- Ethereum is experiencing an increase in exchange supply, suggesting possible selling pressure or investors’ willingness to trade.

- The increase in Tether exchange supply indicates that investors are willing to mobilize capital, possibly transferring funds to other assets.

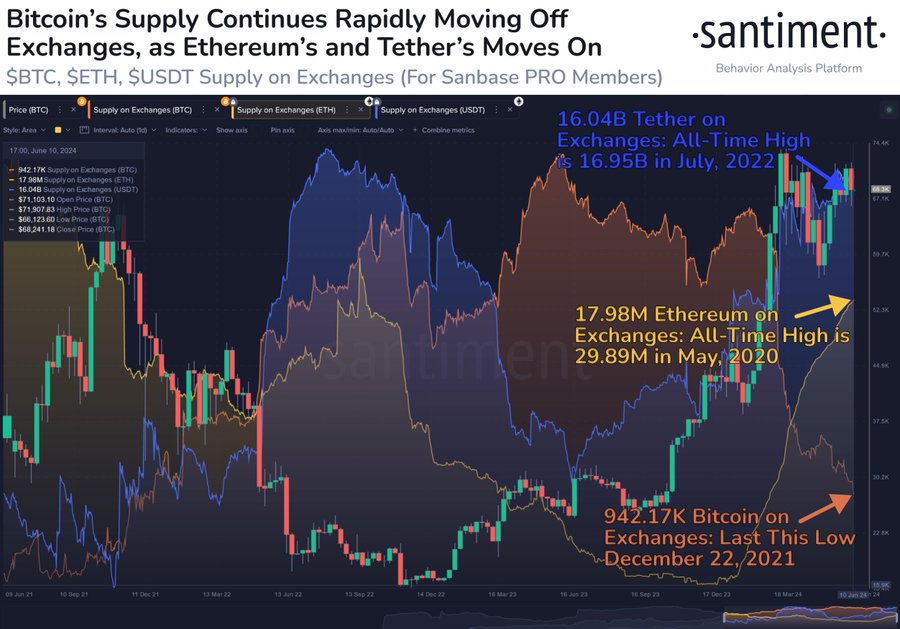

Recent blockchain data reveals diverging trends in Bitcoin and Ethereum exchange supply, suggesting possible shifts in investor behavior within the cryptocurrency market. This analysis, produced by blockchain analytics firm Santiment, points to opposing movements that could indicate a shift in investment focus from Ethereum to Bitcoin.

Key trends in cryptocurrency exchange supply

The “Supply on exchanges” metric measures the total amount of a cryptocurrency’s supply currently in the wallets associated with centralized exchanges. An increase in this metric suggests that investors are depositing their assets on exchanges, usually to prepare for trading activities or to use other exchange-related services.

😎 Bitcoin's supply on exchanges has now dropped to its lowest level since December, 2021 (~942K coins). Meanwhile, Ethereum and Tether are moving back on. Historically, there is less drop-off risk for all of crypto while $BTC's available supply to be sold is limited. pic.twitter.com/vGv0q6esxx

— Santiment (@santimentfeed) June 13, 2024

Conversely, a decrease indicates that investors may be withdrawing their assets to hold them for the longer term outside of exchanges.

According to recent data, the supply of Bitcoin on exchanges has decreased significantly, reaching its lowest level since December 2021, with the current figure at 942,170 BTC. This reduction implies that possibly more investors are opting to hold their Bitcoin rather than exchange it, suggesting a possible anticipation of future increases in value or a preference to hold it as a safeguard against market volatility.

Ethereum and Tether exchange offerings

Unlike Bitcoin, Ethereum has seen an increase in its supply on exchanges, with figures amounting to 17.98 million ETH. Similarly, Tether (USDT), a stablecoin pegged to the U.S. dollar, has also seen an increase in supply on the exchanges, with a total of 16.04 billion USDT.

The influx of Ethereum and Tether on exchanges could be indicative of investors’ intent to trade these assets, possibly due to a perception of increased risk or a desire to capitalize on market movements.

Implications of supply shifts

The opposing trends between these major cryptocurrencies suggest a rotation of capital, potentially from Ethereum to Bitcoin. This movement could be interpreted as a bearish signal for Ethereum, indicating that investors may consider it to currently carry greater risks .

For Tether, increased exchange supply generally indicates a willingness among investors to mobilize previously tied-up capital, reflecting a positive outlook on market opportunities.

Bitcoin’s market behavior

Despite the decrease in exchange supply suggesting bullish sentiment, the price of Bitcoin has remained relatively stable, showing mostly sideways movement in recent months. Currently, Bitcoin is trading at around $67,900, down nearly 5% in the last week.

Recent blockchain data underscores a period in the cryptocurrency markets, with significant changes in exchange supplies of major assets such as Bitcoin and Ethereum. These trends provide valuable insights into investorstrategies and sentiments, reflecting broader market sentiments and possible future movements.