- Bitcoin’s difficulty in breaking above $53,000 marks a critical point, reflecting possible price stabilization.

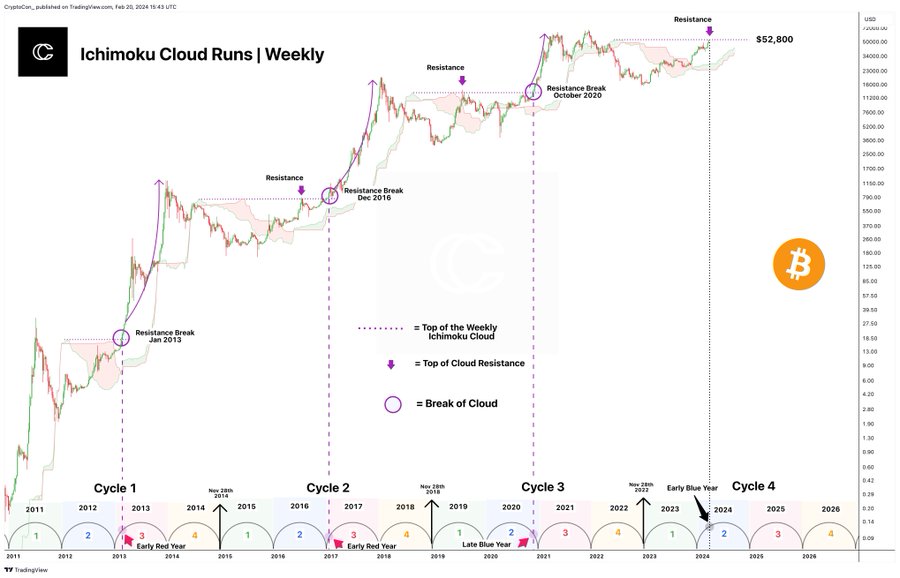

- The coincidence with the cusp of the Ichimoku cloud underscores the technical importance of this key resistance.

The difficulty Bitcoin faces in attempting to break above $53,000 marks a moment of reflection for this leading cryptocurrency. This level, recognized for holding back price increases in the second half of 2021, appears to remain a solid barrier, suggesting a stabilization stage in the price before any breakthrough.

The coincidence of this behavior with the highest point of the Ichimoku cloud highlights the importance of this technical pattern, which has played a crucial role in previous market cycles by holding back price increases.

Over the recent long weekend in the U.S., Bitcoin showed upward momentum from $51,600 to near $53,000, only to then experience selling pressure that drove its value downward to around $51,260.

This price trend mirrors a trend seen in previous days, where attempts to break above $52,500 were quickly reversed.

The difficulty Bitcoin faces in consolidating above $53,000 opens up the possibility of further stabilization in the current range, offering respite following the more than 30% rise since the correction following the launch of Bitcoin ETFs in late January. This price range is established as a key resistant zone, which had already contained increases during the second half of 2021.

This price level not only aligns with the high reached during the “El Salvador” rally in September 2021 and the pre-crash resistance on December 4 of the same year, but also coincides with the upper limit of the previous market cycle in the Ichimoku cloud.

This has served as a considerable barrier for the BTC price on previous occasions, indicating that a successful overcoming of this point could be an indicator of a significant uptrend.

The extensive consolidation observed after reaching this level in previous markets, and the breakouts to higher prices later in Bitcoin’s market cycle , especially after the halving event, highlight the significance of this period .

A successful breakout at this time could be significantly anticipated compared to previous cycles, possibly signaling an adjustment in Bitcoin market dynamics.

Simply put, the Weekly Ichimoku Cloud says that a break of the cloud top point at $52,800 marks the run to #Bitcoin ATHs and the cycle top.

A break of this point now would be almost an entire year earlier than usual, as most occur during the transition from Blue Year… pic.twitter.com/I0XTbgnNpB

— CryptoCon (@CryptoCon_) February 20, 2024

This scenario is a critical time for Bitcoin as it struggles to break above a level that has proven to be a considerable challenge in the past .

The market’s response to this consolidation event and Bitcoin’s ability to overcome this resistance could define its price trajectory in the short to medium term, offering clues as to the maturity of the market and investor confidence in the cryptocurrency.