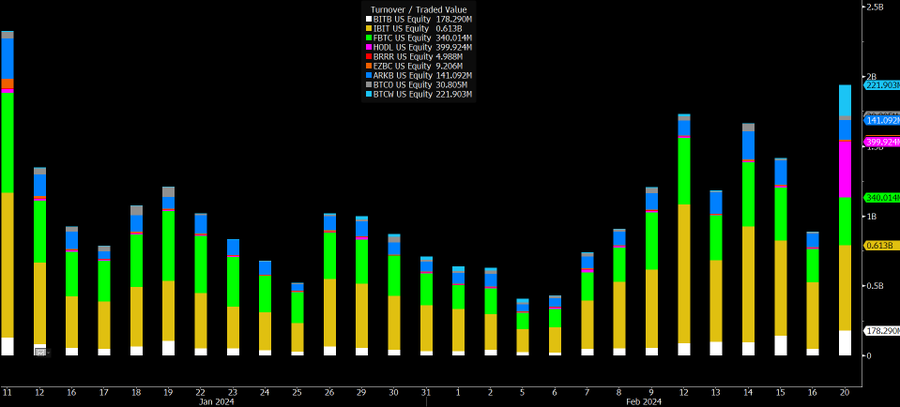

- Bitcoin exchange-traded funds experienced a notable increase in activity, surpassing $2 billion in volume.

- VanEck’s HODL ETF stood out with a 14-fold increase in its daily average, driven by 32,000 individual trades.

Bitcoin exchange-traded funds have seen a surge in trading activity, reaching numbers not seen since their U.S. debut last month.

With volume hovering around $2 billion, these amounts set a new high since that exciting first day of trading on Jan. 11, as Eric Balchunas, ETF analyst at Bloomberg Intelligence, points out.

Within the major players in this event, VanEck’s HODL ETF has shown nearly $400 million in volume, WisdomTree’s Bitcoin Fund (BTCW) recorded $221.9 million in trades and BitWise came in at $178.29 million.

The Nine had biggest volume day since Day One with about $2b in combined trading thx to big contributions from $HODL, $BTCW and $BITB which all broke their personal records. For context $2b in trading would put them in Top 10ish among ETFs and Top 20ish among stocks. It's a lot. pic.twitter.com/547pIl5grI

— Eric Balchunas (@EricBalchunas) February 20, 2024

In particular, the HODL ETF saw an extraordinary surge, with $258 million in volume in one day, multiplying its daily average by 14 times. This increase did not come from a single large investor, but from around 32,000 individual trades, 60 times its regular average.

The increase in activity could be due to the closure of the U.S. markets on Monday for Presidents’ Day, resulting in the weekend’s trades being processed on the first business day of the week.

As for the Bitcoin price, it traded just above $52,200 at the close of the trading day in the U.S., according to data from CoinDesk Indices.

Greta Yuan, research leader at VDX, a regulated exchange in Hong Kong, indicated in an email interview that the intense flow into Bitcoin ETFs from institutional investors shows a willingness to take risks .

On the other hand, gold ETFs have experienced a net outflow. This trend in gold ETFs could be attributed to increased demand from global investors for U.S. equities, Yuan suggests.

Since the launch of 10 spot Bitcoin ETFs on Jan. 11, gold ETFs have seen significant withdrawals, with nearly $10 billion entering the two largest Bitcoin ETFs, although this does not necessarily indicate a direct transfer of funds from gold into Bitcoin.

This development highlights a growing interest and confidence in Bitcoin and cryptocurrencies as an asset class, challenging traditional markets and opening up new investment options.

The relationship between gold and Bitcoin, in particular, shows a potential shift in how safe haven assets are perceived, with Bitcoin positioning itself as a solid alternative to the precious metal.