- Conservative traders wait for ETH to reclaim and maintain key supports before making new bids.

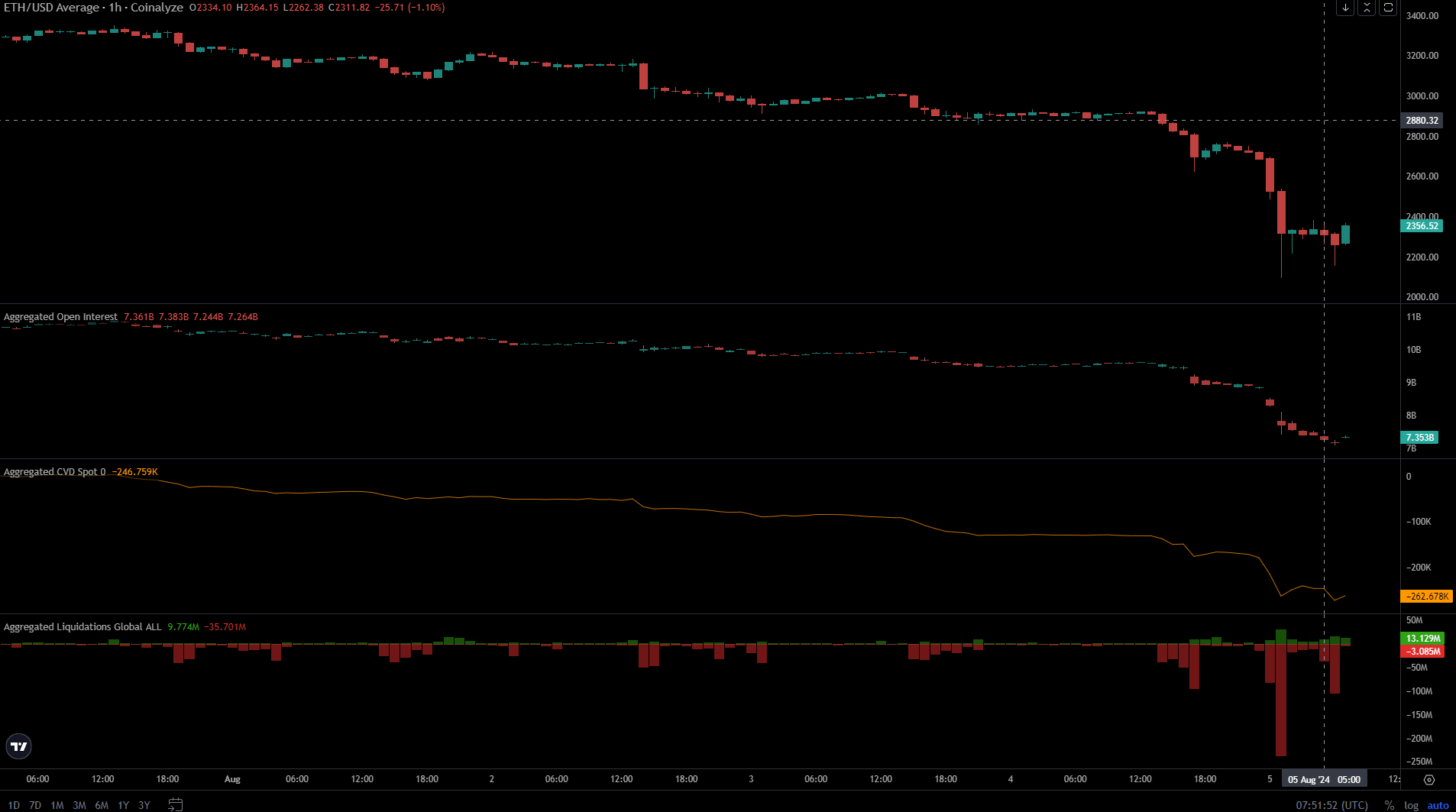

- 270,000 traders affected by liquidations, with open interest dropping from $9.9B to $7.35B since August 3.

