- Despite previous drops following SEC warnings, UNI’s price recovered to $7.81, up 8.31% in the last week.

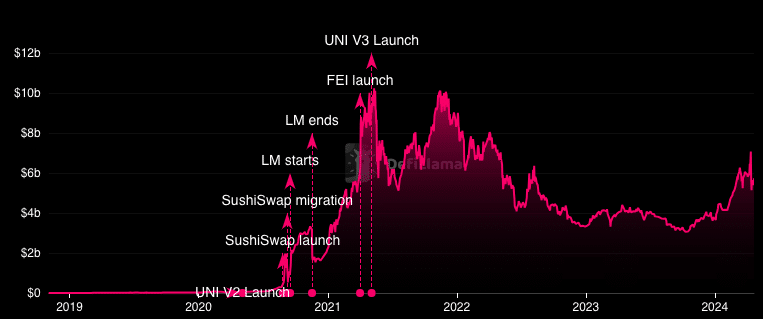

- UNI’s TVL surged by 138% in 30 days, indicating restored investor confidence and positioning for future price increases.

Recent data indicates that Uniswap (UNI) may be positioned to lead a revival in the decentralized finance (DeFi) sector.

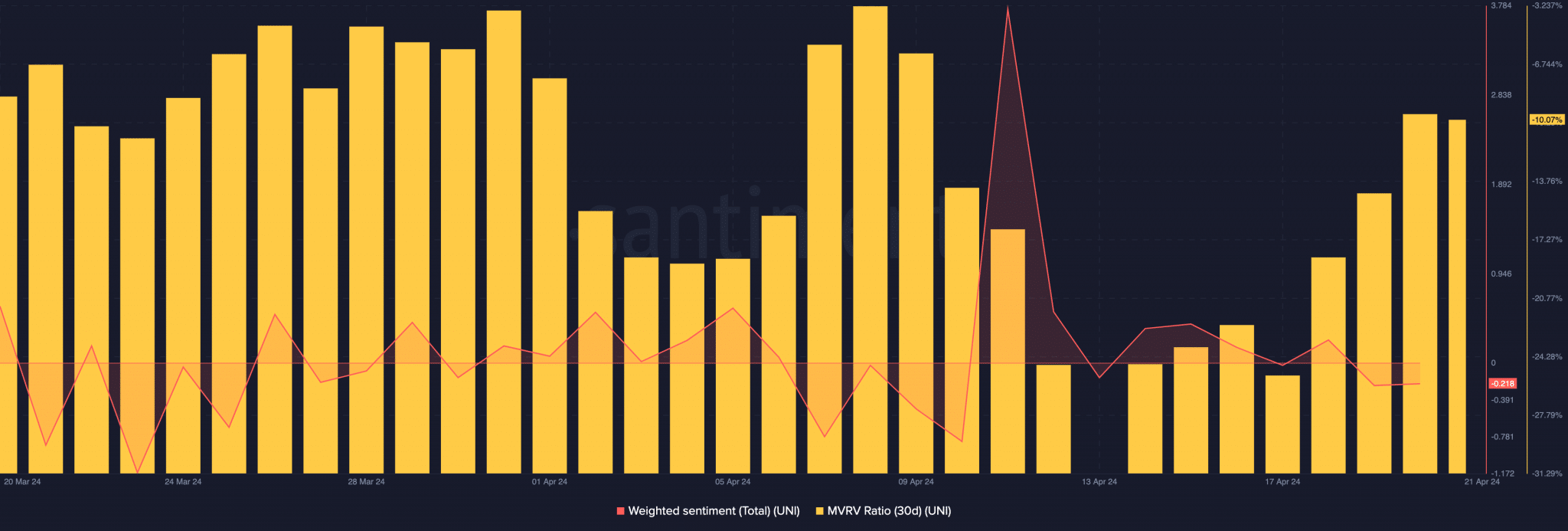

An increase in withdrawals from exchanges and a negative Market Value to Realized Value (MVRV) ratio point to a potential upswing for UNI. This analysis follows a rise in the total value locked (TVL) on the platform, suggesting investor confidence is returning after previous market concerns.

A big movement observed was the withdrawal of 121,871 UNI tokens from Binance, valued at approximately $954,000. This action typically indicates an intent to hold rather than sell, viewed by market analysts as a positive sign for the token’s future price stability.

Related: Uniswap Breaks Records with $250B L2 Volume – UNI Token Price Speculations

Despite a severe drop to $5.86 following a warning from the U.S. SEC, UNI’s price has increased by 8.31% over the past week to $7.81. This recovery is part of a wider interest in DeFi tokens, highlighted by similar actions from a major investor involving Compound (COMP) tokens.

The broader DeFi token market has not mirrored the last bull market dominated by meme coins, real-world assets, and AI tokens. Despite this, the sentiment around UNI has shifted negatively in recent measurements, which could suggest a lack of demand.

However, the current 30-day MVRV ratio is -10.01%, indicating that selling now would likely result in a loss for most holders, potentially setting the stage for a buying opportunity that could propel UNI’s price into double digits.

Read more: Uniswap Responds to SEC Pressure: Trading Fees Hiked to 0.25%

Additionally, if the trend of increasing TVL continues, it could push UNI toward its peak historical values. According to DeFiLlama, UNI’s TVL has surged by 138% in the last 30 days, signaling a resurgence of trust in the protocol.

As the market adjusts to these dynamics, there are suggestions of an impending altcoin season which might further enhance UNI’s market value, possibly reaching between $15 and $20.

This outlook is bolstered by the token’s recovery from negative market sentiments and an increase in foundational strength, as evidenced by the growth in TVL, positioning Uniswap for potential advancement in the DeFi sector.