- Ethereum’s current price at $2,705 could potentially break the $2,800 resistance amid shifting market sentiments.

- Fear and Greed Index at 38 suggests a move from extreme fear to neutrality, boosting investor confidence.

Ethereum, currently trading at $2,705, is inching closer to breaking the $2,800 resistance level, according to the latest market data.

[mcrypto id=”12523″]

The Ethereum Fear and Greed Index stands at 38, indicating a shift from extreme fear to a more neutral market sentiment, suggesting increased investor confidence.

The balance between fear and greed in the market reflects the overall investor sentiment towards Ethereum. This neutrality is pivotal as it may lead Ethereum to test and potentially surpass the $2,800 mark. Such a move would signify a positive shift in momentum not just for Ethereum, but for the broader cryptocurrency landscape.

Ethereum’s Price Movements and Market Recovery

Ethereum has managed to reclaim the $2,800 level, which had previously acted as support before the recent market downturn.

This level is now eyed as a potential springboard for further gains. Observers are keenly watching to see if Ethereum can maintain its rally and secure a position above this resistance, especially after recovering from a weekly low with a strong bullish close.

Analysis of Ethereum’s Ecosystem

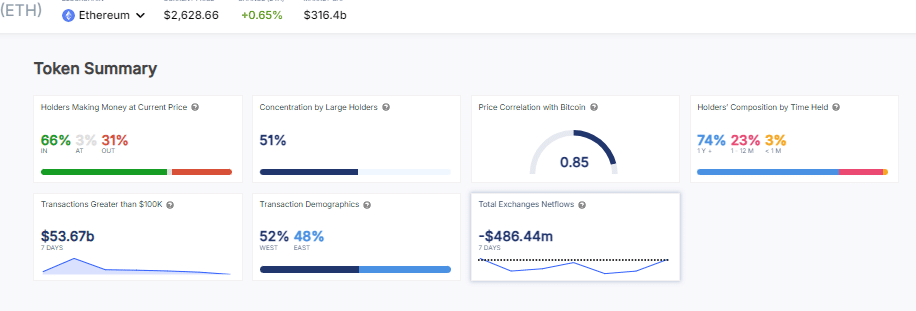

Investigative data into Ethereum’s ecosystem reveals promising signs that support a potential upward movement. Currently, 66% of Ethereum holders are seeing profits, with 51% of all ETH held by large investors, adding to the token’s stability.

Additionally, Ethereum maintains a strong correlation with Bitcoin at 0.85, and a majority of holders, about 74%, have held their assets for over a year, indicating strong loyalty and belief in Ethereum’s value.

On-Chain Indicators and Market Projections

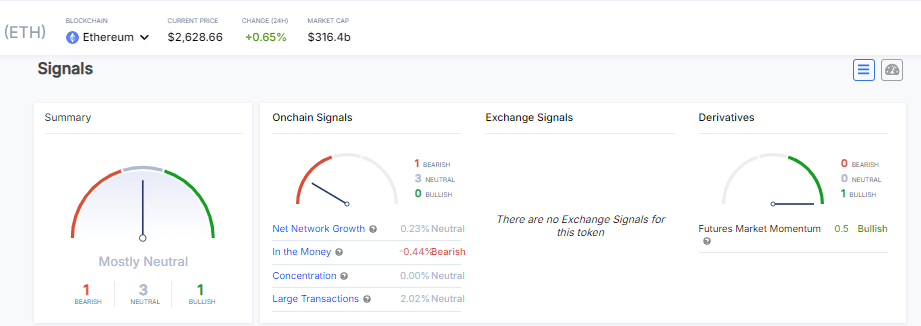

On-chain indicators for Ethereum show a neutral stance with steady network growth at 0.23%. Despite a slight dip in profitable transactions, the futures market exhibits a mild bullish inclination of 0.5%.

These indicators, combined with $53.67 billion in large transactions over the past week, strengthen the case for Ethereum potentially breaking past the $2,800 resistance soon.