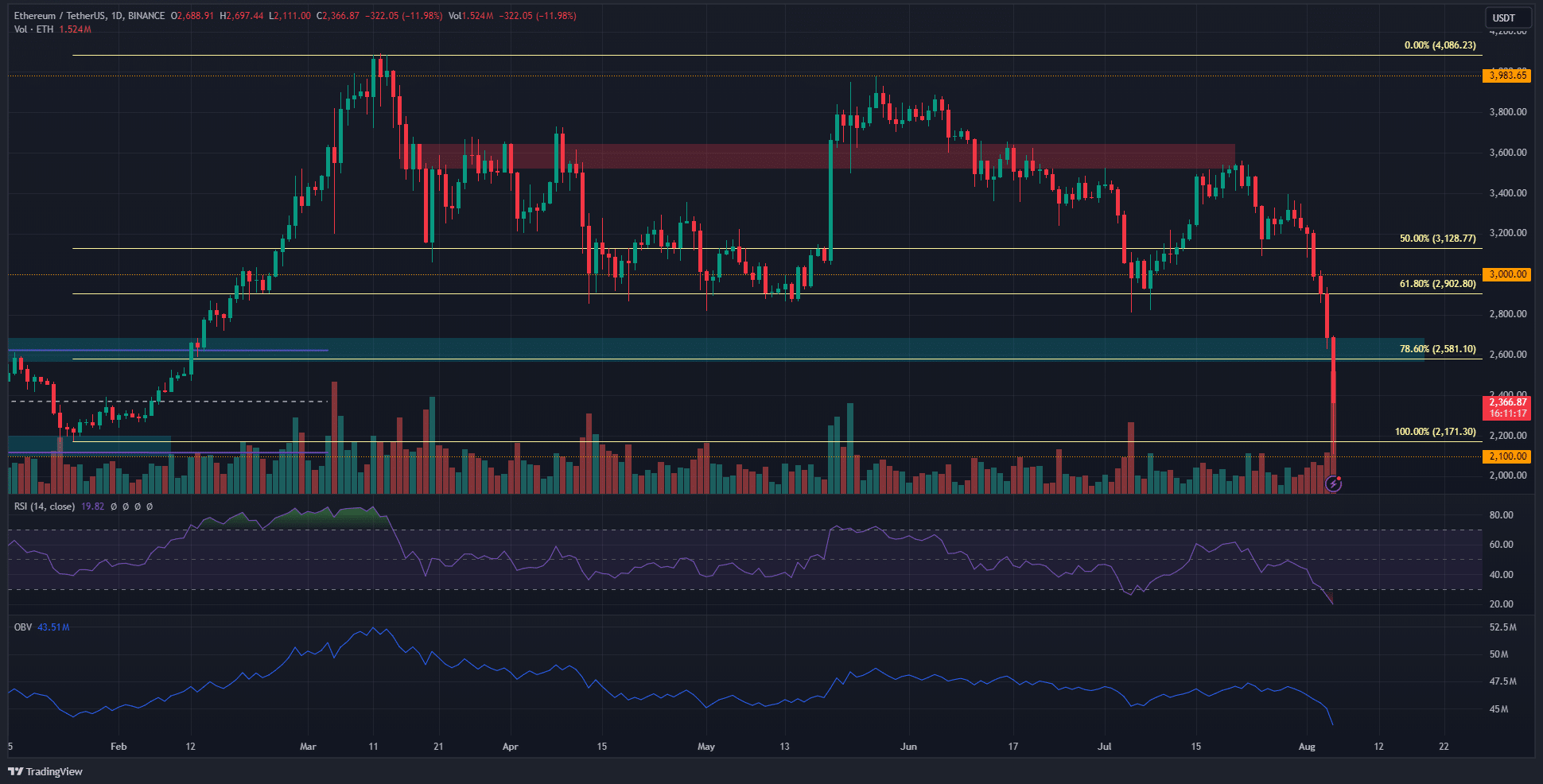

Ethereum (ETH) experienced a sharp decline, falling back to its January lows over recent hours. This drop below $2,900 led to a further 27.5% decrease within the next 12 hours. As of now, ETH has rebounded to $2,366 from its low of $2,100, marking a 12.17% recovery.

Despite this partial recovery, it’s premature to declare a bottom for Ethereum. Investors are advised to wait for more definitive market signals in the coming week.

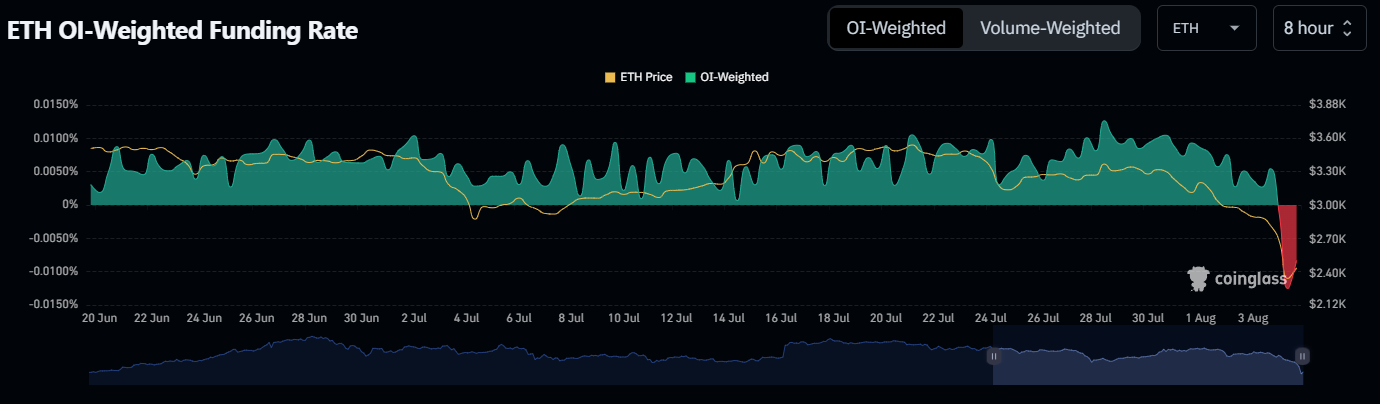

The price drop caused a massive liquidation event, with $346.5 million worth of ETH liquidated within 24 hours. The daily Relative Strength Index (RSI) fell to 19, the lowest point since August 18, 2023, indicating an oversold market condition.

