- Dogecoin demonstrated tenacity by rising 2.11% over the past day, despite a 14% weekly decline.

- Significant sell-offs by whales show a divergence in the market’s attitude from rising long positions.

The memecoin that went viral, Dogecoin (DOGE), has shown resiliency during the course of a week that saw significant declines in cryptocurrency prices. The digital asset with a dog motif saw a 2.11% increase in value during the last trading day, giving its investors and enthusiasts hope.

According to CoinMarketCap data, this recovery follows a depressing 14% loss in its value over the previous week, which is consistent with the overall declines observed, particularly those memecoins based on Ethereum (ETH).

[mcrypto id=”12355″]The Whales’ Great Arrival

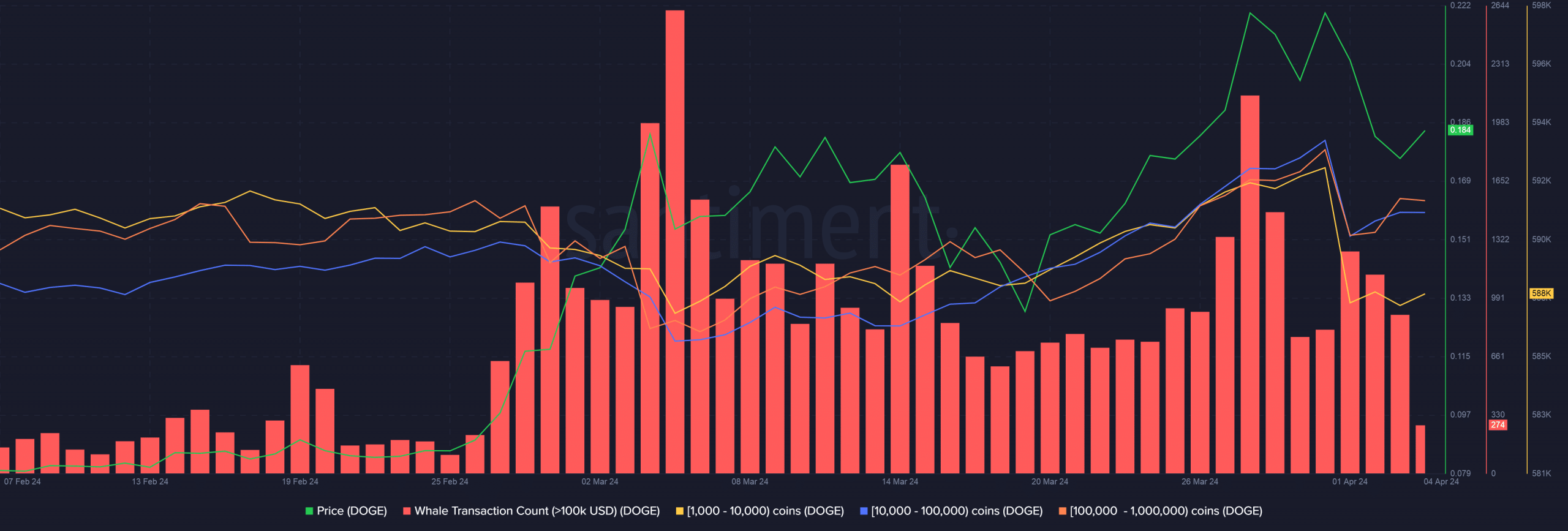

A prominent element in the current DOGE price movement has been the significant sell-offs by major coin holders, also known as “whales.” Santiment’s data showed a notable decline in the number of wallets containing 1,000–1 million DOGE coins.

Simultaneously, there was a surge in transactions above $100,000, highlighting the large-scale withdrawal of whales from Dogecoin.

Prior to this, Dogecoin whales amassed 1.4 billion DOGE in response to ETHNews’ previous allegation that Elon Musk had sold the cryptocurrency for $49.5 million. This accumulation was a significant development.

Some investors in the market are nevertheless positive about a speedy comeback despite these sell-offs. On social media, a well-known cryptocurrency trader, Yomi, posted his opinion, praising DOGE’s fortitude during this correction phase and voicing optimism about a return to $0.20 in the next few days.

#Dogecoin is one of maybe 5 #Altcoins that never lost its 200 sma on the 4HR time frame during the correction proving that it’s one of the stronger coins this cycle so far. Let’s get this back to .20 cents + now. ##DOGE pic.twitter.com/AD03rzHT5C

— Yomi (@OG_Yomi) April 4, 2024

Positive Signals In the Face of Bearish Trends

Hyblock Capital data indicates that whales on the Binance platform are taking more long positions, which supports the positive view.

This implies that some investors are beginning to feel bullish despite the recent sell-offs. This change could suggest that the recent sell-offs were a calculated attempt to unwind highly leveraged long positions, which is a typical strategy in erratic markets.

Technical Indicators Tell a Mixed Tale

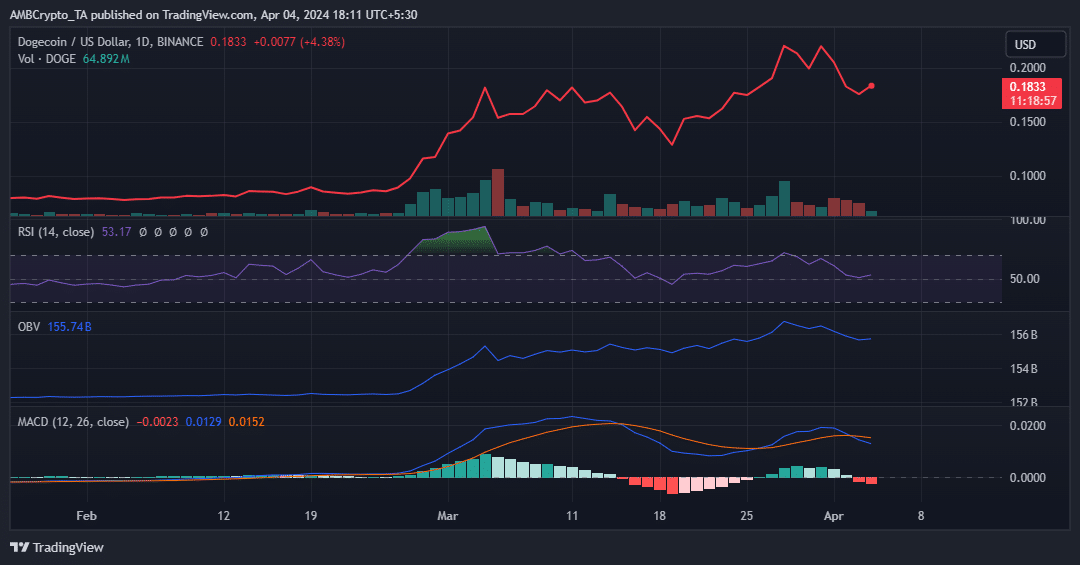

Through TradingView, analysts examined a number of important technical indicators in order to better comprehend DOGE’s possible future movements. A rise from the neutral 50 level was seen in the Relative Strength Index (RSI), a signal that is frequently seen as positive.

On Balance Volume (OBV), on the other hand, it gave a less encouraging picture, with lower highs and lows reflecting the price decrease of DOGE and suggesting that the decline would continue.

Additionally, the Moving Average Convergence Divergence (MACD) line’s dip below the signal line may indicate that DOGE’s value will continue to decline.