- JPMorgan warns that Bitcoin remains overvalued despite recent corrections, indicating a valuation beyond its fundamentals.

- Strategists forecast a possible further drop in Bitcoin’s price, affected by slowing flows into cash ETFs.

JPMorgan’s recent analysis casts a cautious eye on Bitcoin’s immediate future, focusing on several critical areas that could influence its value in financial markets.

According to this report, despite a recent correction that saw Bitcoin lose more than 15% of its value before a post-FOMC meeting recovery, the cryptocurrency remains valued beyond what its fundamentals would suggest, remaining in an overbought state.

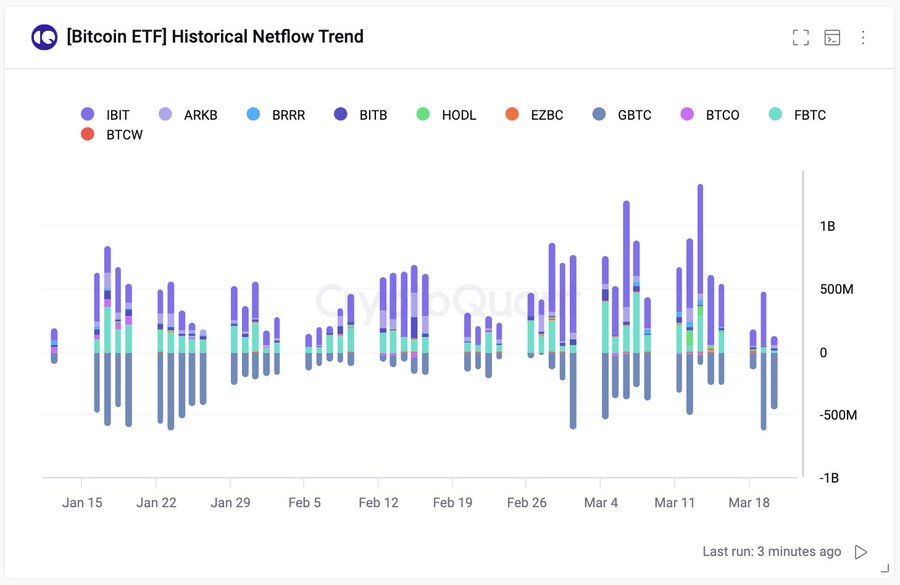

An understandable shift at the behavioral level is expected among investors, evidenced by an outflow of Bitcoin exchange-traded funds (ETFs) into cash over the past week.

This movement suggests a possible reduction in demand or an inclination toward profit-taking, countering the previous expectation of continued positive net inflows into these ETFs.

With the approaching Bitcoin halving event, as we mentioned on ETHNews, expected in mid-April, where rewards for miners will be cut in half, the report anticipates that the profit-taking trend could persist .

This occurs against a backdrop where the market is still showing signs of overbought conditions, despite the aforementioned correction. Traditionally, halving has acted as an impetus for Bitcoin’s price rise , although on this occasion, the analysis suggests proceeding with caution.

In addition, JPMorgan analysts forecast a potential further decline in the Bitcoin price, supported by the slowdown in flows into cash Bitcoin ETFs and the persistent overbought state of the cryptocurrency .

This outlook is reinforced by a recent decline in demand for Bitcoin ETFs, which has resulted in a reduction in the price of the digital currency beyond 10% of its peak value reached the previous week.

Finally, the report highlights that the nine Bitcoin ETFs launched in the U.S. have seen outflows for four consecutive days, with a net outflow value of $95 million on Thursday, March 21 alone.

This set of factors, according to JPMorgan, could put downward pressure on Bitcoin’s value in the near term, increasing volatility and potentially leading to a sharper correction in its price in the near future.