- Daily creation of 1,500 “Bitcoin millionaires” reflects potential for rapid wealth generation in the market.

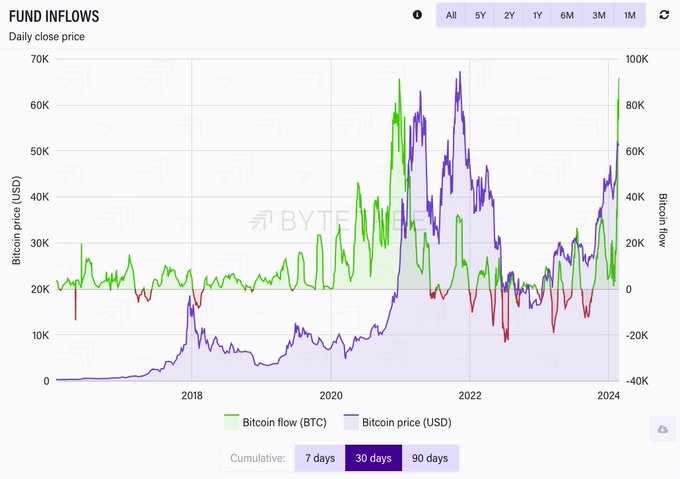

- U.S. spot Bitcoin ETFs drive asset accumulation, attracting $60 billion under management.

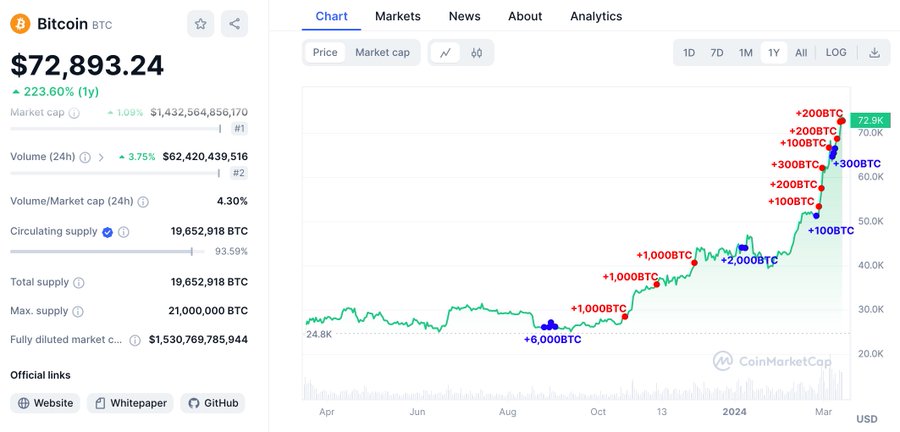

The recent escalation in Bitcoin’s value to over $73,000 and the daily creation of approximately 1,500 new “millionaires” reflects robust investor confidence and adoption. The implication of these events for Bitcoin is multifaceted and has several dimensions that merit analysis.

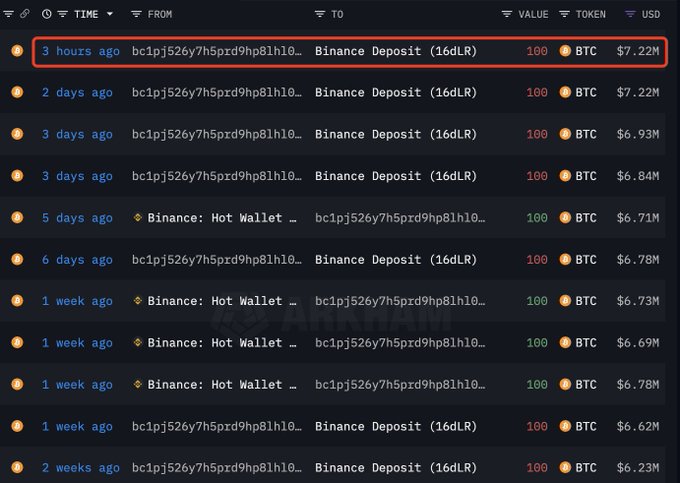

One particular investor, who has navigated the market astutely, managed to make approximately $217 million in profits with Bitcoin by holding 4.3K BTC, valued at $313 million. This investor made a deposit of 100 BTC on Binance, valued at $7.22 million, three hours ago to take profits.

