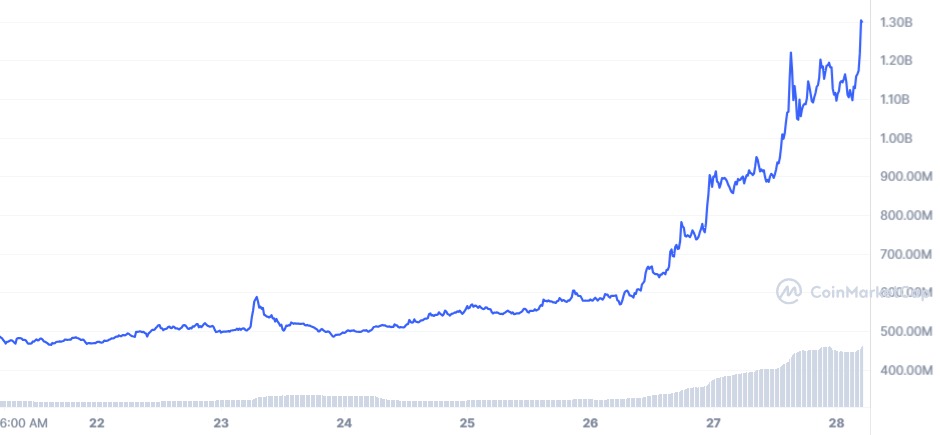

- Pepe Coin leads the meme coin rally, reaching $1.1 billion in market capitalization, driven by speculation and social media.

- Significant “PEPE Whales” transactions highlight the growing interest in Pepe Coin, generating substantial gains and increasing its market value.

PEPE Coin has surprised the cryptocurrency market this year, experiencing 140% growth in one week. This increase has captured the attention of amateurs and revived interest in memecoin, particularly those born from social networks.

With a year that got off to a quiet start as we previously reported on ETHNews, Pepe Coin is now positioned at the forefront in the memecoin sector. With a market cap that reached $1.3 billion, there are expectations that it could again reach its high of $1.8 billion.

always have been $PEPE pic.twitter.com/WqfISOum5O

— Pepe (@pepecoineth) February 27, 2024

This rise is largely due to speculation and intense activity on platforms such as Twitter, where its active community and the possibilities it offers as an investment stand out. The visibility on networks has increased its popularity and, therefore, its value in the market.

Influence of Large Portfolios in PEPE

Recent activities within the PEPE ecosystem have been decisive. Significant transactions by six prominent portfolios resulted in the sale of nearly 2 billion PEPE tokens, with considerable gains. This activity reflects the growing interest and positive dynamics around it during its current uptrend.

With the increase in the value of Pepe Coin, this phenomenon is part of an optimistic environment that encompasses the cryptocurrency market in general. Both Bitcoin and Ethereum have recorded notable rises, providing a favorable environment for Pepe Coin and other digital currencies.

Beyond Pepe Coin

Interest in meme cryptocurrencies transcends Pepe Coin. Floki Inu and Dogecoin, as we have discussed elsewhere on ETHNews, have also experienced rallies recently, with Floki Inu reaching price highs since May and Dogecoin breaking key resistance barriers .

Shiba Inu is another currency that has seen a rebound by breaking through important resistance levels and holding above key technical indicators according to our reports in ETHNews, suggesting possible appreciation in its value.

What does the daily chart tell us?

RSI: The RSI is near 90, which is well above the traditional overbought threshold of 70. This could suggest that the asset is being overbought and could be setting up for a price correction or reversal.

MACD: The MACD shows that the MACD line has crossed above the signal line and both are rising, which is a bullish sign. However, such a sudden spike can also lead to a correction if the move is not supported by solid fundamentals.