- TRON defends that its token sales targeted international users, arguing inapplicability of U.S. laws.

- A ruling favorable to TRON could restrict the SEC’s regulatory influence over cryptocurrency projects with international operations.

This case demonstrates the legal and regulatory tensions in the crypto sector, especially in relation to the application of U.S. securities laws to entities and transactions that have a global reach. TRON’s defense against the SEC’s allegations points to several important issues and their potential consequences for TRON and the cryptocurrency marketas a whole.

“The SEC is not a global regulator. Its efforts to leverage highly attenuated contacts with the United States, to extend U.S. securities laws to predominantly foreign conduct, go too far and should be rejected,” wrote the TRON Foundation.

Jurisdiction and Enforcement

TRON’s main argument, that its operations and token sales were conducted entirely outside the U.S., calls into question how far the SEC’s jurisdiction over largely international activities can go.

If the court accepts this argument, it could set an important precedent limiting the SEC’s ability to regulate token offerings globally based on the absence of direct or relevant contact with the United States.

Related: TRON leverages AWS: Full node deployment on cloud giant’s platform

This could facilitate the expansion and development of cryptocurrency projects outside the U.S., while complicating regulatory and compliance efforts for those entities operating in multiple jurisdictions.

“Undeterred, the SEC seeks to bring foreign defendants before this Court, asserting that subsequent secondary sales on a U.S.-based platform serving users around the world, and global contests on social media, and airdrops of those same digital assets, were somehow “unregistered U.S. securities offerings,” even though the connection to the U.S. forum in each case is tenuous at best,” stated TRON Foundation.

Effects on Confidence and the Market

Regardless of the outcome, this case highlights regulatory uncertainty in the sector could impact investor confidence. For TRON, a positive outcome could improve its market position and attract users and investors seeking to avoid U.S. regulatory intervention. On the other hand, a prolonged legal dispute could generate instability and variability in the price of its tokens, affecting the perception of risk among investors.

You can read: TRON Network Data Integrated with Token Terminal: New Perspectives for Analysts

Implications for Cryptocurrency Regulation

This case also highlights the challenge of applying traditional securities regulations to cryptocurrencies, assets that defy the usual classifications. The TRON defense underscores the need for a clearer and more tailored regulatory framework that can accommodate the global and decentralized nature of cryptocurrencies.

The outcome of this case could incentivize regulators to develop rules that are more specific and tailored to the reality of cryptocurrencies, rather than applying existing laws that may not be entirely adequate.

A favorable decision for TRON could limit the SEC’s ability to intervene in international token offerings, while an adverse decision could underscore the need for regulatory compliance across national borders, even for projects based outside the US.

This case underscores the importance of international regulatory cooperation and the development of regulations that recognize the uniqueness of cryptocurrencies.

TRX Analysis

The TRX coin price could reach a high of $0.182, with an average of $0.165 for this year 2024. On the other hand, the minimum price could drop to $0.155.

In addition, demand for TRX is expected to increase considerably in the coming years, thanks to the growth of decentralized applications (DApps) developed on the TRON platform.

USDT transactions through TRON have shown a steady increase since the beginning of February, now averaging over 2 million transactions per day. This increase is bringing the number of transactions closer to the peak observed in January 2023.

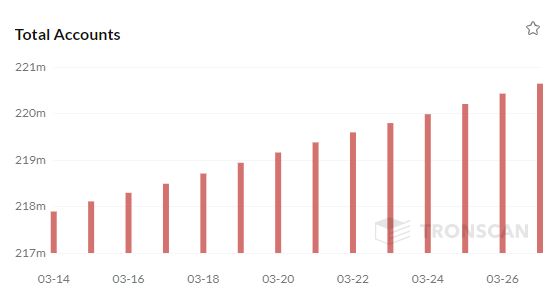

The TRON network continues to expand with an average of 196,394 new accounts daily. Since March 14, with 217.8K, the total reached 220.6K by March 27.