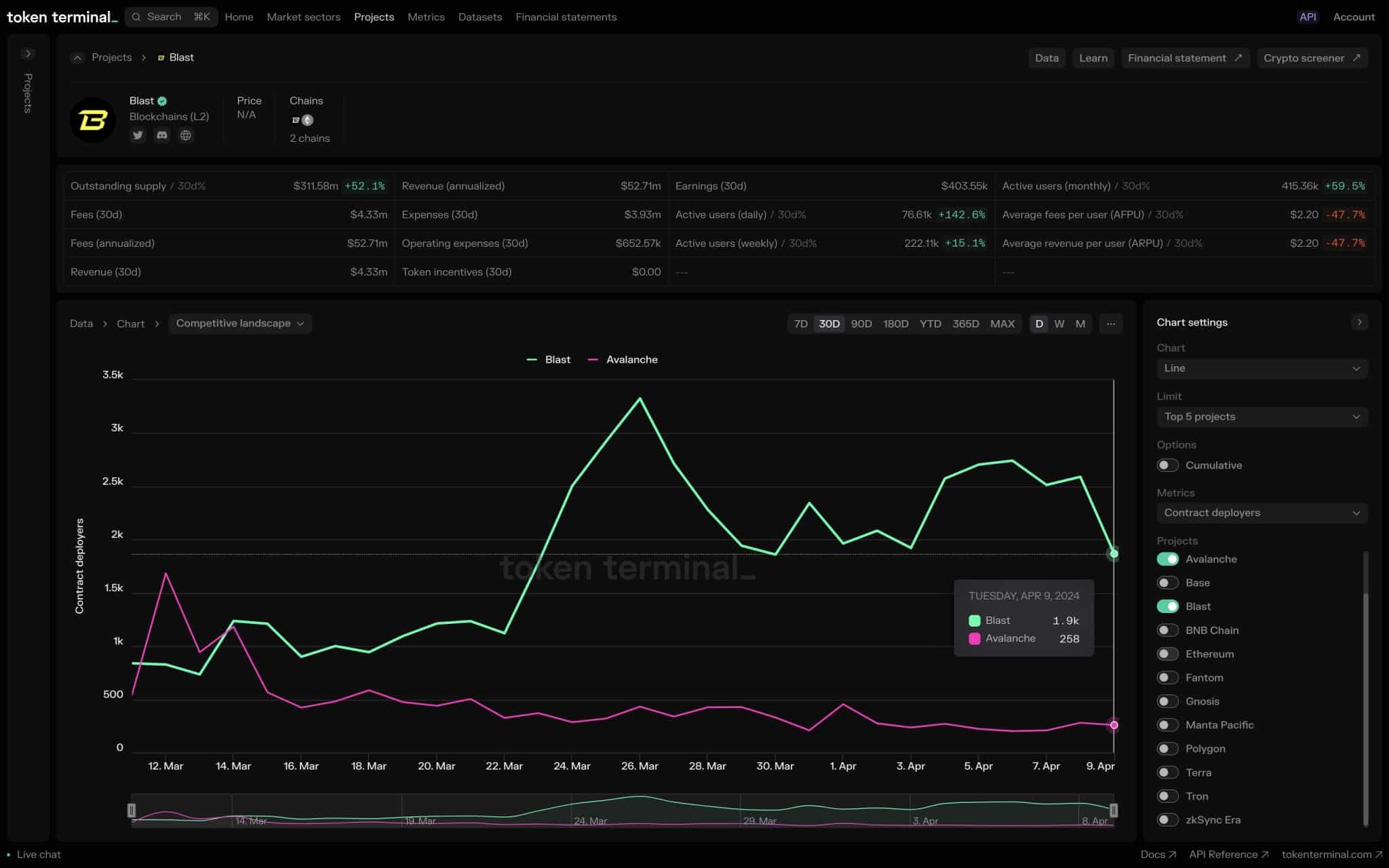

- The considerable reduction in the number of smart contract implementers points to a serious halt in Avalanche network innovation.

