- Fidelity’s Bitcoin ETF garners nearly $7 billion since January, ranking alongside BlackRock’s record-breaking Bitcoin ETF.

- Despite political hurdles, Standard Chartered predicts Ethereum could reach $8,000 if a spot Ethereum ETF is approved.

Fidelity has updated its Ethereum (ETH) exchange-traded fund (ETF) application to include a staking mechanism. This adjustment allows for the potential staking of a segment of the fund’s assets through a reliable staking provider. This proposal mirrors the structure seen in previously approved Bitcoin ETFs, drawing parallels to the existing framework for the primary cryptocurrency, as we mentioned in ETHNews.

Amended 19b-4 filed on Fidelity spot ether ETF…

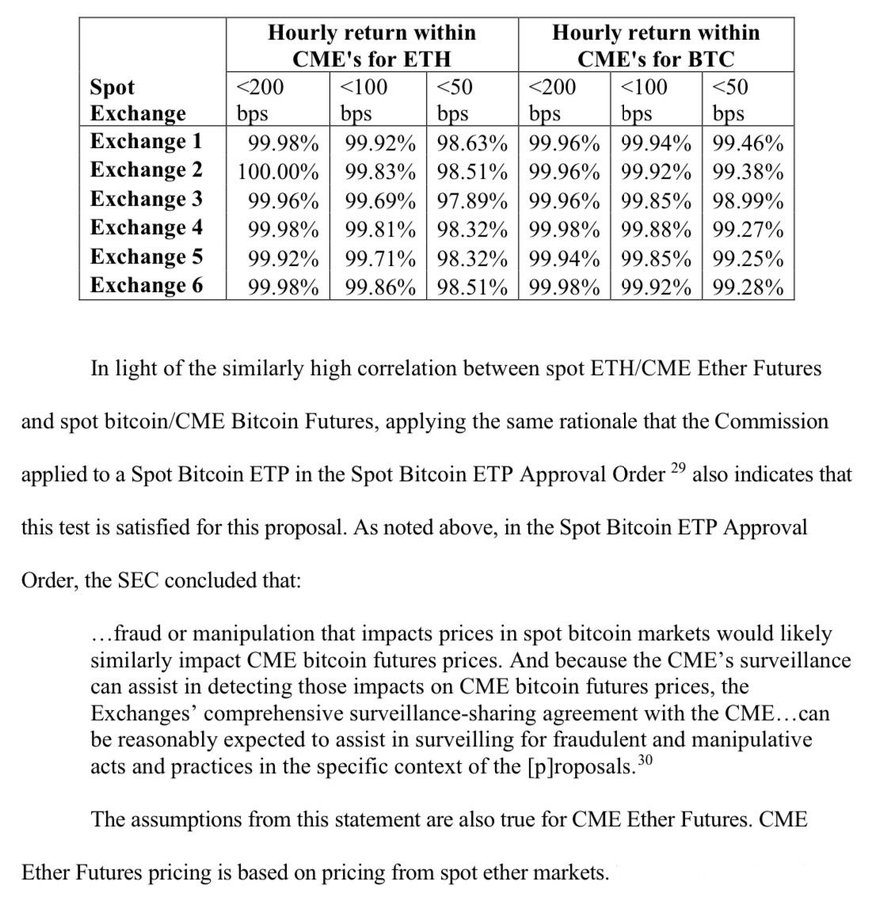

Includes more in-depth analysis on correlation b/w eth spot & futures markets (assume getting feedback this is important issue).

Also references spot btc ETF approval.

Here’s money page IMO. Issuers not gonna let SEC off hook. pic.twitter.com/Bo4rCKdYbW

— Nate Geraci (@NateGeraci) March 19, 2024

Fidelity’s refined proposal cites the approval of multiple Bitcoin ETFs, making a case for the authorization of a comparable offering for Ethereum, the foremost alternative cryptocurrency. The justification hinges on the close correlation between Ethereum and the Bitcoin futures offered by the Chicago Mercantile Exchange (CME).

Given that the Securities and Exchange Commission (SEC) relies on CME’s oversight to assist in identifying potential fraudulent or manipulative actions, Fidelity suggests that the same oversight could extend to spot Ethereum ETFs.

Despite these advancements, the likelihood of a spot Ethereum ETF approval this May remains low, with political challenges being a significant barrier. This situation unfolds amidst the SEC’s scrutiny from Congress, following the success of Bitcoin ETFs.

Opinions vary on the impact a spot Ethereum ETF might have. Investment firm VanEck posits that an Ethereum ETF could surpass the influence of Bitcoin equivalents. Conversely, Eric Balchunas, a senior analyst at Bloomberg, suggests that an Ethereum ETF might not make as significant an impact, likening it to a supporting act following a headline performance.

Amidst these discussions, Standard Chartered has boldly forecasted that Ethereum’s price could soar to $8,000 should the SEC greenlight a spot Ethereum ETF. However, this optimistic prediction is met with skepticism by many experts, highlighting the uncertain future of Ethereum’s ETF prospects amidst regulatory and political headwinds.

Ethereum (ETH-USD) has experienced a notable decrease in its price, currently standing at $3,287.49, marking an 8.09% decline from its previous close.