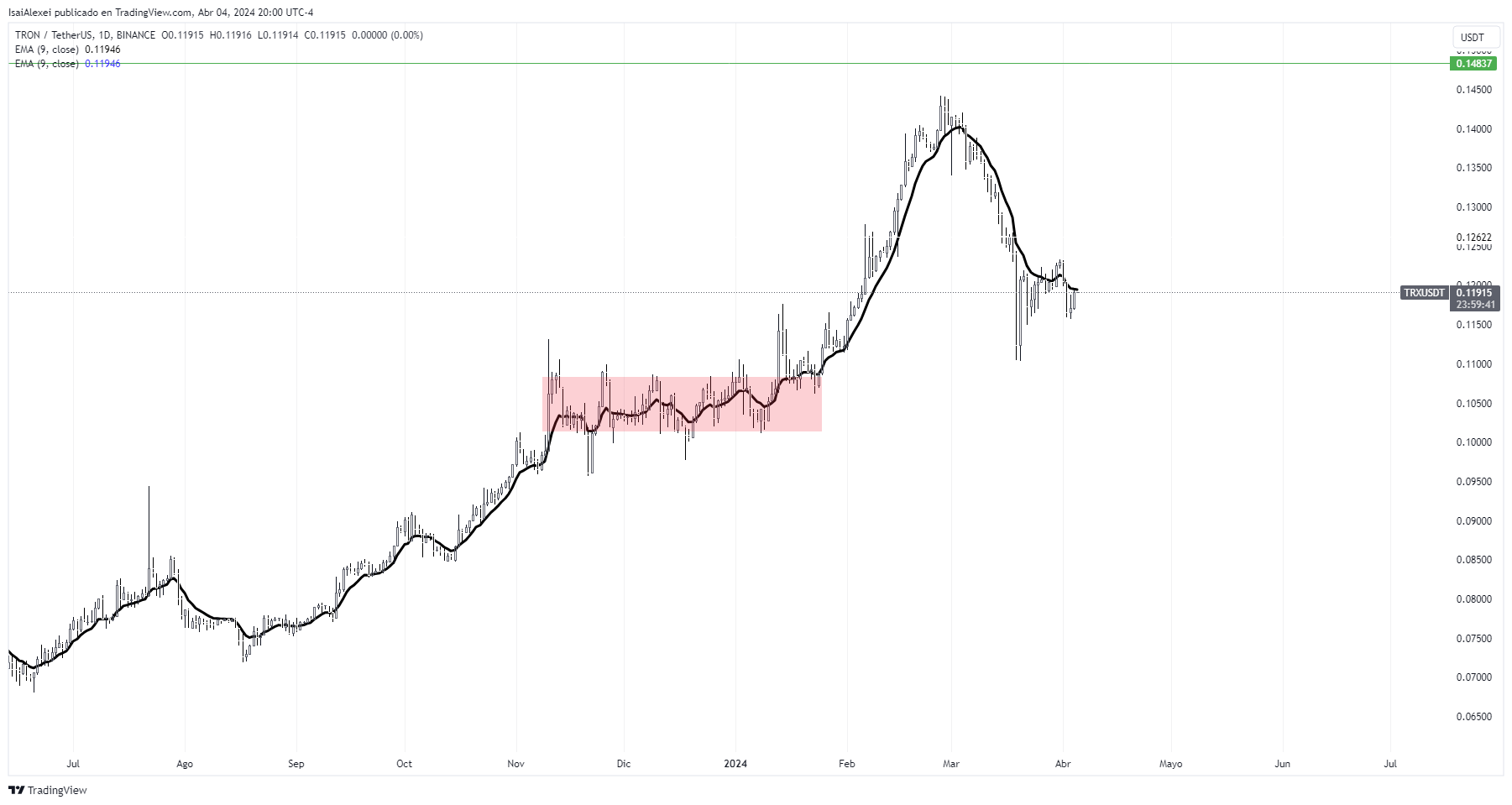

TRON (TRX) experienced a 20% decrease in its price, accompanied by a reduction in trading activity over the last week. The Relative Strength Index (RSI) for TRX, an indicator used to evaluate the momentum and changes in market conditions, now stands at 60, indicating a neutral market position.

This measurement suggests that TRX may stabilize as it enters a consolidation period, characterized by limited price movement and balanced buying and selling pressures.

The RSI for TRX, over a seven-day period, adjusted from a high of 84.6 to 60.8, signaling a shift from potentially overbought conditions to a more moderate market sentiment. This adjustment points towards an upcoming period where TRX’s price might move within a narrow range, reflecting a stable market environment.

