- Glassnode predicts Bitcoin’s value could potentially surpass gold, forecasting a 65x ratio in the ongoing market movement.

- Bitcoin’s recent all-time high of approximately $73,700 showcases its strong market performance and growing acceptance as “digital gold.”

Bitcoin (BTC) continues to hold the spotlight, captivating both investors and analysts alike. A recent proclamation by the cofounders of Glassnode, a leading firm in blockchain analytics, has ignited discussions within financial circles.

Through a tweet on the account 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰, they have conveyed a striking forecast regarding Bitcoin’s potential to eclipse gold in terms of value.

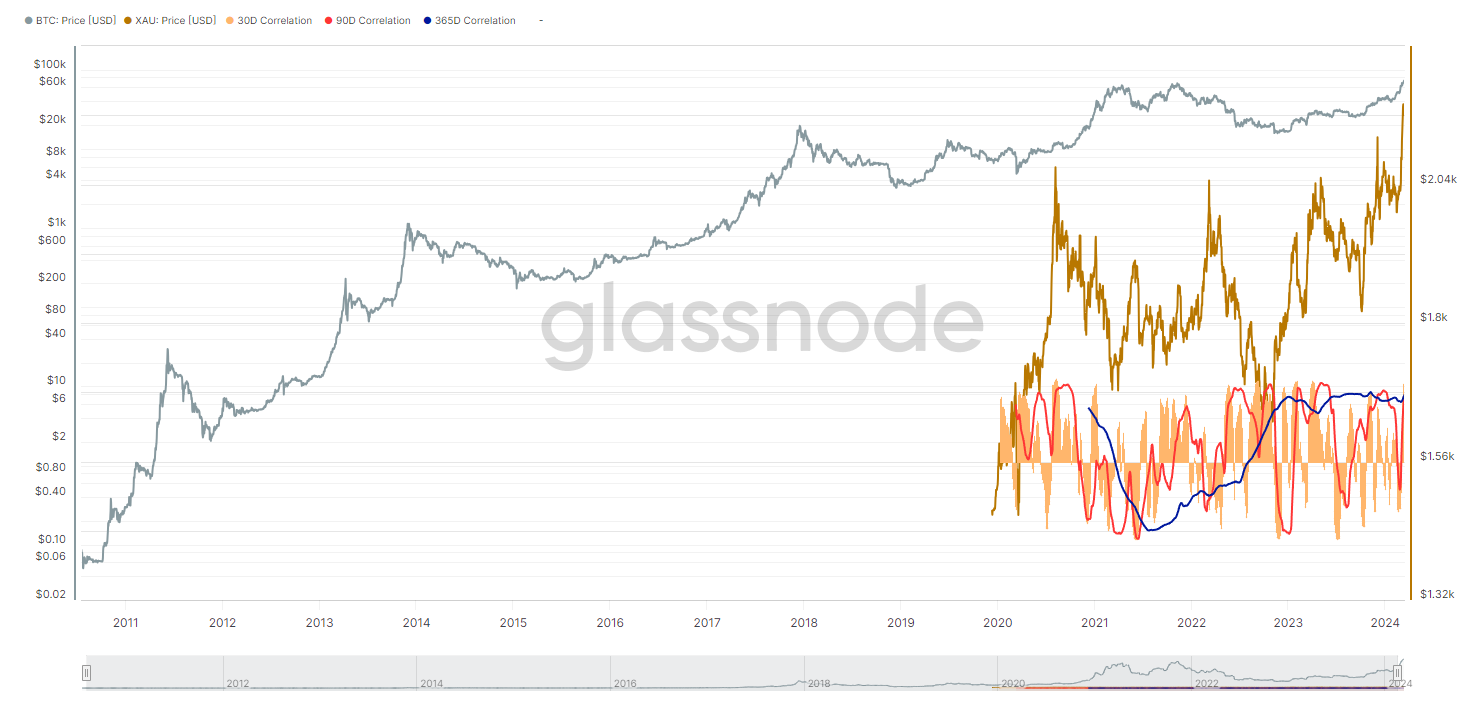

Remember #Gold vs. #Bitcoin?#BTC dominates #Gold – big time. We suggested a 65X ratio to come at the end of the move.

For now we have only reached ~34X. But…. there is an End Date in sight 😉More highs to come into this extreme #BlowOffTop as forecasted by @HenrikZeberg pic.twitter.com/ePmzvJ1M49

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) March 14, 2024

The Bold Claim: Bitcoin to Dominate Gold

The essence of Glassnode’s assertion lies in the anticipated ratio between Bitcoin and gold. Currently, the value of Bitcoin stands at approximately 34 times that of gold. However, Glassnode’s cofounders envision this ratio ballooning to 65 times in favor of Bitcoin by the culmination of the ongoing market movement.

This prediction is not merely a speculative statement but is grounded in the current trajectory of Bitcoin’s market performance, as we have previously reported in ETHNews.

The Current State of Bitcoin

Bitcoin’s market dynamics offer a compelling narrative of resilience and exponential growth. Recently, the cryptocurrency reached a new all-time high (ATH) of around $73,700.

Despite a marginal dip to $72,738, marking a negligible 0.03% decrease over the last 24 hours, Bitcoin has demonstrated remarkable momentum, with a 40.74% upsurge in the past month.

This performance not only illustrates the robust enthusiasm surrounding Bitcoin but also solidifies its status as a formidable contender against traditional investment assets like gold.

Understanding the Complex Nexus

The comparison between Bitcoin and gold transcends simple value metrics, entailing a complex interplay of factors including market sentiment, technological advancements, regulatory developments, and macroeconomic conditions.

Bitcoin, often dubbed “digital gold”, is increasingly being recognized as a viable store of value and investment asset. This shift is propelled by the growing acceptance of Bitcoin among both retail and institutional investors, alongside significant progress in blockchain technology and more coherent regulatory frameworks.

The Implications of Glassnode’s Forecast

Should Bitcoin actualize the predicted 65x ratio over gold, the repercussions for the financial sector could be profound. This development would not only reaffirm Bitcoin’s ascendancy in the digital age but also challenge the conventional paradigms of investment and value storage. It is a testament to the fluidity and transformative potential of the digital economy, where traditional assets like gold may no longer hold undisputed dominion.