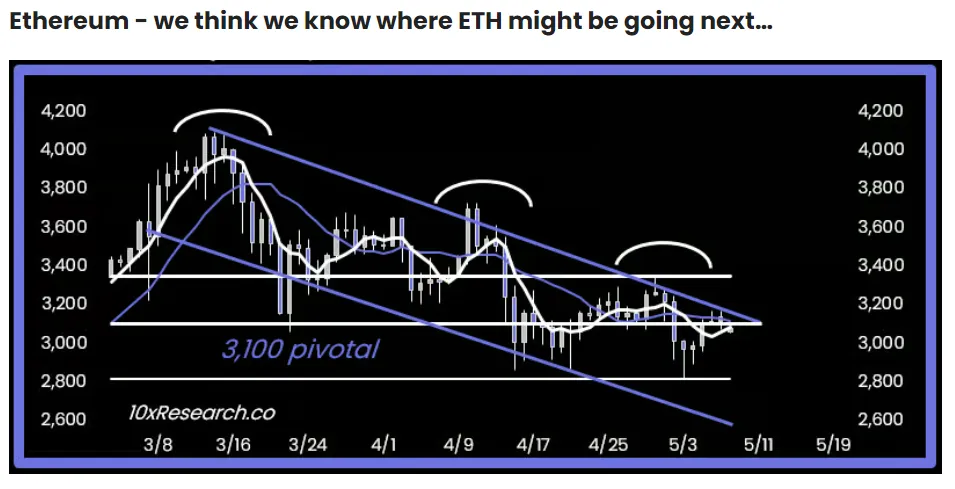

- Due to strong bearish trends and weak market fundamentals, analysts believe Ethereum may soon drop to $2500.

- Due to their close relationship, Ethereum’s decline might impede Bitcoin’s ascent and have an impact on the entire cryptocurrency market.

Ethereum (ETH) is at the forefront of the major fall now affecting the cryptocurrency market. At $2,906.11, ETH has been down 3.98% in the past 24 hours, bringing its weekly loss to 7.55%, according to CoinMarketCap. This bearish trend raises concerns about its future prospects and short-term stability.

ETH Bearish Sentiments Echo Across the Market

The second-biggest cryptocurrency by market cap, ETH, is struggling with weaker fundamentals in addition to market volatility.

Ethereum’s uneven performance in current market cycle, in sharp contrast to its typical function as a trigger for positive trends, has analysts at 10X Research raising concerns about the possibility of a low of $2,500.

The Unbreakable Link Between Ethereum and Bitcoin

A recent study with an astounding R-square of 95% demonstrated the strong correlation between ETH and Bitcoin.

This implies that the decline of ETH may have an immediate effect on the performance of BTC, therefore impeding the capacity of the larger cryptocurrency market to draw in fiat money.

Sector Professionals Weigh Notably, Ethereum is underperforming technically and fundamentally, according to Daniel Yan of Kryptanium Capital.

Ethereum: the No.2 token in the world continues to disappoint both from the fundamental and technical perspectives. The below Daily Chart looks particularly weak to me. If 2950 breaks, we will easily see 2500-2600 range in a crash. This is not a base case for me but a risk for… pic.twitter.com/ja7bYHTq3i

— Daniel Yan (@_D_Y_A_N) May 10, 2024

He issues a caution that Ethereum may swiftly drop into the $2,500–$2,600 zone if the price falls below $2,950, which would exacerbate the problems facing the market.

New Dynamics in Network Activity

With a move toward Ethereum Layer 2 solutions, which last month accounted for an amazing 82% of all Ethereum transactions, the mainnet of Ethereum is witnessing less activity. This change in usage of Ethereum’s network is mostly the result of reduced transaction costs.

Not insignificant changes are also taking place in the ETF scene. The staking component was eliminated from ARK Invest and 21Shares’ spot ETH ETF application lately, in line with what ETHNews previously disclosed.

Perhaps in response to possible comments from the Securities and Exchange Commission (SEC), this streamlining aims to expedite the clearance process.