- Dogecoin is seeing pessimistic sentiment and technical signals that point to possible falls despite a brief price boost.

- Whale sell-offs and short-term retail holder behavior exacerbate Dogecoin’s price vulnerability.

Though it has shown some short-term signs of recovery, Dogecoin (DOGE) has recently been the focus of attention due to a combination of gloomy market signals and adverse investor sentiment.

The meme-inspired cryptocurrency is currently trapped in a negative technical shape, a rising wedge, which frequently signals impending swings lower in the trading community.

According to CoinGecko statistics, this bearish pattern occurs at a moment when Dogecoin’s price is beginning to show tentative signs of strength. As of this writing, DOGE is trading at roughly $0.2007, up 6.02% over the previous day and 11.22% over the previous week.

The coin’s technical perspective and the general attitude of investors are very different from this short-term bullish trend.

Retail Behavior and Whale Investors: Effects on DOGE

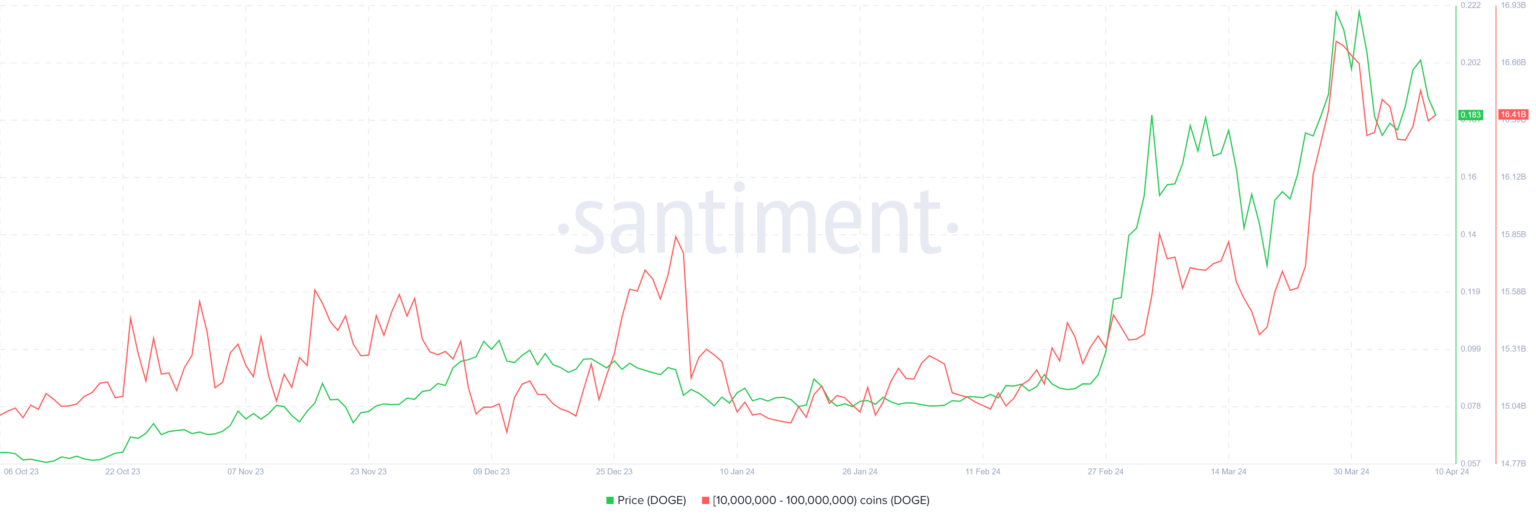

The actions of major Dogecoin holders are one of the main causes of the pessimistic outlook. Particularly, since the start of the month, addresses with between 10 million and 100 million DOGE have sold more than 300 million DOGE, or around $55 million.

Whale investors’ retreat indicates an increasing sense of pessimism in the market, which could result in large losses, especially for individual investors, in line with what ETHNews previously disclosed.

Regarding individual investors, their deeds likewise depict a convoluted picture. Even if the price of DOGE has recently increased, in the previous ten days, about 6% of the entire circulating supply has been moved to their wallets, bringing their holdings to 13%.

These short-term holders, who hold their DOGE for one to three months on average, put the price stability of Dogecoin at greater risk of possible sell-offs.

The Rising Wedge: A Threat to Stability

The present dynamics of prices and investor behavior highlight the precarious equilibrium in the Dogecoin market. Dogecoin’s current rising wedge formation makes the outlook more challenging.

Converging trendlines that slope upward in this bearish chart pattern indicate a possible reversal if broken. If this pattern holds true, Dogecoin would experience a significant decline, possibly falling 42% from its current trading price of $0.185 to $0.105.

For DOGE holders, there is, nevertheless, a ray of optimism. Further gain may be possible if the slow uptrend persists and $0.220 is proven to be a solid support floor, disproving the current negative argument.

With the latest price data reflecting short-term optimistic indicators, this scenario would represent a considerable turn around from the current situation. This YouTube video delves further into these developments.