- Bitcoin (BTC) whales own over 40% of the BTC supply due to recent accumulation.

- The price of BTC is around $70,866.64, reflecting a bullish trend over the past week.

According to on-chain data, recent accumulation has left Bitcoin whales owning more than 40% of the total BTC supply.

Market intelligence site IntoTheBlock reports that these big holders have been expanding their Bitcoin holdings since mid-March. Whales are Bitcoin addresses with more than 1,000 BTC, or about $71.4 million at current exchange rates.

Since mid-March, the amount of Bitcoin held by large holders has steadily increased.

Addresses holding over 1,000 $BTC now collectively own more than 40% of the total Bitcoin supply! pic.twitter.com/yGkTTFj20c

— IntoTheBlock (@intotheblock) June 5, 2024

Significant Influence on BTC Price

Owing to their large holdings, whales are powerful people whose decisions can have a big effect on the price of Bitcoin. Knowing market dynamics requires keeping an eye on whale collective behavior, such as their overall supply pattern.

According to a chart from IntoTheBlock, Bitcoin whales have been accumulating over the past few months.

Following the all-time high of Bitcoin’s price, this accumulation started to gather steam. Whales saw it as a chance to purchase additional Bitcoin even as the wider market panicked.

Thanks to their most recent acquisitions, whales now control more than 40% of the total circulating quantity of Bitcoin. Should whales keep accumulating, they may soon hold more than half of the supply, which might have conflicting effects on Bitcoin’s value.

Recent Market Data

At the time of writing, Bitcoin was valued at about $70,866.64 on CoinMarketCap, down 0.13% on the previous day but exhibiting a bullish trend with a 4.57% rise over the previous seven days.

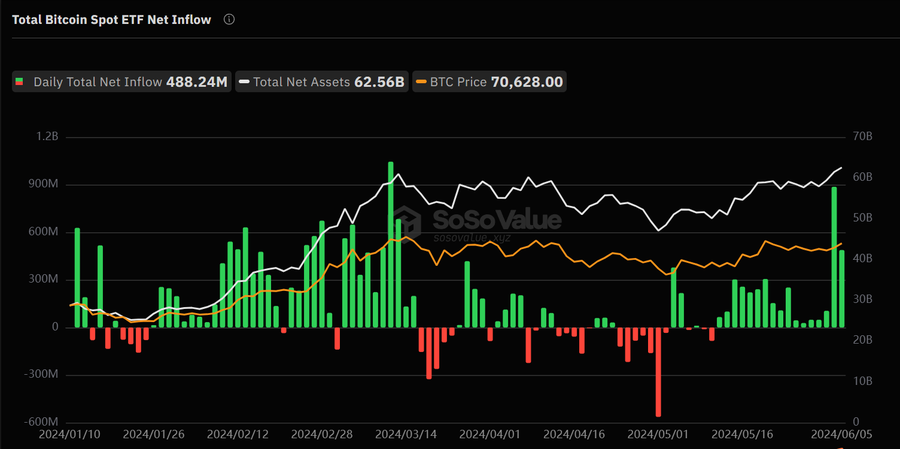

Furthermore, June 5 saw a net inflow of $488 million for Bitcoin spot ETFs, which was the 17th day in a row. Single-day inflows for Grayscale ETF GBTC were $14.5802 million, Fidelity ETF FBTC was $221 million, and BlackRock ETF IBIT was $155 million.

SosoValue reports that as of right now, the cumulative net inflow of Bitcoin spot ETFs has hit $15.338 billion.

As previously reported by ETHNews, ETHNews featured Matt Horne of Fidelity, who suggested a modest Bitcoin allocation to reduce risk and optimize profits.