- Glassnode’s “Accumulation Trend Score” has hit the maximum mark, indicating active Bitcoin accumulation by large investors.

- Score differentiation shows larger entities like ETFs are now buying aggressively, suggesting a bullish market sentiment.

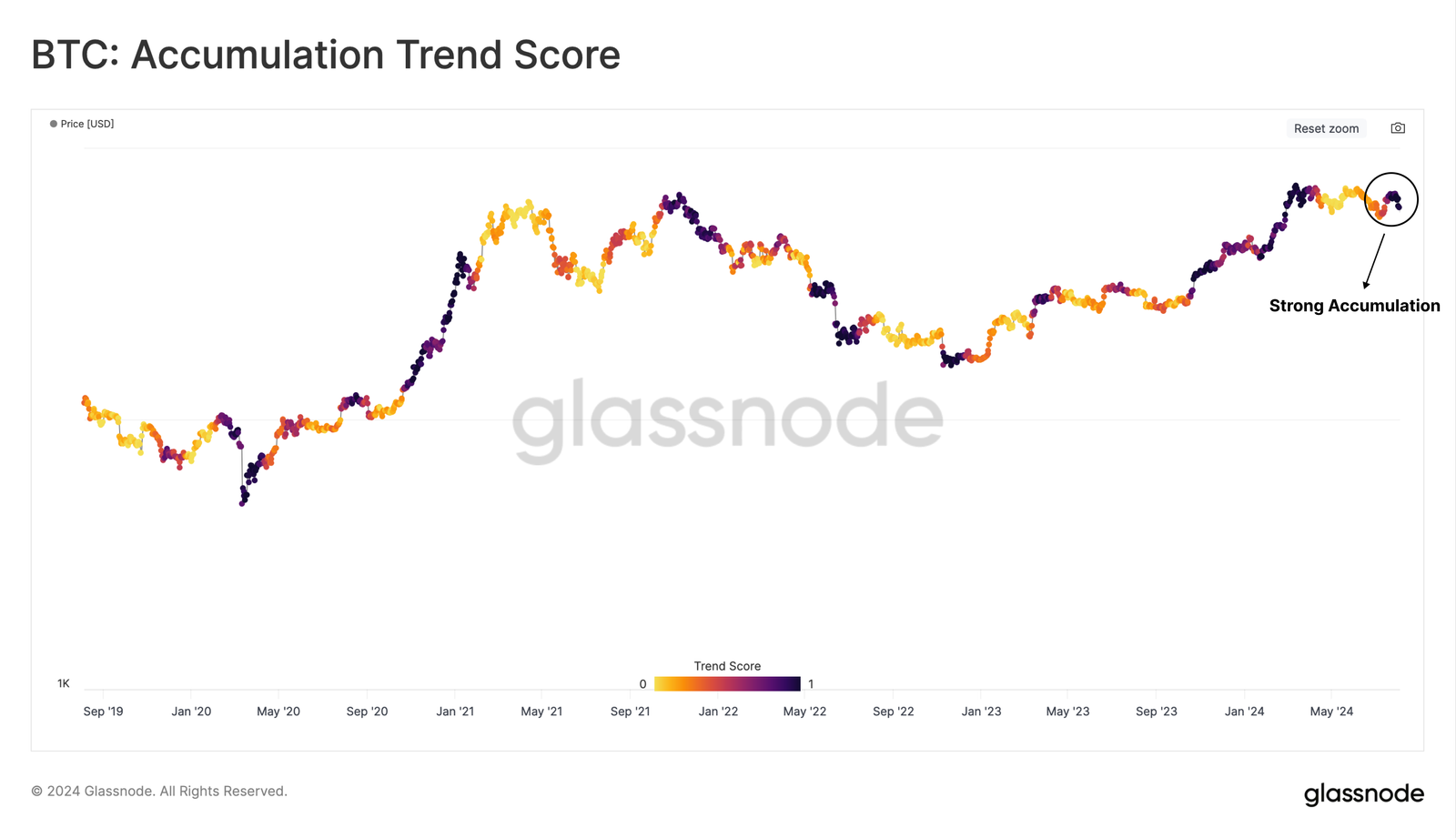

The recent Glassnode report indicates a resurgence of Bitcoin accumulation among investors, signaling a potential shift in market dynamics. According to the latest data, the “Accumulation Trend Score” , a key metric used by Glassnode, has reached the maximum value of 1.