Earlier this year, Ethereum saw a strong rally to $4,000, but recent events have retraced those gains entirely. The $2,500 to $2,600 range is now expected to act as a resistance zone.

The On-Balance Volume (OBV) indicator formed a new low, highlighting the extreme selling pressure. Trading volume for the day reached 1.55 million ETH, the highest in 2024, underscoring the intense market activity.

For conservative traders and investors, the current market environment suggests caution. They might prefer to see ETH reclaim and stabilize above key support zones before considering new bids. The futures market saw turmoil, with the Open Interest dropping from $9.9 billion on August 3 to $7.35 billion. This reduction indicates a considerable unwinding of leveraged positions.

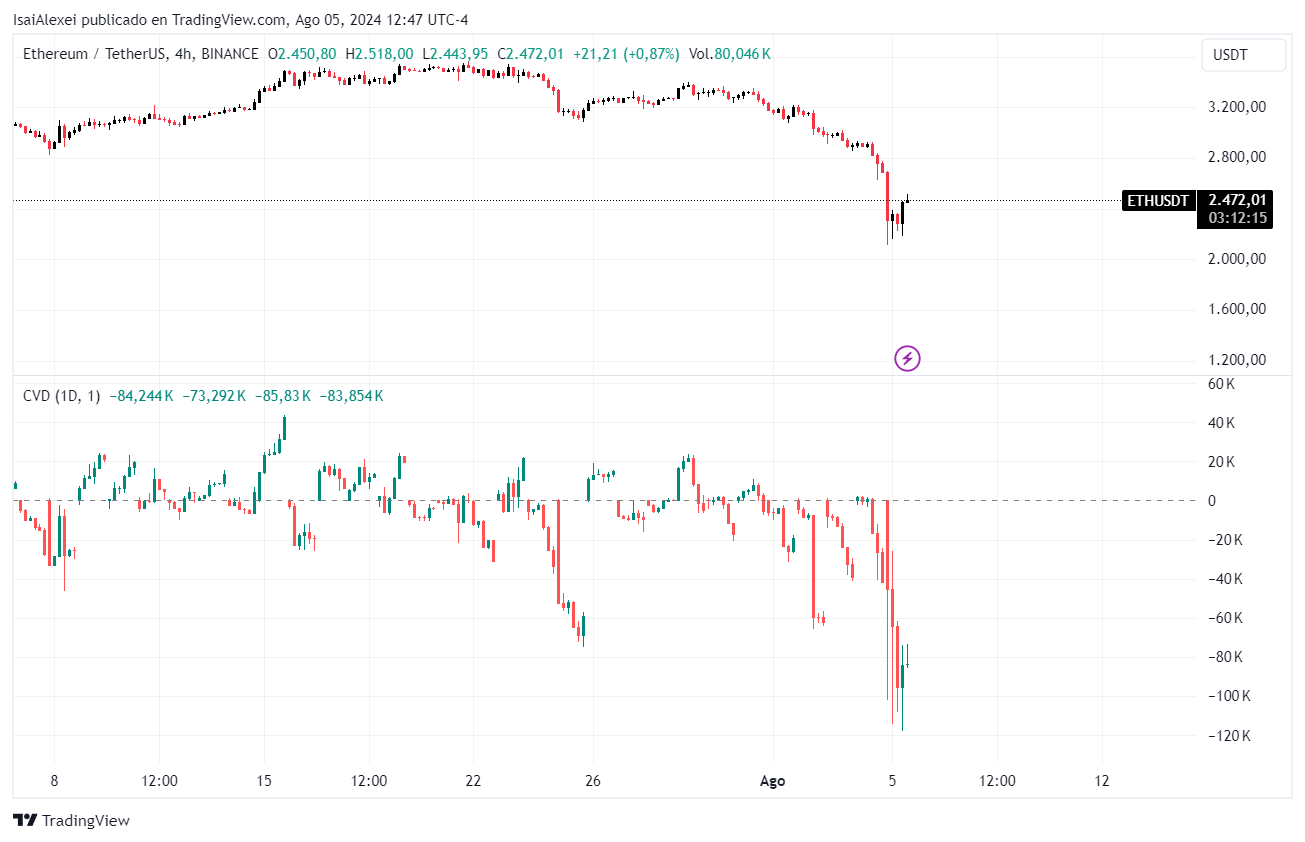

The market witnessed over 270,000 crypto traders affected by liquidations during this downturn, most of which were long positions. The spot Cumulative Volume Delta (CVD) fell further, reinforcing the perception of substantial selling activity.

A potential bounce towards $2,500 is possible, but additional selling pressure is likely during the New York trading session.

Overall, Ethereum needs to cross the $2,500 mark to instill confidence among investors and signal a bullish trend. Until then, the market remains cautious, with many waiting for clearer indications of stability and recovery.