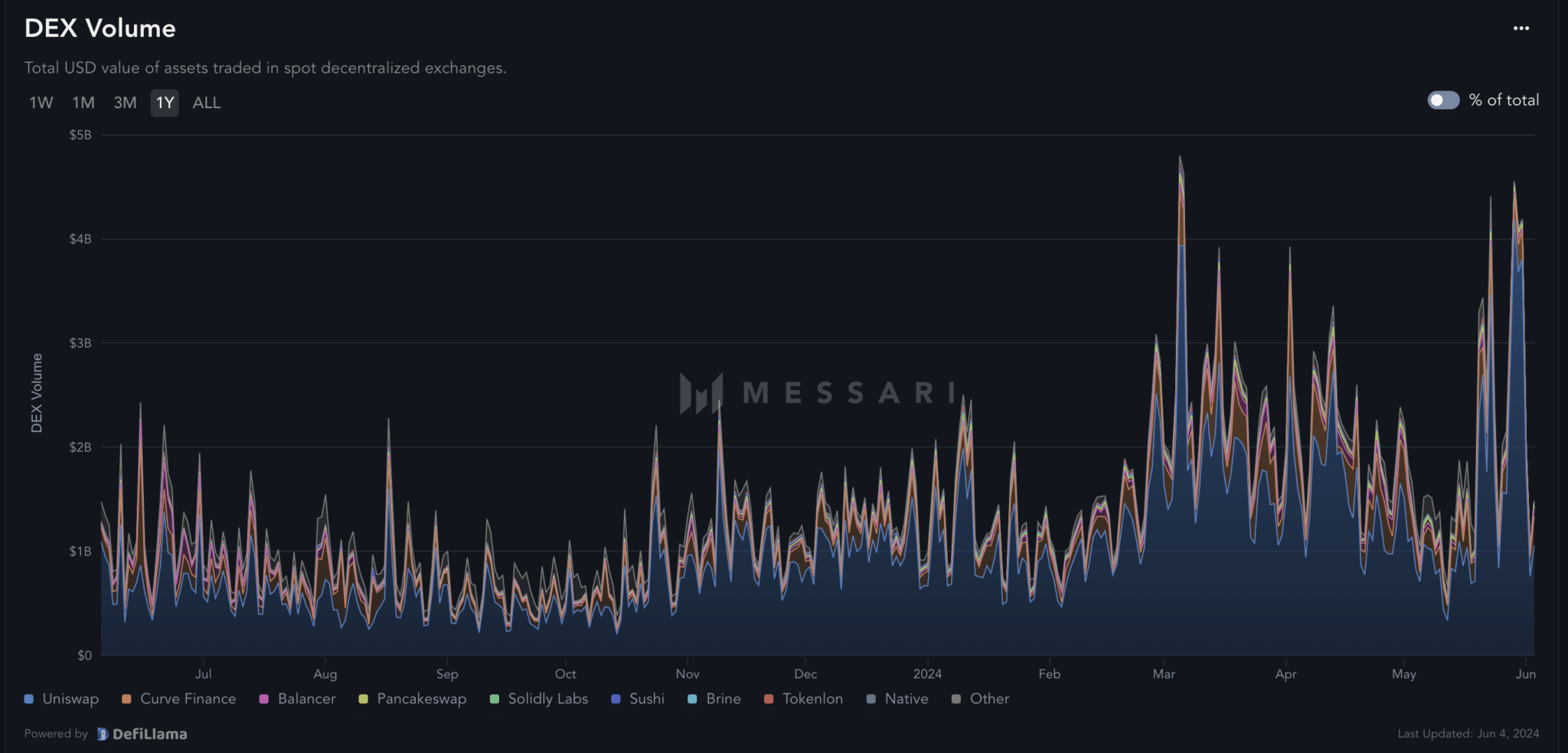

- Ethereum’s DEX volume dropped $2.21 billion, indicating reduced on-chain trading and lower demand for ETH this week.

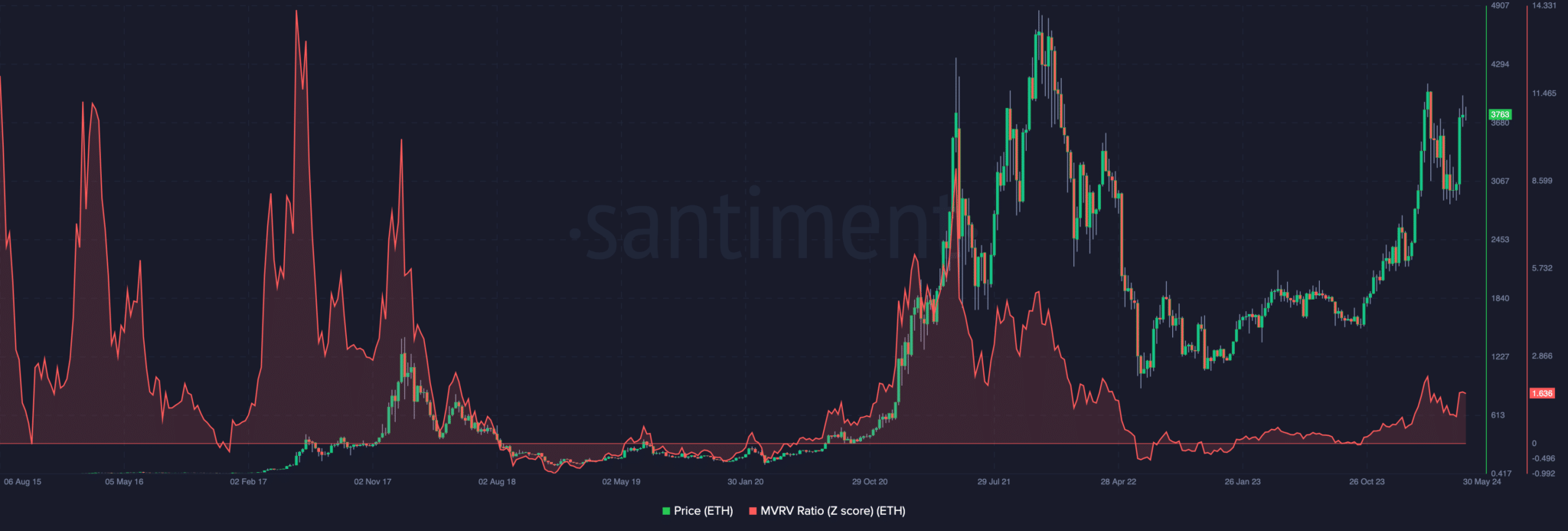

- The MVRV Z Score indicates potential long-term bullish momentum for Ethereum, despite recent short-term price drops.

Ethereum’s decentralized exchange (DEX) volume has seen a sharp decline over the past week, dropping from $3.34 billion on May 28 to $1.03 billion. This $2.21 billion decrease reflects reduced on-chain trading and diminished demand for ETH. As of now, Ethereum is priced at $3,763, marking a 3.5% decrease within the last week.

Despite this drop, some indicators suggest potential bullish momentum for Ethereum. The Market Value to Realized Value (MVRV) Z Score, a metric that correlates strongly with price movements, shows positive signals. When the MVRV Z Score is negative, it indicates a bearish phase, whereas a positive score indicates a bullish phase.

Currently, the MVRV Z Score for Ethereum stands at 1.63. Comparatively, during the peak of previous bull cycles in 2017 and 2021, the MVRV Z Score reached 14.19 and 4.76, respectively. If history were to repeat, Ethereum’s price could climb higher in the long term.