This metric assesses investor behavior by analyzing balance changes across Bitcoin wallets, with a particular focus on the volume and profile of the investors involved.

The Accumulation Trend Score is important because it differentiates between small and large Bitcoin holders, giving greater significance to the actions of larger investors. A score close to 1 suggests that either a big number of small holders or major institutional entities are actively accumulating Bitcoin.

Conversely, a score near 0 indicates a lack of accumulation activity, suggesting that these significant players are either distributing their holdings or are inactive in terms of accumulation.

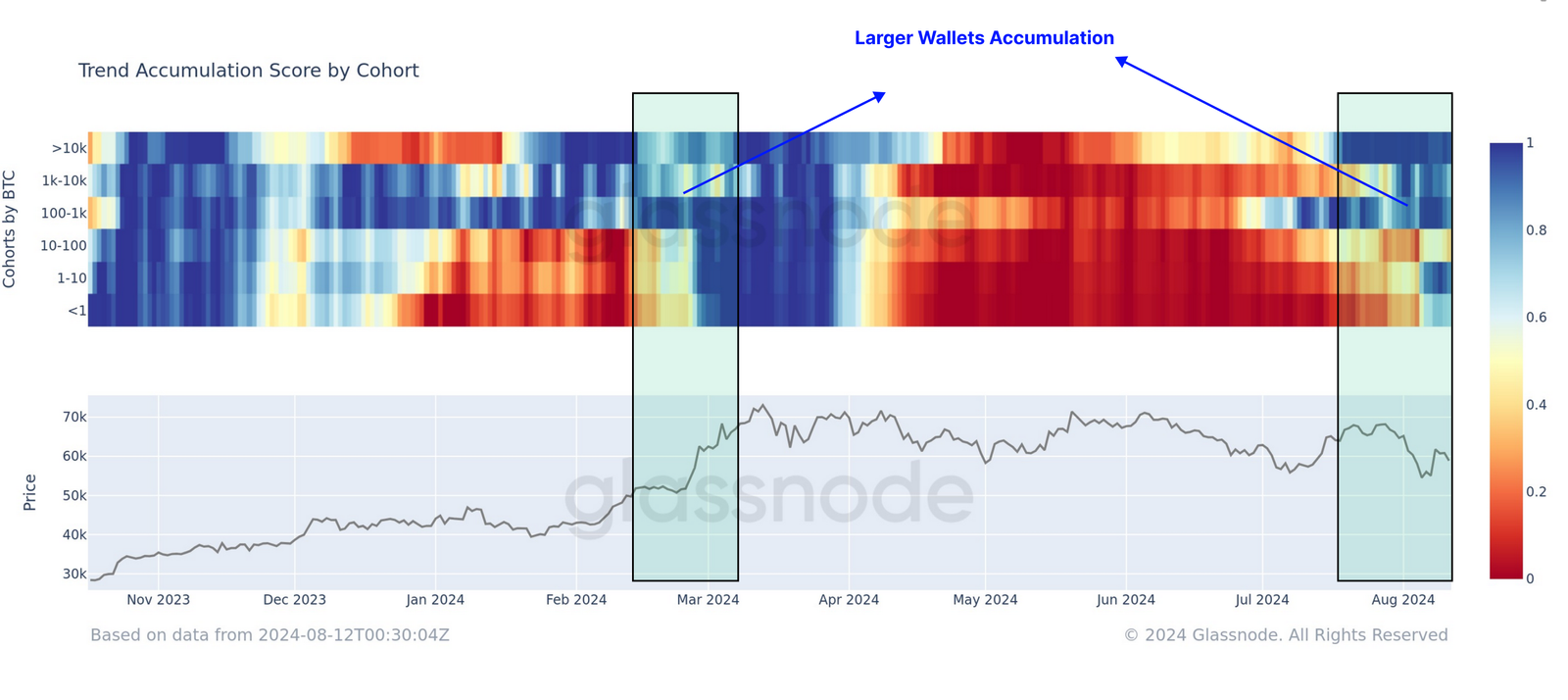

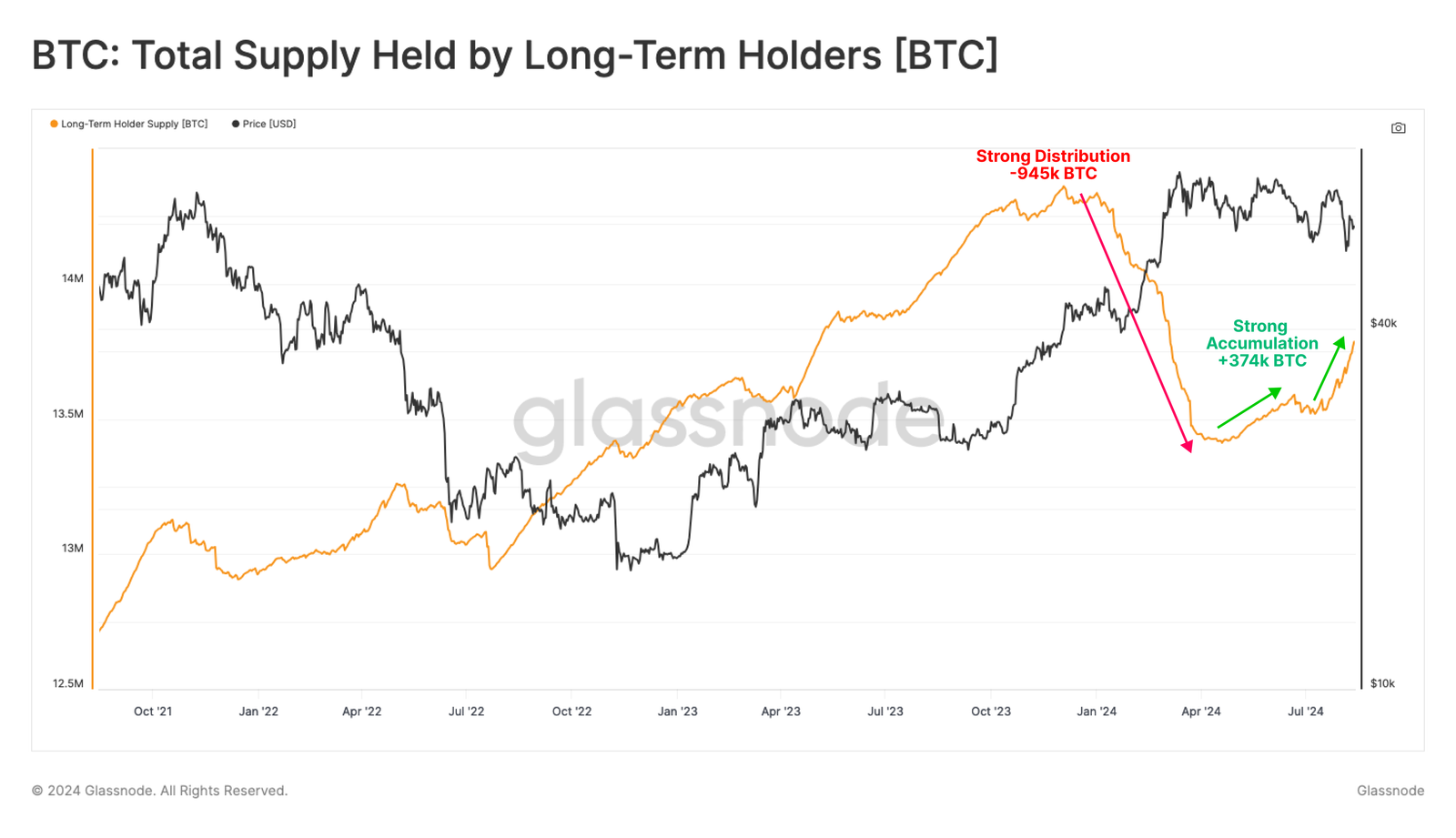

The detailed analysis in the report highlights that during the period following Bitcoin’s price peak, the Accumulation Trend Score was predominantly red across all market sectors, implying widespread distribution rather than accumulation.

