- A Wells Notice from US regulators to Uniswap, which alluded to a possible litigation, caused a sharp decline in the value of the UNI token.

- Large holders and whale addresses offloaded millions of UNI tokens, which caused further price drops and market volatility.

Federal officials warned Uniswap of impending litigation on April 10 by sending them a Wells Notice. This revelation has shaken the market’s confidence in the decentralized exchange’s token, which has alarmed investors and sent shockwaves through the sector.

Significant Decline in UNI Value

The market’s response to the news was unequivocal and merciless. As per data on CoinMarketCap, the price of UNI dropped like a brick to $9.08, which is a significant 15.28% dip from 1 week ago and also down 3.61% in the last 24 hours.

Once more, it illustrates just how volatile markets can be when reacting to regulatory changes that affect crypto assets.

In response to the uncertainty, major holders have sold off a sizable portion of their UNI token holdings. Lookonchain reports that just three significant holders offloaded 2.03 million UNI tokens, worth a total of about $20 million, in line with what ETHNews previously disclosed.

Additionally, two whale accounts moved a sizable 1.25 million UNI tokens, or roughly $11.7 million, to Binance, indicating a plan to profit from selling at current market rates.

Additional Market Impacts

These big trades set off a domino effect that continued. Another investor made $1.67 million by selling 472,691 UNI tokens for $4.59 million in USDC. In addition, six wallets deposited 316,430 UNI tokens worth $3.16 million to Binance.

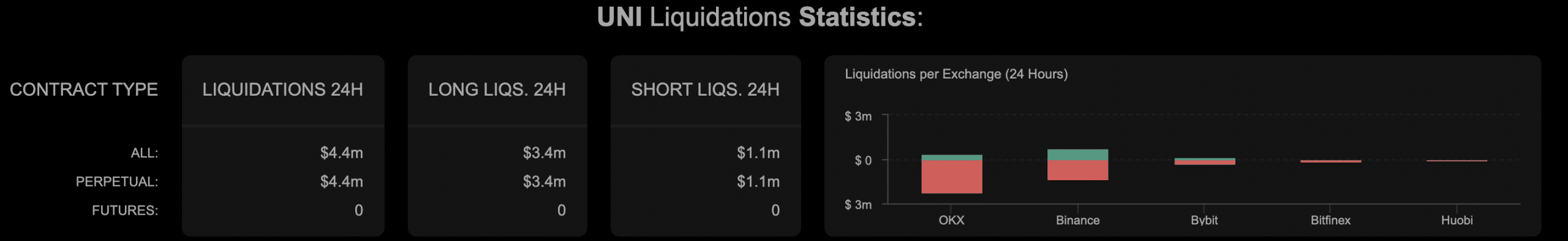

These significant sell-offs had repercussions that affected individual traders as well. Using data from Coinalyze, an analysis showed traders lost a significant amount of money. Of the positions liquidated in the recent 24 hours, $3.4 million were long bets.

These traders may experience reduced confidence and an unwillingness to trade further as a result of the emotional and financial toll they have taken, which could inhibit market liquidity and investor involvement. To explore more details about this development, you can watch the following YouTube video: