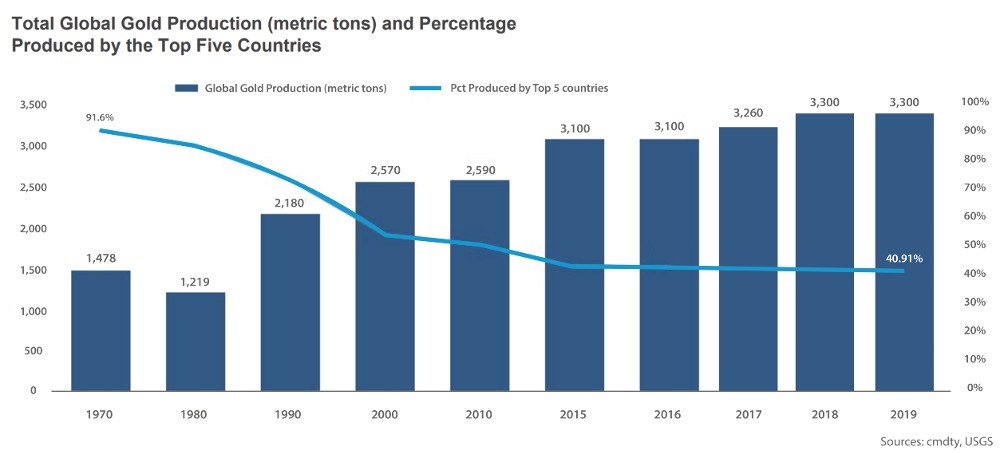

- Schiff highlighted gold’s lasting value and utility in industries like jewelry and electronics, serving as a reliable store of value.

- Bitcoin’s adoption curve mirrors tech stocks’ trajectory, suggesting potential long-term growth as a widely accepted asset class.

In a recent live debate organized by ZeroHedge and presented on YouTube, billionaire investor Anthony Scaramucci of SkyBridge Capital engaged in a heated discussion with top analyst Peter Schiff over whether Bitcoin (BTC) or gold serves as a better inflation hedge.

— zerohedge (@zerohedge) May 3, 2024

The debate also included Erik Voorhees, CEO of ShapeShift, and Nouriel Roubini, a professor of economics at New York University.

Peter Schiff, a longstanding critic of Bitcoin, began by arguing that Bitcoin, originally created as a digital currency, fails to function effectively because of its slow and expensive transactions. Schiff emphasized that Bitcoin lacks the tangible utility that gold possesses, particularly in industries like jewelry and electronics.

He further asserted that gold retains its intrinsic properties over time, serving as a genuine store of value. In contrast, Schiff claimed that Bitcoin’s perceived value is based purely on speculative demand, lacking any practical applications.

On the other hand, Anthony Scaramucci countered by highlighting that only 5% of gold’s value comes from manufacturing purposes, with most of its value derived from its acceptance as a store of value.

Scaramucci emphasized that Bitcoin, like gold, has a deflationary aspect due to its fixed supply. He views Bitcoin as “digital gold,” noting its portability compared to physical gold.

Scaramucci also highlighted that Bitcoin is following an adoption curve that will impact its value over decades. He likened it to the trajectory of tech stocks, which eventually became standard components of the S&P 500 index. This point underscores the evolving nature of Bitcoin as an asset class and its potential for long-term growth.

The discussion highlighted the contrasting views on the merits of Bitcoin and gold as inflation hedges. While Schiff underscored the enduring value and tangible uses of gold, Scaramucci emphasized the digital and deflationary nature of Bitcoin, drawing parallels with the technology sector’s growth.

Correlation Between Bitcoin and Gold

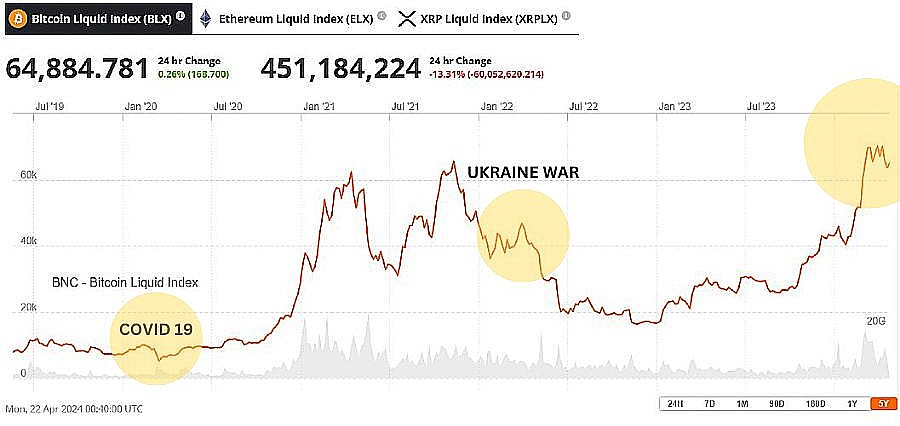

Over the past five years, studies have indicated a weak correlation between Bitcoin and gold. There have been periods where they showed slight positive correlation, especially during times of market stress.

However, this pattern has not been consistent.

The correlation between the two assets typically fluctuates from slightly negative to mildly positive. This suggests that while Bitcoin and gold may sometimes respond similarly to certain economic events, their price movements are generally not closely aligned.

Some investors view Bitcoin as a safe haven asset, driven more by narrative and sentiment than by its intrinsic qualities. While a segment of investors treats Bitcoin as a hedge against inflation and currency devaluation, like gold, this perspective is not universally held or supported by market data.

For example, investors did not significantly shift funds to Bitcoin during the Covid-19 pandemic or at the start of the Ukraine conflict. Bitcoin’s record high in March 2024 was likely influenced more by the introduction of Bitcoin ETFs in the United States and the impending halving, rather than by a shift to safe-haven assets during high inflation.

However, gold had reached its highest point of $2,070 in August 2020, around 15 months before Bitcoin’s peak, according to TradingView

Bitcoin’s market is evolving, and its role could change over time. Its future might align more with traditional assets or form a distinct niche. The evolving nature of both Bitcoin and gold presents a challenging landscape for investors looking for an inflation hedge, emphasizing the importance of careful analysis and understanding of these unique assets.

In the end, the debate showcased the divergent perspectives on these assets, with Schiff focusing on the traditional value of gold and Scaramucci advocating for Bitcoin’s potential as a modern store of value.