- Ethereum experiences $62 million in long liquidations, marking significant trading activity since May 23rd amid price volatility.

- A 52% decrease in Ethereum’s options trading volume reflects fewer market participants, resulting in reduced liquidity.

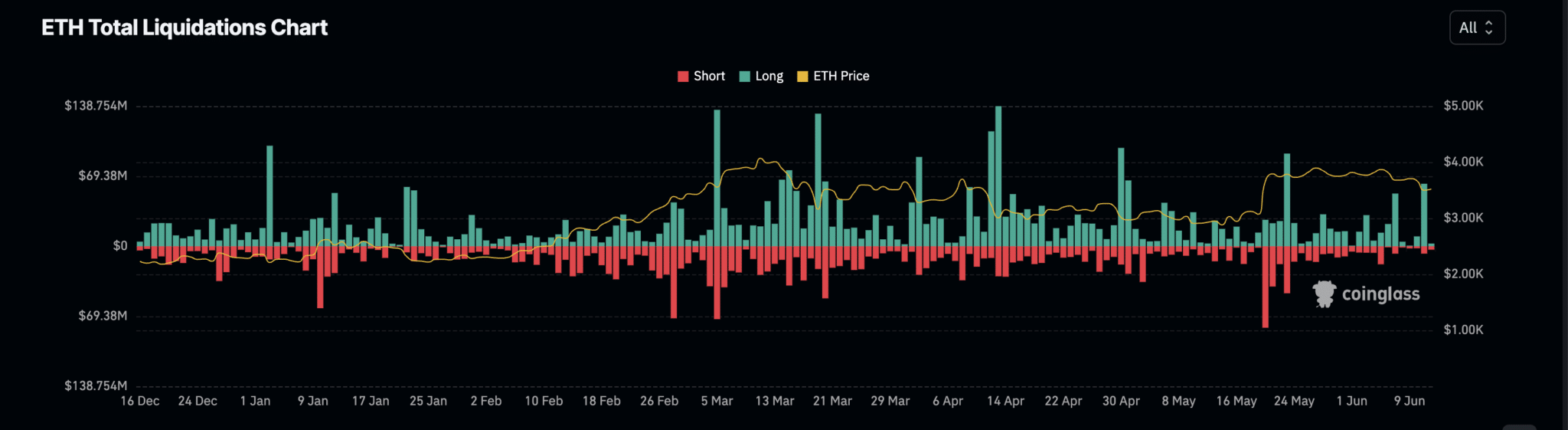

Ethereum (ETH) has experienced notable fluctuations, particularly in its derivatives segment. Over the past 24 hours, Ethereum has seen long liquidations amounting to $62 million, marking a significant trading event since May 23rd. This surge in liquidations coincides with a broader downturn in the coin’s derivatives market activity.

Details of the Market Movement

On June 11th, the derivatives market for Ethereum reported a substantial spike in long liquidations, where positions favoring a price increase were forcefully closed due to a sudden drop in the asset’s value.

This resulted in $62 million in long liquidations, while short liquidations were relatively minimal at $7.3 million. This scenario typically occurs when there are not enough funds to maintain open positions, forcing traders to exit at a loss.

Decline in Derivatives Market Activity

The past day has also witnessed a 52% decrease in the trading volume within Ethereum’s options market, which recorded a trading volume of $321 million. A decline in trading volume indicates a reduction in market participants buying or selling options, leading to reduced liquidity. This liquidity drop can widen the bid-ask spreads, making it challenging for traders to execute transactions at preferred prices.

Furthermore, the Open Interest in Ethereum, which measures the total number of unsettled contracts in the market, has decreased by 2%, standing at $15.73 billion. A fall in Open Interest suggests that more traders are closing their positions rather than opening new ones, contributing to a less active market.

Positive Funding Rate Amidst Market Turmoil

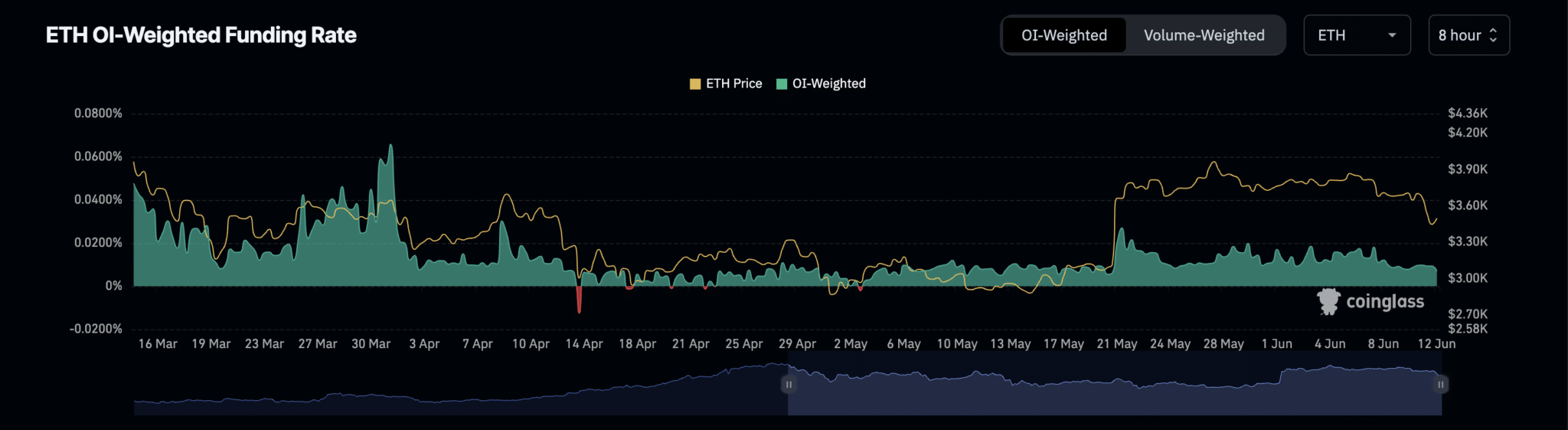

Despite these challenges, Ethereum’s Funding Rate has remained positive, indicating continued interest in holding long positions. The Funding Rate, which was recorded at 0.0069% at press time, is a mechanism in perpetual futures contracts that helps align the contract price with the spot price of the underlying asset.

A positive Funding Rate reflects a stronger demand for long positions over shorts, suggesting that traders anticipate a potential rise in Ethereum’s price.

While there has been a notable downturn in activity and an increase in forced liquidations, the positive Funding Rate signals a prevailing optimism among some traders about the future price of Ethereum.

This mixed sentiment in the market underscores the volatile and unpredictable nature of cryptocurrency investments, where price movements can trigger rapid changes in trader behavior and market conditions.