- Prominent investors, known as ‘whales’, boost LINK’s value by withdrawing $17 million from Binance, signaling optimism.

- Accumulation by ‘whales’ and the expectation of a spot ETF for Chainlink reinforce its growth potential.

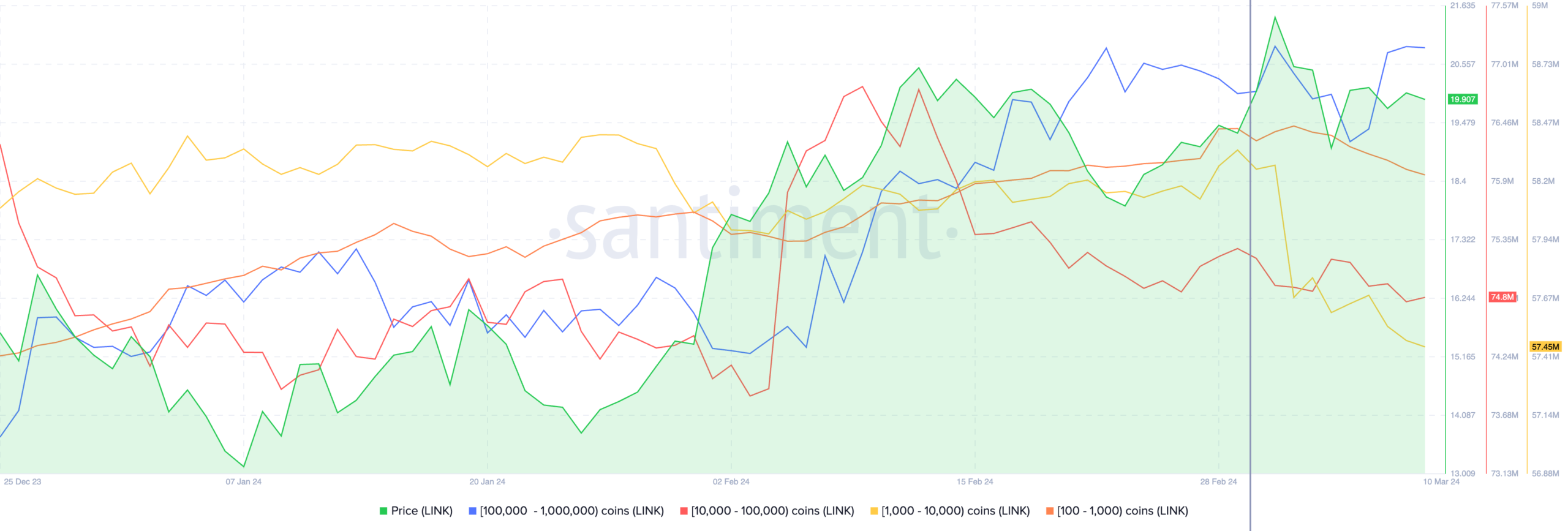

What’s going on with Chainlink? Over the past few days, a notable capital injection has been detected in LINK, with ‘whales’ withdrawing a considerable sum of about $17 million from the Binance platform.

This is not an isolated event. The accumulation has not only been reflected in these direct transactions, but also in the expansion of LINK holdings among these large market investors.

This phenomenon has set off a chain of speculation and analysis within the crypto community, as we have read elsewhere on ETHNews, Are we facing a prelude to a jump in the price of LINK? Although the crypto market is known for its volatility, the ‘whale’ accumulation strategy is often an indicator of an underlying confidence in the medium to long-term potential of a cryptocurrency.

Market Reaction

Despite facing a slight contraction in its share price recently, Chainlink has maintained a track record of impressive monthly gains, verging on 9%. This performance is a testament to the resilience and promise LINK offers its holders, especially when considering the broader context of its recent accumulation.

The current situation surrounding LINK has not only captured the attention of those closely watching the behavior of ‘whales’, but has also stoked debate about the need for and impact of spot ETFs for cryptocurrencies such as Chainlink .

With products like Grayscale’s Chainlink Trust GLNK trading at an exorbitant premium, the call for more equitable regulation and investment offerings gains momentum.

Chainlink (LINK)current price is approximately $21.46 USD, up $1.51 (7.58%) in the last reporting period. It has experienced an overnight price range of $21.06 to $22.22, reaching a 52-week range of $4.98 to $22.22. This behavior reflects a recent uptrend in Chainlink’s price, indicating growing interest and adoption in the market.

Analyzing technically, the recent rally in price and the touch of the 52-week high suggest strong investor demand. The break of its resistance near the 52-week high could indicate continued upside potential.