- There are questions about the sustainability of growth due to diminishing transaction and DEX volumes, even while the total value locked has increased.

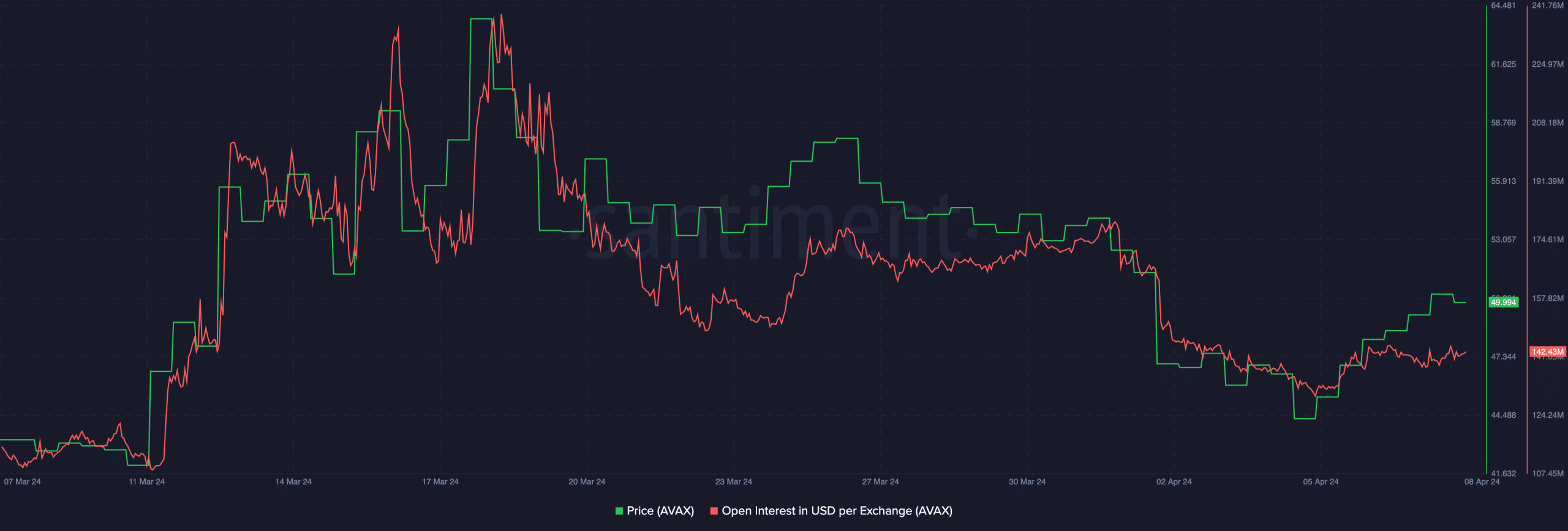

The Avalanche (AVAX) cryptocurrency has demonstrated strength in recent weeks by holding onto a steady price despite the volatility of the broader market. According to the most recent data available on CoinMarketCap, AVAX is currently trading at about $46.83, up 0.10% over the last day and 2.79% over the last week.

However, there are a number of unsettling tendencies influencing the Avalanche network that could be problematic for its future, lurking beyond the surface of this seemingly good price activity.

Innovation and Developer Engagement Obstacles

The sharp drop in the number of Avalanche network smart contract deployers has been one of the most obvious signs of distress. The reduction may indicate a halt in innovation or deeper ecosystem issues.

The Avalanche ecosystem’s drop in new projects and developers may signal a funding or developer support issue. Developer participation is essential to the health and success of any blockchain platform; therefore, this trend is concerning.

The rapid fall in innovation and developer engagement poses a danger to Avalanche’s credibility and momentum in the rapidly developing blockchain space. If these problems are not resolved quickly, Avalanche may fall behind its rivals, who are drawing in developers and introducing cutting-edge initiatives.

