- Polkadot Community approves RFC-10 to burn coretime revenues, promising to reduce DOT supply, increase value.

- RFC-10 introduces financial stability to the Polkadot Treasury, seeking to balance innovation with predictable revenues for the future.

Recently, the Polkadot Community has approved a proposal called RFC-10, a change that promises to transform the management of revenue generated from coretime sales, a key part of its structure. This seeks to reduce the amount of DOTs in circulation, opening the door to possible increases in their value.

Supply Reduction to Stimulate Value

The strategy of burning tokens is not new to the industry. This approach has proven to be effective in increasing the value of cryptocurrencies by reducing their supply. Recall the case of Ethereum in 2021, when Vitalik Buterin’s burning of a massive amount of Shiba Inu catapulted its price.

$DOT is gonna burn revenues from coretime sales 🔥$DOT is gonna have a deflationary pressure mechanism 🚀 https://t.co/1zjfYpbOHL pic.twitter.com/M2LJowOPnx

— BizaRre Crypto (@Biz_R_) February 13, 2024

Similarly, although the implementation of Polkadot’s RFC-10 does not lead to an immediate burn, its prolonged effect promises significant adjustments in DOT supply, which could favor its long-term appreciation.

Changes in Revenue Generation

Until now, Polkadot Treasury has relied primarily on rates for its revenue, with a policy of burning a portion and reserving another for platform development. The introduction of Polkadot 2 and the sale of coretime raised questions about how to manage this new revenue.

The decision to adopt a marketplace for block space, moving beyond parachain auctions, hints at an effort to adapt to the needs of applications and users.

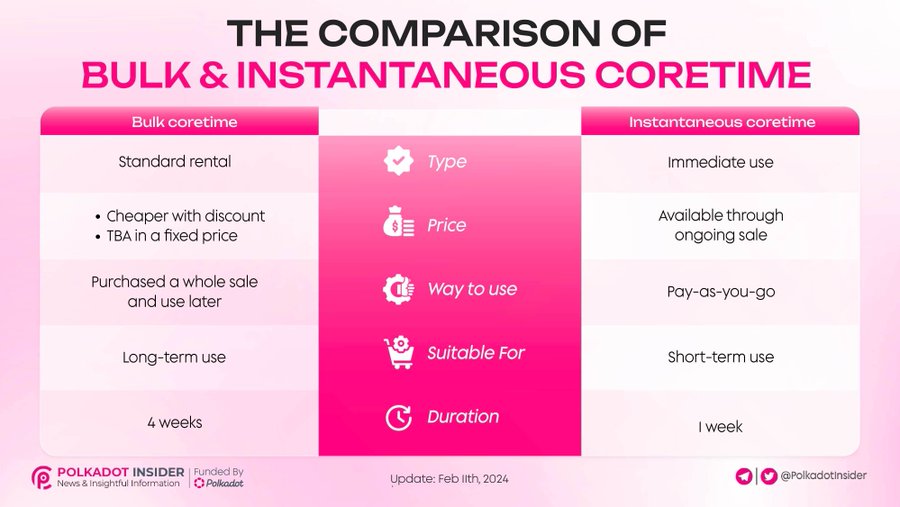

💡 With Bulk & Instantaneous Core Time, @Polkadot bids farewell to traditional lease auctions

🎉 Coretime transforms into a tradable commodity, empowering applications of #parachains & new projects

🔄 Learn the difference between 2 types of rental #Polkadot #DOT pic.twitter.com/KLyFZCaDHh

— Polkadot Insider (@PolkadotInsider) February 13, 2024

The Revenue Destination Debate

The central discussion on RFC-10 revolved around the management of revenue from coretime sales. Jonas Gehrlein’s proposal, focused on maintaining stable revenues for the Treasury without adding volatility, has resonated with the community. With the unanimous approval of RFC-10, Polkadot sets a precedent in the search for a balance between innovation and financial stability.

A New Era for Polkadot

The adoption of RFC-10 not only speaks to the maturity of the Polkadot community in prioritizing predictability and revenue stability, but also highlights the importance of adapting to the market.

This change in revenue management for coretime sales not only promises to influence DOT’s valuation, but also reflects an evolution in the way blockchain platforms adapt to the needs of their users and developers.

This careful approach to resource management and innovation opens new avenues for Polkadot to strengthen its market position and for its users to experience a more stable and promising environment.

At the time of this writing, DOT is trading at $7.61