- BCH experienced an 84% increase in price, reaching over $600 before Halving on March 31.

- Anticipation of the deflationary effect of the Halving and the influx of 230,000 new investors significantly boosted demand.

The recent appreciation in the price of Bitcoin Cash (BCH), which peaked above $600 for the first time in three years on March 31, marking an 84% increase in the last 10 days, reveals several interesting dynamics in the cryptocurrency ecosystem and provides clues as to what could happen in the near term, especially in the context of the upcoming Halving event on April 4, 2024.

Analysis of Price Rise and Investor Influx

This price increase is largely due to the anticipation of the deflationary effect of BCH Halving, similar to what has been observed with Bitcoin (BTC) in the past.

Halving, a scheduled event that halves the rewards of mined blocks, is a mechanism designed to control cryptocurrency inflation and, theoretically, increase its value by making it more scarce.

The influx of 230,000 new investors and the creation of new portfolios in just the last 10 days of March is a strong indicator that interest and demand for BCH is increasing significantly. This flow of capital into BCH, especially just before Halving, suggests a strong expectation that the price of BCH will continue to rise in the near term.

You can read: Optimism over halving of BCH drives Bitcoin Cash price to new highs

Potential Pre-Halving Price Rise

With Halving just days away, it is plausible that the uptrend will continue, pushing the BCH price possibly towards $700, if the current pace of capital inflows and investor interest continues. A decisive break of the $640 initial resistance level could be a critical indicator of BCH price’s ability to reach this target prior to Halving.

Post-Halving Outlook

However, it is crucial to keep in mind that, historically, many projects using the Proof of Work (PoW) mechanism experience significant price corrections following Halving events.

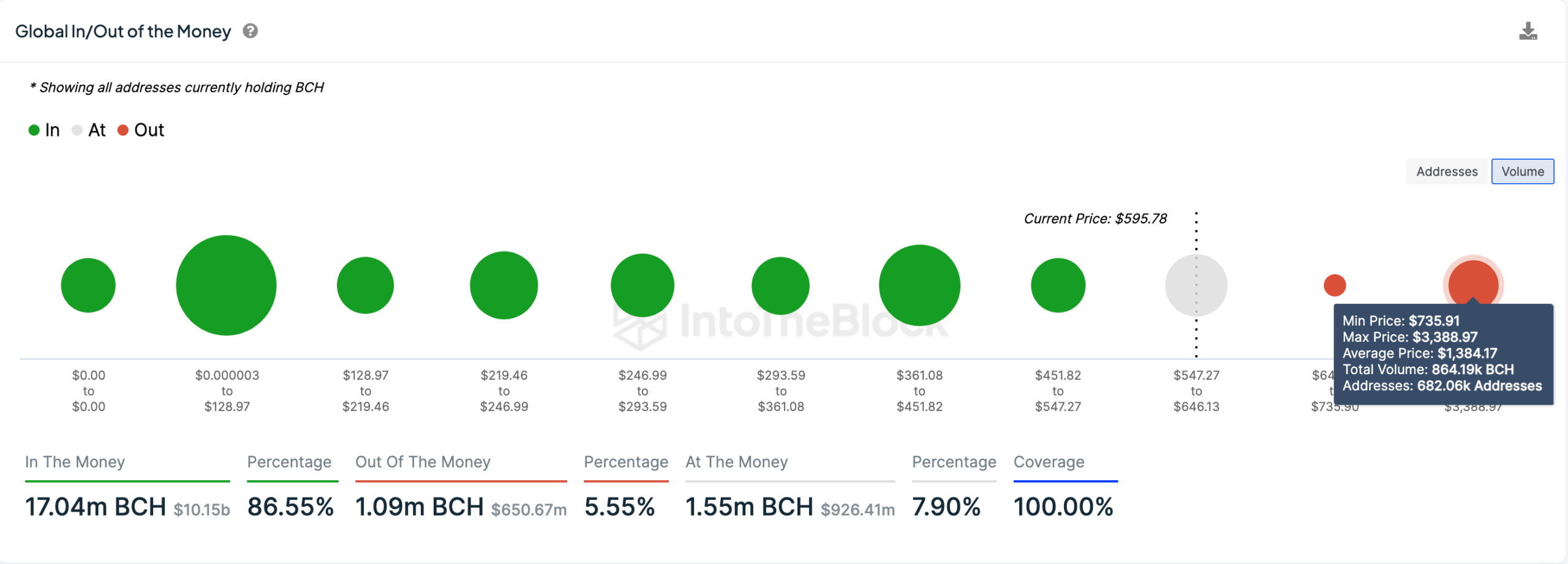

The expectation that miners and some strategic investors may begin selling their holdings even 48 hours before Halving to lock in gains in the face of the reduction in block rewards from 6.25 BCH to 3.125 BCH could result in a rapid price retracement below $450.

Related: Bitcoin Cash seeks new all-time high ahead of halving and block size upgrade

Post Halving recovery

Despite the possibility of a massive post-Halving sell-off, solid investor interest and a significant increase in the number of funded wallets could provide a cushion against a steep price drop.

In addition, if the price falls below certain critical levels, such as $451, investors who purchased BCH at the peak price may be motivated to make hedge purchases to avoid incurring losses, which could facilitate a rapid price recovery.

While the near-term looks promising for BCH with the potential to reach or even surpass $700 before Halving, investors should remain cautious and attentive to post-Halving market dynamics.

Bitcoin Cash (BCH-USD) is currently priced at around $633.80 USD, up $38.11, representing a rise of approximately 6.40% since it was last recorded.