- ADA’s recent price action surpassed a previous lower high of $0.4235, hinting at a potential shift in market structure.

- Resistance observed in the $0.44-$0.475 range, with critical levels extending up to $0.5 marking a bearish order block.

Recent data on Cardano (ADA) prices shows a potential turning point as the currency experienced a 35% surge in value from July 8 to July 13. This increase is largely attributed to the intensified buying activity of large-scale holders, indicating a shift in market.

While the long-term outlook for ADA remains bearish, there is a growing sentiment that the critical resistance level of $0.5 could play a decisive role in the coming days.

ETHNews is analyzing the current market structure, the ADA price recently surpassed the previous lower high of $0.4235. This development suggests a potential shift in market structure, though it does not necessarily confirm the onset of an uptrend.

Resistance remains firm within the $0.44-$0.475 range, and a bearish order block is noticeable in the $0.46-$0.5 region. A daily close above the $0.5 mark could indicate the beginning of an uptrend, but until such a breakout occurs, investors are advised to exercise caution.

The Relative Strength Index (RSI) for ADA has crossed above the neutral 50, suggesting an increase in bullish momentum. Additionally, the On-Balance Volume (OBV) indicates that the recent price gains are supported by substantial buying pressure, reflecting the activities of the whales who have been actively accumulating ADA.

In terms of investment strategy, the near-term retest of the $0.42-$0.43 zone could present a lucrative buying opportunity, with potential targets ranging up to the $0.46-$0.5 zone. It’s important to note that a sustained breakout above $0.5 could signal the start of a more prolonged uptrend, potentially reaching previous levels at $0.57 and $0.68.

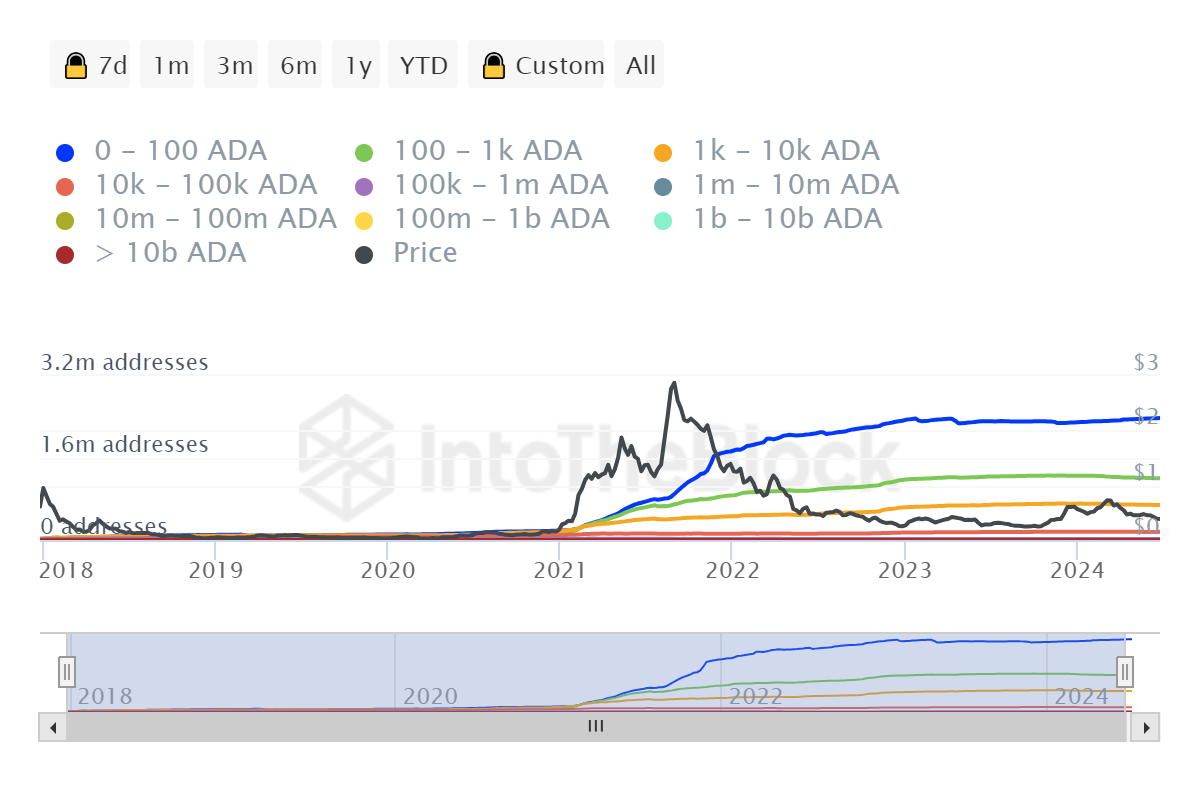

[mcrypto id=”12352″]This surge in ADA is underpinned by ETHNews data showing a 6.93% increase over the past month in holdings by addresses with tokens valued at over $10 million. This pattern of accumulation suggests that despite recent price declines, there is a confidence among major investors that ADA has the potential for substantial future gains.