- A prospective $1.95 billion SEC fine against Ripple’s XRP could have an impact on investor confidence and market prices.

- The dumping of XRP by whale investors signifies bearish market sentiment.

Protracted legal battles with regulators have driven price volatility for Ripple-backed XRP. The recent events have shaken the cryptocurrency community, requiring a closer look at on-chain data to understand XRP’s market dynamics.

Financial Penalties of the SEC

On March 25, when Ripple CEO Brad Garlinghouse made public the company’s expectation of a sizable sanction from the US Securities and Exchange Commission (SEC), the commotion really started, as previously reported by ETHNews.

The regulatory body is about to fine Ripple a whopping $1.95 billion for what it considers to be the illegal sale of securities made possible by the company’s direct sales of its XRP Coin to institutional investors, having partially succeeded in its accusations.

This information unleashed a wild period of conjecture as traders tried to predict how the upcoming fines would affect the value of XRP.

The XRP community was thrown into a speculative frenzy on Friday when the SEC formally filed its motion for the fine under secret at a US District Court, adding to the uncertainty. Garlinghouse reassured investors of Ripple’s strong financial position and ability to absorb the financial impact of the fines in an effort to allay their fears.

Reaction of Investors to Ripple’s Difficulties

A closer look at on-chain data, however, reveals a very different picture of investor mood, especially among whale investors and large corporate holders of XRP reserves.

According to Santiment’s real-time wallet balance tracking, whale investors made a noticeable withdrawal of XRP after the SEC filed its motion.

These big players sold out more than 290 million XRP coins between March 29 and April 3, bringing their total holdings down to 44.9 billion at the 30-day mark. This massive liquidation, which is valued at almost $170 million at today’s market levels, has always put pressure on XRP prices, which have dropped 13% since the selling frenzy started.

There have been significant knock-on effects from this sell-off, and both speculative investors and tactical retail swing traders are showing hesitation to buck the bearish trend that the whales have established.

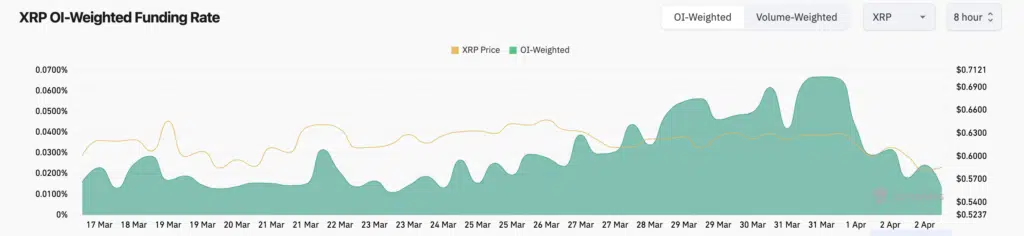

Developments in the derivative markets, where Coinglass’ funding rate measure demonstrates that bull traders are obviously not very optimistic about XRP’s short-term price trajectory, further support the general mood.

Effect of Whale Sell-Off on the Market

The combination of bearish funding rates and whale investor sell-offs signals an impending decline in XRP that could push it over the $0.55 mark.

The price of the cryptocurrency is currently hovering at the lower Bollinger band indicator at $0.58, having already dropped below the 20-day simple moving average. If this crucial support level gives way, it may signal a more significant reversal below the predicted $0.55 barrier.

On the other hand, a rebound in bullish momentum depends on XRP’s capacity to overcome the $0.62 resistance level. Such a turnaround appears unlikely, though, given the prevailing selling inclination among heavyweight investors and the uncertain environment we are currently in.

The cryptocurrency world is still in suspense as the story develops and is anxious to see what action Ripple may take next in this intense legal dispute.

Meanwhile, the XRP price has tumbled by 3.38% and 8.03% over the previous 24 hours and 7 days, respectively, reaching $0.578.