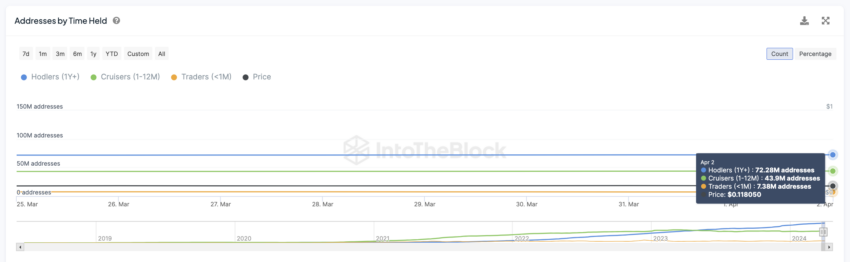

The cryptocurrency has also seen a decrease in the number of holders, with the total dropping from 7.52 million to 7.38 million addresses from March 25 to April 2. This suggests a trend towards decreased volatility in TRX’s price, potentially leading to a more stable market phase.

Read more: Tron vs. SEC: Legal Showdown Escalates as TRX Challenges Jurisdiction – Impact on Investors?

On April 2, TRX showed a technical pattern known as a death cross, a situation where its short-term Exponential Moving Average (EMA) drops below its long-term EMA. This pattern, often considered a bearish signal, came after a 22.34% correction in TRX’s price following a previous death cross on March 5. With the RSI at 60, TRX is at a critical point.

If the support level at $0.1145 does not hold, the price could drop to $0.097, the lowest since December 2023.

Conversely, if market conditions improve, TRX could rise towards the $0.14 resistance level, potentially leading to an uptrend.

Recent USDT Minting Activities on the Tron Blockchain

Tether, a leading stablecoin issuer, recently minted an additional billion USDT on the Tron blockchain. This action took place shortly after another issuance of a similar amount, resulting in a total of two billion USDT created within a span of 48 hours. To date, Tether has not provided a statement regarding these issuances.

Tether Treasury minted 1B $USDT again 22 hours ago and has minted a total of 2B $USDT in just 2 days.

Will the price of $BTC rise as before?https://t.co/buOAbgA9Xc pic.twitter.com/ykHlMbD79r

— Lookonchain (@lookonchain) April 4, 2024

USDT currently represents 69.2% of the total stablecoin market’s capitalization, which stands at $153.2 billion, with USDT’s own market capitalization at $106.2 billion.

The DefiLlama dashboard supports these figures, confirming USDT’s significant position in the market.

Related: Tron Founder Reveals Impact of Warren Buffett’s $4.56 Million Lunch: A Transformative Experience

Analysts have identified a correlation between the supply of USDT in circulation and fluctuations in the price of Bitcoin (BTC).

Specifically, they note that since the end of 2022, the circulating supply of USDT increased by approximately 30 billion. This increase has coincided with periods of rising prices for Bitcoin, suggesting a potential link between USDT supply adjustments and market movements.

USDT’s Market Dominance and Its Impact

Tether’s transparency regarding its reserves, which back the value of USDT, has been questioned. This scrutiny stems from concerns that a lack of clarity could lead to a depreciation in USDT’s value, potentially affecting the cryptocurrency market at large.

Additionally, Tether was subject to criticism following a Wall Street Journal investigation, which alleged that the company’s banking relationships might have involved deceptive practices.

I'm at the PlanB anniversary in #lugano

So much energy and people excited to talk about #Bitcoin

While I was on on stage I heard some clown honks, pretty sure was WSJ.

As always ton of misinformation and inaccuracies. Poor guys, must be difficult be them but need better media.— Paolo Ardoino 🍐 (@paoloardoino) March 3, 2023

Furthermore, Lookonchain experts reported that Tether authorized an additional issuance of one billion USDT on the Tron network, replicating an action from two days prior.

Tether Treasury minted 1B $USDT again 2 hours ago.#TetherTreasury has minted a total of 6B $USDT in the past month.

It seems that after every minting, the price of $BTC increases, is it a coincidence?https://t.co/8NzHewH6Rlhttps://t.co/2wFo2DEvz3 pic.twitter.com/D5lEev8MdU

— Lookonchain (@lookonchain) April 2, 2024

Despite Tether’s significant role in the stablecoin market, the company has yet to comment on the relationship between its recent USDT expansions and the corresponding increases in Bitcoin prices.