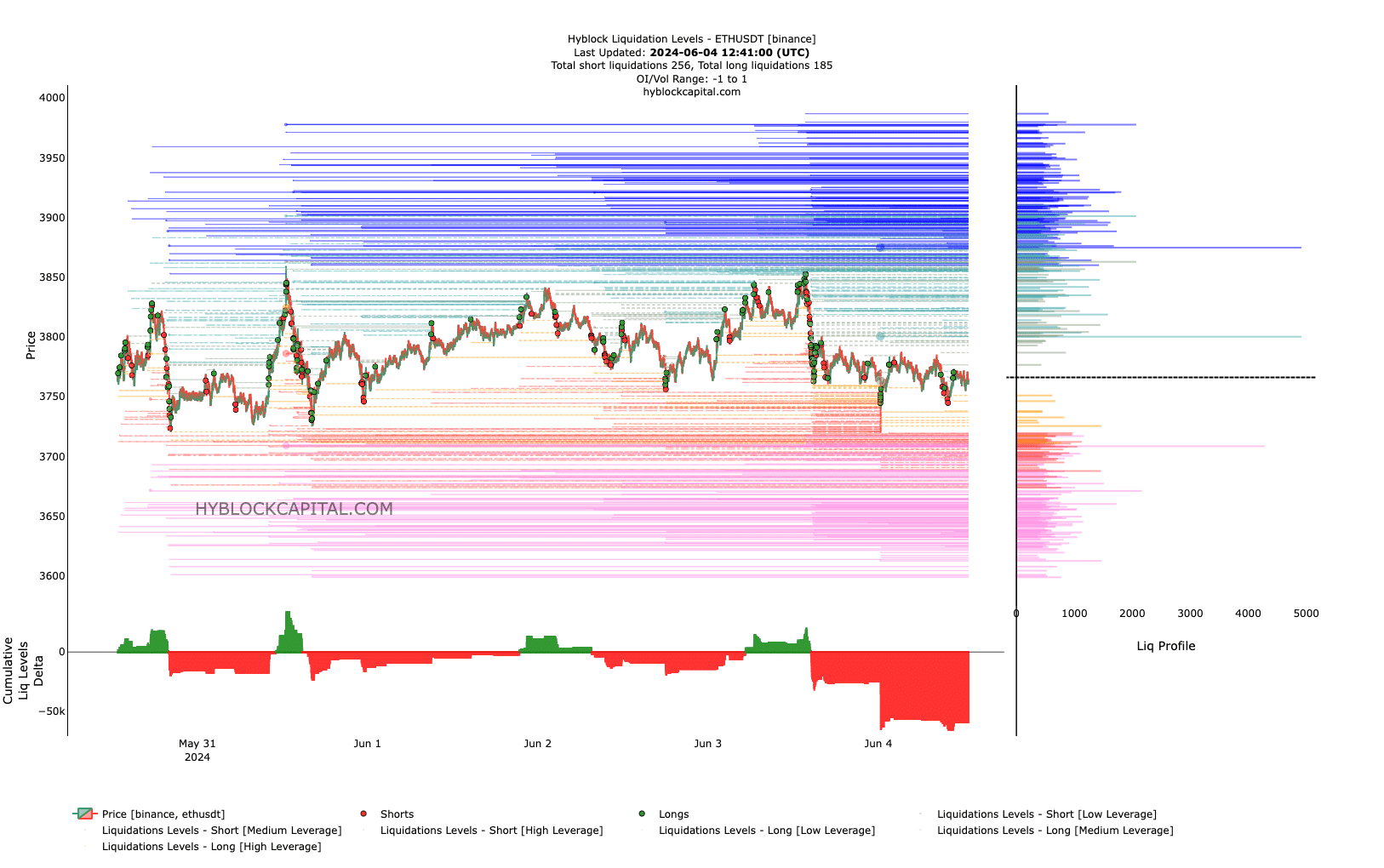

In the short term, Ethereum’s price might experience fluctuations due to liquidation levels. Liquidation occurs when an exchange forcefully closes a trader’s position to prevent further losses. At present, large-scale liquidations for Ethereum could occur between $3,882 and $3,946. This range suggests that the price could move towards these levels.

Moreover, the Cumulative Liquidations Levels Delta (CLLD) is an essential measure. A positive CLLD shows an increase in long liquidations, whereas a negative CLLD indicates a higher occurrence of short liquidations. At present, the CLLD is negative, with short liquidations surpassing $59 million in the past week.

This negative CLLD is considered bullish for Ethereum, implying that late short traders might fail to capitalize on the dip, potentially allowing Ethereum’s price to recover.

While Ethereum’s DEX volume and demand have declined recently, certain market indicators point towards a possible recovery and price increase. Traders and investors should keep an eye on liquidation levels and the MVRV Z Score for further insights into Ethereum’s market behavior.