- In response to Lorie Logan of the Dallas Fed’s abrupt declaration that rate reductions were premature, more than $200 million worth of Bitcoin was liquidated.

- Certain cryptocurrencies, such as Akash Network and Cheelee, showed endurance in the face of instability and managed to post gains despite the market collapse.

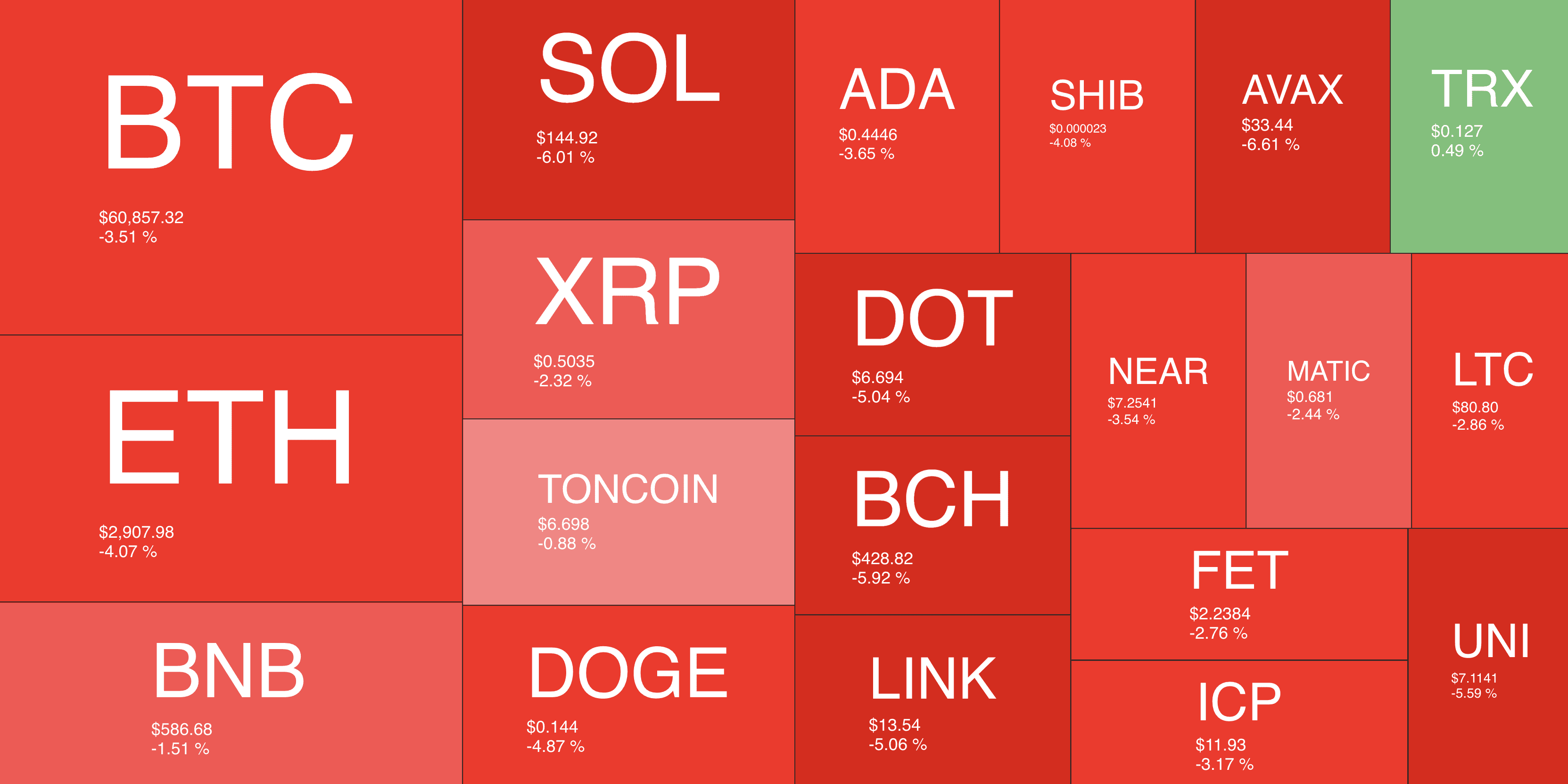

The cryptocurrency market has suffered greatly in the last day, with Bitcoin spearheading a broad decline in most other digital currencies. At first steady around $63,000 for the entire week, Bitcoin’s price abruptly fell below $61,000, a significant decline for the top cryptocurrency.

According to CoinMarketCap, Bitcoin’s current price is about $60,712.09, down 4.09% in the last 24 hours. It has also had a bearish position of 5.10% during the last 7 days.

Fed’s Influence: How a Single Statement Shook the Crypto World

The President of the Dallas Federal Reserve, Lorie Logan, made remarks during a conference in New Orleans that appeared to have set off this precipitous fall in the value of Bitcoin.

Logan made a suggestion that talking about rate reductions would be premature, which infuriated investors and caused a sell-off that turned the charts crimson. The subsequent liquidation of almost $200 million in positions highlighted the market’s volatility and unease.

The Altcoin Avalanche: Which Coins Got Hit Hardest?

Not only Bitcoin suffered significant losses, but most other cryptocurrencies did as well. Each of Ethereum, Solana, and Polkadot fell by 4.1% to about 6%, and the market heatmap turned red.

Particularly badly hit were ThorChain and Theta Network, which fell by 9.2% and 10.8%, respectively.

By contrast, a few cryptocurrencies, such as Cheelee and Akash Network, were able to defy the general market chaos. Investors were given some hope amid an otherwise depressing market period by the roughly 3% advances in both digital assets.

But one has to take into account the background of these market swings. Before this sharp fall, Bitcoin whales were very active, having bought almost $941 million worth of the cryptocurrency, as previously reported by ETHNews.

Major players’ large investment was mostly seen as a favorable indication for Bitcoin’s long-term prospects, implying that, for those with a wider perspective, current prices could offer a purchasing chance.