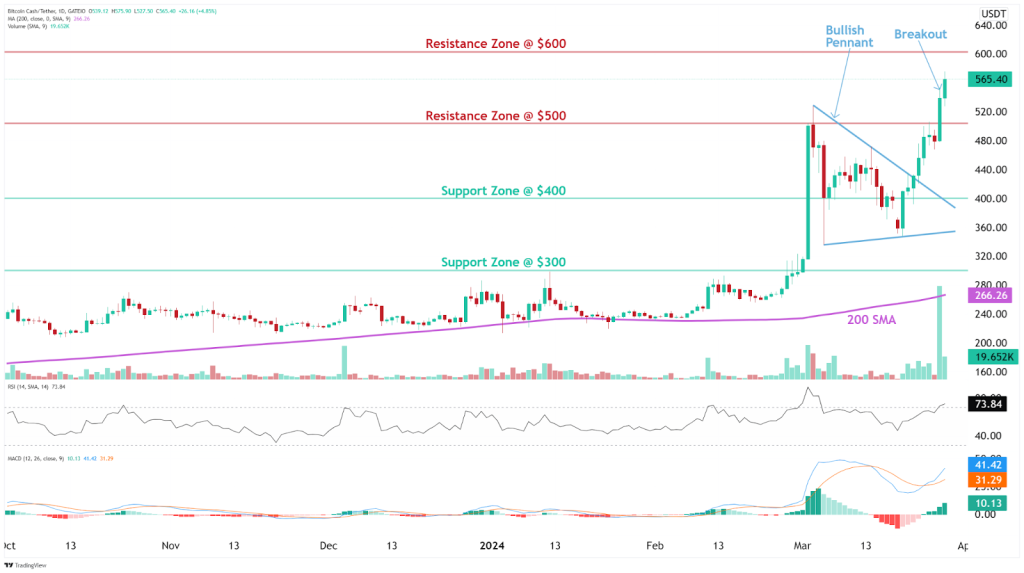

- Overcoming the $500 resistance marks a key moment, with stop-loss recommendation at $460 by altFINS.

- Chart analysis reveals patterns such as the symmetrical triangle, indicating possible significant price breaks in the future.

Bitcoin Cash (BCH), is focused on the upcoming halving event that will take place in four days. Its purpose is to slow the rate at which BCH is generated, thereby reducing the amount of new supply and helping to limit inflation with a total of 21 million units.

In anticipation of halving, Bitcoin Cash has posted significant gains, with its price up more than 35% in the past 24 hours and 104% in the pastweek. In parallel, open interest in BCH derivative products has grown from $213 million to $706 million.

This will be the second halving for Bitcoin Cash since its creation in 2017 as a result of a Bitcoin fork. The halving is expected to make transactions cheaper due to the increased block size, which allows for more transactions to be included.

The proximity of halving has generated growth in interest and investment in Bitcoin Cash

Analysts have suggested that the price could rise from its current level of $568 to $600 by April 1, and potentially reach $2,000 in the following months as more capital is injected.

In addition, Coinbase, a leading U.S. cryptocurrency exchange platform, is expected to introduce cash-settled, margin-settled futures contracts for BCH on April 1, which could facilitate further investment in the network.

The increase in open interest along with price gains suggests that investors are securing their positions in anticipation of halving. An increase in the Bitcoin Cash hash rate has also been seen, suggesting higher mining profitability compared to Bitcoin, especially in light of this impending event.

Related: Bitcoin Cash Eyes New All-Time High Ahead of Halving and Block Size Upgrade

Latest Price Data

Accordingto the information provided by CoinMarketCap, the price of BCH stands at $600.02, experiencing a growth of 34.79% in the last day .

This price development suggests the possibility of an outstanding macro advance, strengthened by favorable technical signals, a consistent uptrend and encouraging on-chain data.

Overcoming Key Resistances

Recently, the $500 barrier posed a considerable challenge for BCH. Overcoming this resistance in the March trading sessions signals a promising time for the cryptocurrency.

The altFINS platform suggests implementing a stop-loss at $460 as a prudent strategy to control risk.

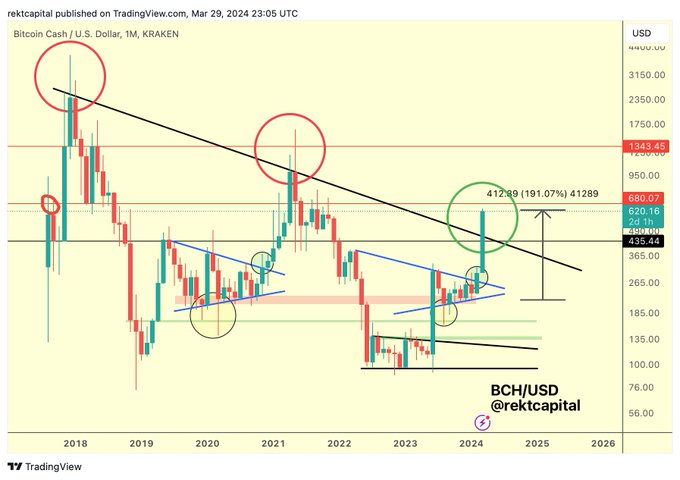

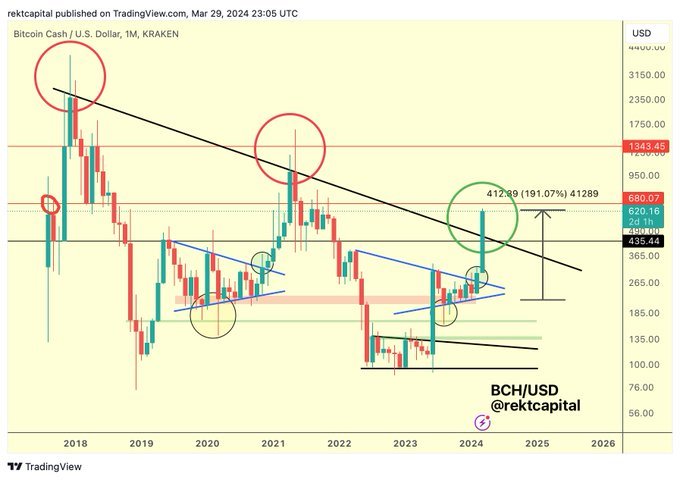

Monthly Chart Analysis

The monthly chart is highlighted by red and green candlesticks, which illustrate market fluctuations over time. The upper wicks in previous price movements reveal traders’ efforts to transcend previously established resistance.

Read more: Bitcoin Cash (BCH) Struggles Amid Market Uptrend, Halving Event Looms

Analyzing the trendlines, a black descending line is identified that has acted as a firm restraint against upward attempts in price.

On the other hand, a blue rising line suggests a convergence in price movements, typical of a symmetrical triangle, a pattern that often anticipates significant price breaks.

Support and Resistance

The dotted lines mark historical support and resistance levels, marking critical points where the currency often changes course. These demarcations are crucial to understanding the market’s resistance to break or decline beyond these values.

Amid the technical analysis, Rekt’s chart annotations offer insight into the market’s past and future potential. An optimistic forecast highlights a target of $412.89, which would imply a 191.07% rise from a base level, potentially tied to the apex of the triangle or a recent low.