Initiating his approach on August 24, 2023, by beginning to gather BTC, he later extracted 8.5K BTC from Binance at an average rate of $32,854. Following this, he placed 4.3K BTC back into Binance, valuing each at an average of $43,534. Currently, he possesses these 4.3K BTC, valued at $313 million, culminating in a profit margin of approximately $217 million.

Many investments like this have occurred throughout the year, increasing wealth in both individuals and many sectors, making Bitcoin the safest digital asset to invest in at the moment, as we have detailed in ETHNews.

Financial Consolidation and Bitcoin Investment Trends

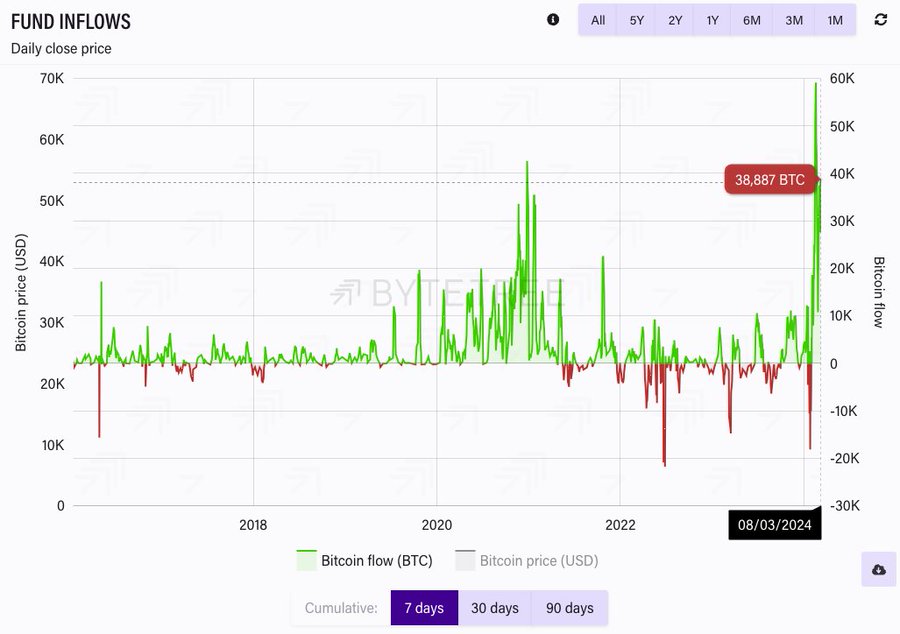

The daily creation of approximately 1,500 new “Bitcoin millionaires” driven by the latest BTC bull backed by U.S. spot Bitcoin ETFs demonstrates Bitcoin’s unique wealth generation dynamics, even compared to the 2021 boom that saw more than four thousand new millionaire wallets a day .

With wealth accumulation now seeing less than 2,000 portfolios reaching between $1 million and $10 million daily, the market reflects a maturation, where institutional investment through ETFs and the growing adoption of Bitcoin as an investment asset and store of value become more evident.

Optimistic Bitcoin Price Projections for 2025

Standard Chartered forecasts that BTC’s value might surpass $100,000 by the conclusion of 2024. In contrast, Scaramucci’s projection of a $170,000 value for Bitcoin indicates a view of significant upside in its price, substantiated by interest in recent Bitcoin ETFs and the expected Bitcoin halving event.

If Bitcoin is at $45,000 at half, which is where it is now, it will be at $170,000 by mid to late 2025. – Scaramucci

Fundstrat predicts that by the end of the year, BTC’s price will range from $116,000 to $137,000. Meanwhile, the investment firm VanEck has established a medium-term goal for Bitcoin, aiming for a value of $350,000.

Some independently conducted analysts have observed an influx of funds into the Bitcoin market “like never before,” predicting that this pioneering cryptocurrency is on track to reach $100,000.

The current price of Bitcoin (BTC-USD) is approximately $73,243.68 USD, which represents an increase of $397.69 ( 0.55%) from its previous close. This movement indicates a slight uptrend in the last few hours.

The price range over the past 24 hours has been $72,656.02 to $73,650.56, showing relatively subdued volatility in the short term. Bitcoin has reached a new 52-week high range, extending to $73,650.56, underscoring the strong uptrend it has maintained over the past year.