DeFi Sector: Conflicting Indications Despite Growing Fears

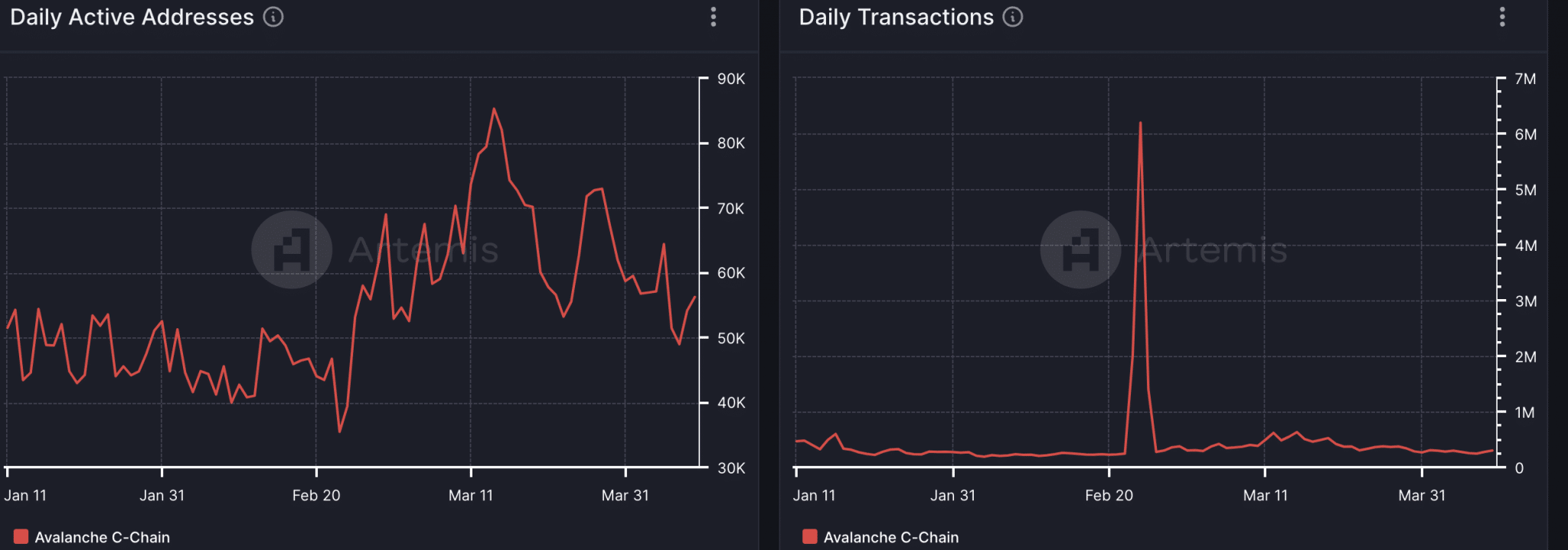

Regarding the decentralized finance (DeFi) industry, some measures paint a more concerning picture despite a reported rise in the total value locked (TVL) on the Avalanche network, which suggests continuous user investment.

Avalanche’s decentralized exchanges (DEXs) have experienced drops in both transaction traffic and trade volume, indicating a slowdown in user uptake and network utilization overall.

The discrepancy between rising TVL and declining activity levels casts doubt on the sustainability of the current TVL growth. It seems more likely that the growth is the result of returning customers increasing their investment than of drawing in new ones.

Since fresh user interaction is essential for the ecosystem’s continued health and expansion, this could result in a stagnant ecosystem with limited growth potential.

Reduction in Trading Activity and Open Interest

Additionally, there has been a decline in open interest on AVAX, suggesting a decline in trading interest. This decline in open interest and the decline in DEX trade volumes point to a wider lack of interest in trading within the Avalanche ecosystem, which may further discourage new players from joining the market.

Previously, the impending Durango update, which is expected to streamline AVAX staking through improved Avalanche wallet integration, was encouraging news, despite earlier worries about the network and development activities, as previously reported by ETHNews. For a deeper dive into these developments, a detailed explanation is available in this YouTube video.