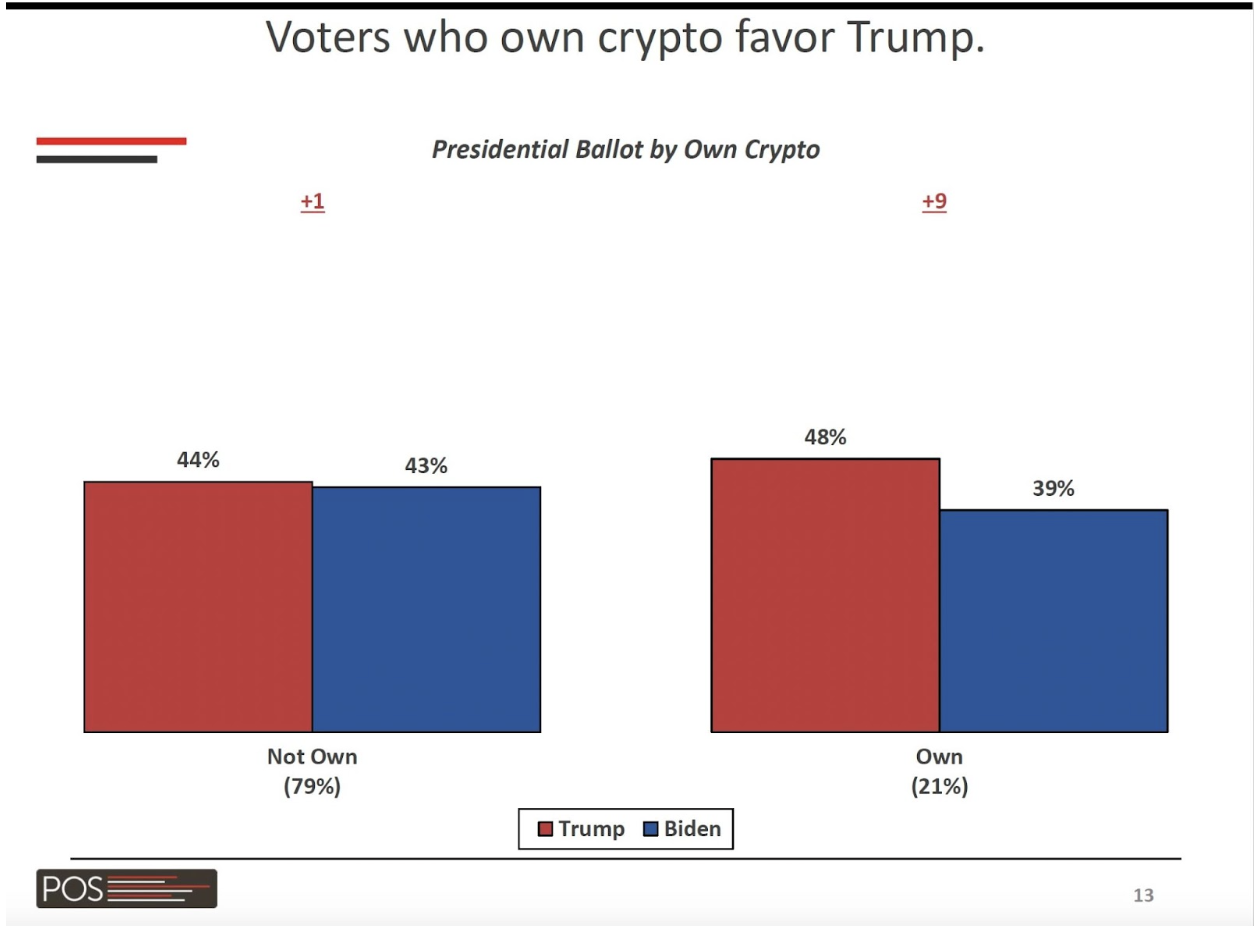

- 48% of crypto owners favor Trump over Biden, highlighting the political influence on crypto preferences.

- Paradigm survey shows 19% of voters own or use cryptocurrencies, highlighting their growing influence in elections.

For the cryptocurrency sector, these results suggest a greater insertion of these digital currencies in the U.S. political and social debate. The considerable support for Donald Trump among cryptocurrency holders, compared to President Joe Biden, shows how political stances on cryptocurrencies can influence voting preferences.

The fact that 48% of crypto owners prefer to vote for Trump, compared to 39% in favor of Biden, highlights the relevance of crypto policies in electoral decisions.

The Republican Party’s preference for placing cryptocurrencies higher on its domestic agenda, especially with regard to discussions of central bank digital currencies (CBDCs), and Trump’s promise to eliminate CBDCs if he wins the election, suggests a policy direction that could benefit the development and adoption of cryptocurrencies.

