- Recent surge in meme coin trading on Base boosts its market cap; network faces increased phishing scam incidents.

- Ethereum’s layer-2 ecosystems, like Base, could reach a $1 trillion market cap by 2030, as projected by VanEck analysts.

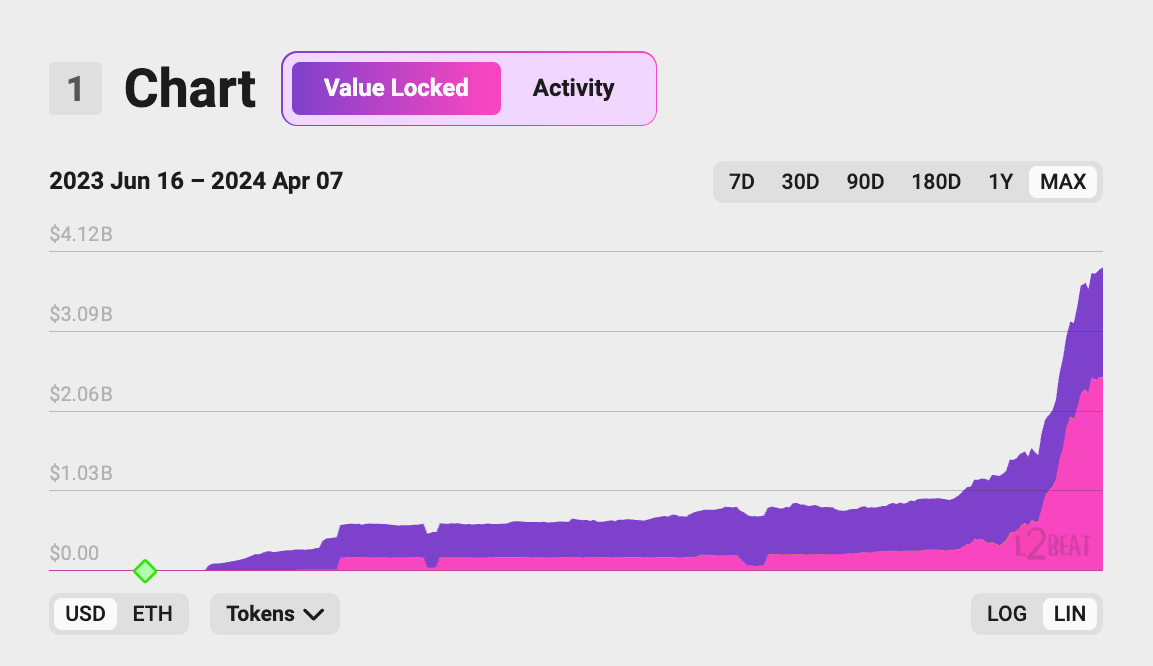

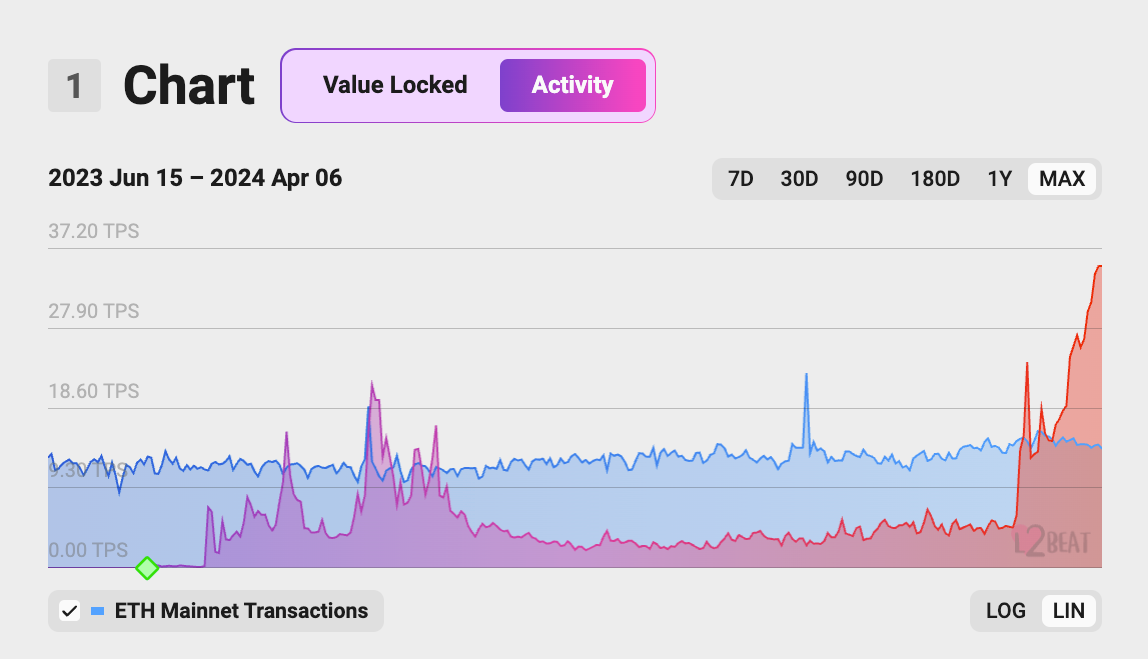

Coinbase’s Ethereum layer-2 solution, Base, recently surpassed a total value locked (TVL) of $4 billion, marking a significant increase in its market presence. This growth has positioned Base ahead of Ethereum and Arbitrum in terms of transaction volume, according to the latest data from L2Beat, recorded on April 7.

The TVL of Base includes $1.45 billion in assets bridged from Ethereum and $2.7 billion in assets minted on the Base platform, bringing its total to $4.15 billion. This places Base as the third-largest Ethereum layer-2 network by TVL, ahead of Blast but behind Optimism and Arbitrum.

Over the last week, Base experienced a 13.2% increase in its TVL, distinguishing it as the only top-five Ethereum layer-2 network to see growth during this period. Starknet, Optimism, Arbitrum, and Blast all reported decreases in their TVLs.

Base also recorded a significant surge in activity, with 50.34 million transactions over the past 30 days, exceeding the transaction counts of both Arbitrum and Ethereum.

One notable factor contributing to Base’s growth is the increased activity in meme coin trading on its network, which saw the market capitalization for meme coins jump to over $1.6 billion. However, Base’s rising popularity has also led to an increase in phishing scams, with $3.35 million reported stolen in March due to such activities.

Of interest: Coinbase Announces DOGE Futures Trading, Recognizing Its Transition from Meme Status

Ethereum’s efforts to enhance its blockchain’s efficiency for layer-2 data processing, such as the recent Dencun upgrade aimed at reducing transaction fees, support the growth of networks like Base.

With the Ethereum layer-2 ecosystem’s market capitalization projected to reach $1 trillion by 2030, as estimated by VanEck analysts, Base and similar networks may benefit significantly from Ethereum’s ongoing development and current limitations related to speed and network congestion.