- The AMM in XRPLedger uses liquidity pools and mathematical formulas to automate the exchange of cryptocurrencies without intermediaries.

- Liquidity providers are incentivized with transaction fees, fostering a decentralized and efficient financial marketplace in XRPLedger.

The implementation of the Automated Market Maker (AMM)system on XRPLedger, after receiving majority endorsement, is a significant transformation for the cryptocurrency financial arena, particularly for Ripple and XRP holders .

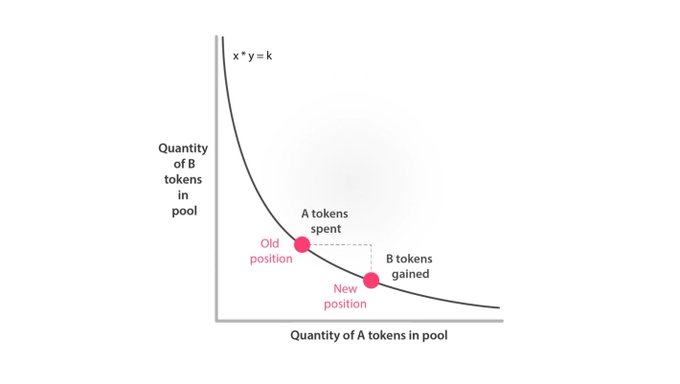

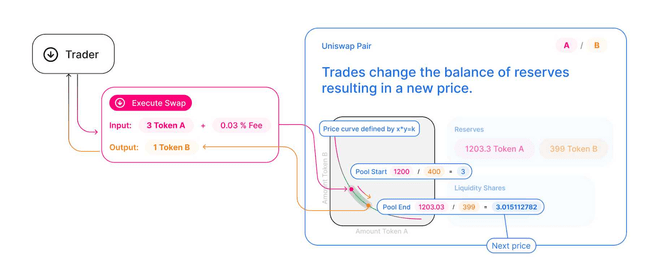

The Automated Market Maker (AMM) in the XRPLedger works through a protocol that facilitates cryptocurrency trading automatically, without the need for a traditional intermediary such as a centralized exchange. Its operation is based on algorithms that define the price relationship between two assets in a decentralized environment.

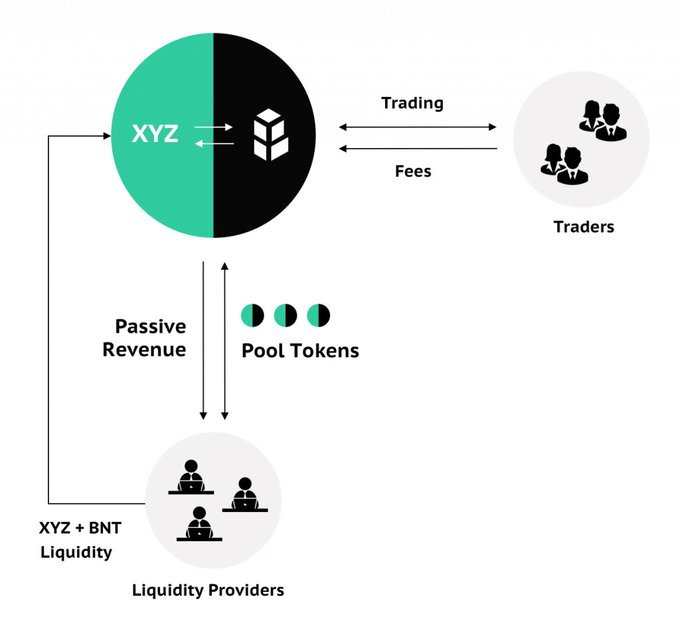

The Automated Market Maker (AMM) in XRPLedger operates via liquidity pools, where users deposit cryptocurrency pairs to facilitate automatic exchange without intermediaries.

It uses a mathematical formula to determine the price of assets, based on their proportion within the pool, which makes it possible to execute trades automatically and maintain the balance of the values of the exchanged assets.

To incentivize the provision of liquidity, providers receive a portion of the commissions generated by transactions conducted on the AMM. This promotes a decentralized, efficient and inclusive financial environment, allowing users to actively participate in the market and benefit from exchange operations without the need for a third party.

First, the incorporation of the AMM allows XRP holders the opportunity to generate passive income through the provision of liquidity to the market. Such activity transcends the traditional strategy of holding cryptocurrencies awaiting appreciation, instead promoting more active and conscious participation in the market.

This mechanism not only benefits individuals through the potential increase in return on their investments, but also contributes to the robustness and efficiency of the XRP market by adding depth and liquidity.

Second, this scheme incentivizes greater interaction and participation in the XRPLedger market, thus fostering increased liquidity and price stability. For Ripple, this translates into a strengthening of XRP as a more effective settlement medium for financial transactions, especially with regard to international payments, where speed and efficiency are critical.

The integration of the AMM with Decentralized Exchanges (DEX) marks a considerable advance, broadening the spectrum of operability for Ripple and the XRP coin. This synergy facilitates new modes of trading and utilization of XRP, potentially elevating its applicability in a wider range of financial and commercial transactions.

This approach not only promotes a more equitable distribution of benefits among participants, but also strengthens the community governance of the XRPLedger ecosystem, potentially raising the level of user engagement and trust in the platform.

Finally, the impact of the ongoing litigation between the SEC and Ripple is an aspect that cannot be ignored, so we have recorded in ETHNews. A favorable outcome in this regard could have a positive effect on the market’s perception of XRP and thus strengthen its legal and regulatory position.

The current price of XRP (Ripple) is approximately $0.623500 USD, experiencing an increase of $0.003300 (0.525800%) in the last reporting period .

It has had an intra-day price range of$0.593577 to $0.629482, with a 52-week range of $0.358142 to $0.887511 .This reflects moderate volatility in the price of XRP over the last year, showing both periods of appreciation and depreciation.