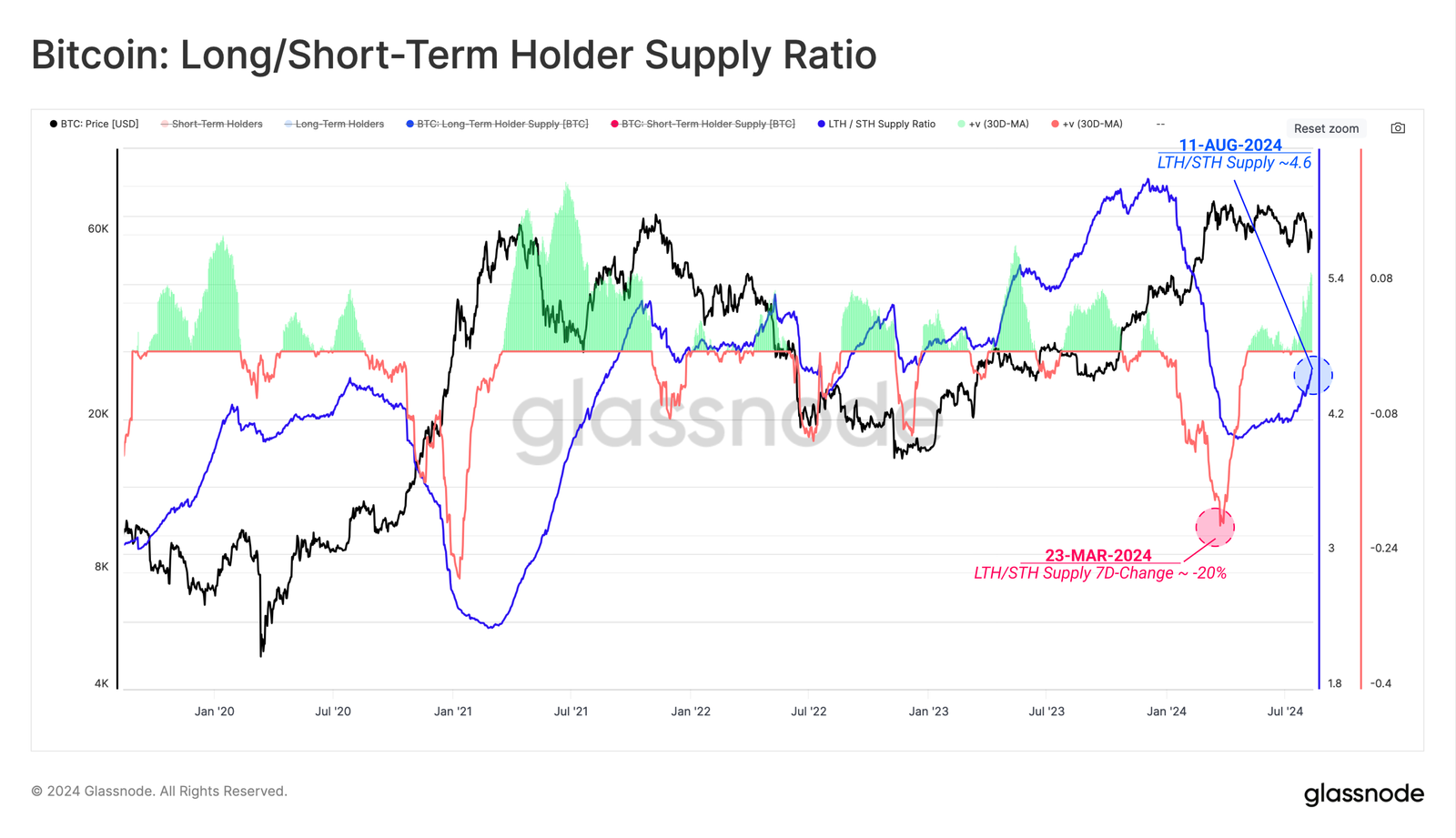

However, this trend appears to be reversing. The latest data show the indicator turning blue, particularly among the largest holder groups, suggesting an intense phase of accumulation is underway.

Notably, the most substantial accumulation is occurring within the cohort of holders possessing over 10,000 BTC. This group includes heavyweight entities such as spot exchange-traded funds (ETFs), which are now demonstrating behaviors consistent with a strong buying regime.

The impact of these large-scale purchases is enough that the combined market version of the Accumulation Trend Score has escalated to 1, driven by the robust activity of these major players.

The historical context provided by Glassnode illustrates that similar levels of accumulation activity were last observed during the run-up to Bitcoin’s all-time high prices.

If past patterns hold, the current accumulation could be a potentially bullish trend in the Bitcoin market, heralding optimistic prospects for its value in the near future.