Paradigm’s survey also shows that crypto owners make up a sizable segment of the electorate, indicating that 19% of voters use or own cryptocurrencies and an additional 16% are interested in investing in digital assets.

This not only evidences the growing adoption of cryptocurrencies among the general public, but also the potential for this group to influence electoral outcomes, especially in close contests.

In addition, the change in the demographics of cryptocurrency owners, with a particular increase among communities of color and youth, reflects a greater diversity in the profile of cryptocurrency investors.

This could have important implications for political strategies and crypto regulation, considering the obvious interest of these groups in how cryptocurrencies will be handled legislatively, as we have reviewed on ETHNews.

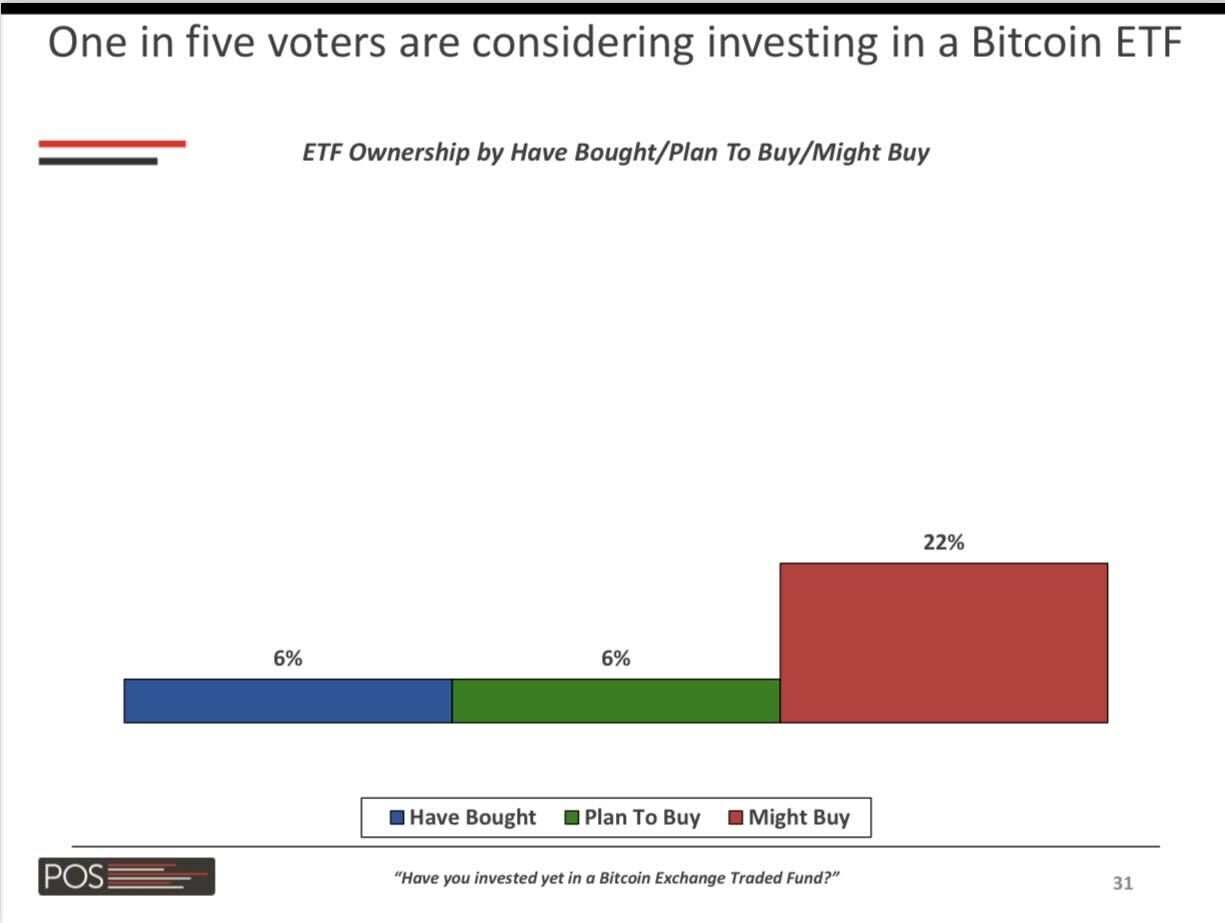

Finally, the growing interest in Bitcoin spot ETFs, as a method of investing in cryptocurrencies, indicates an increased recognition and curiosity of the U.S. public towards cryptocurrencies.

This could lead to more widespread adoption of cryptocurrencies and, potentially, a growing demand for clear and enabling regulations that promote the growth of the crypto sector.