- Despite a market downturn, whale activity suggests possible price stabilization with a near-term target around $0.45.

- Dormant circulation data reveals reduced movement of long-held tokens, suggesting lower selling pressure on XRP.

In a recent shift within the cryptocurrency market, XRP has seen an increase in holdings from its largest investors, known as whales, despite the overall price decline.

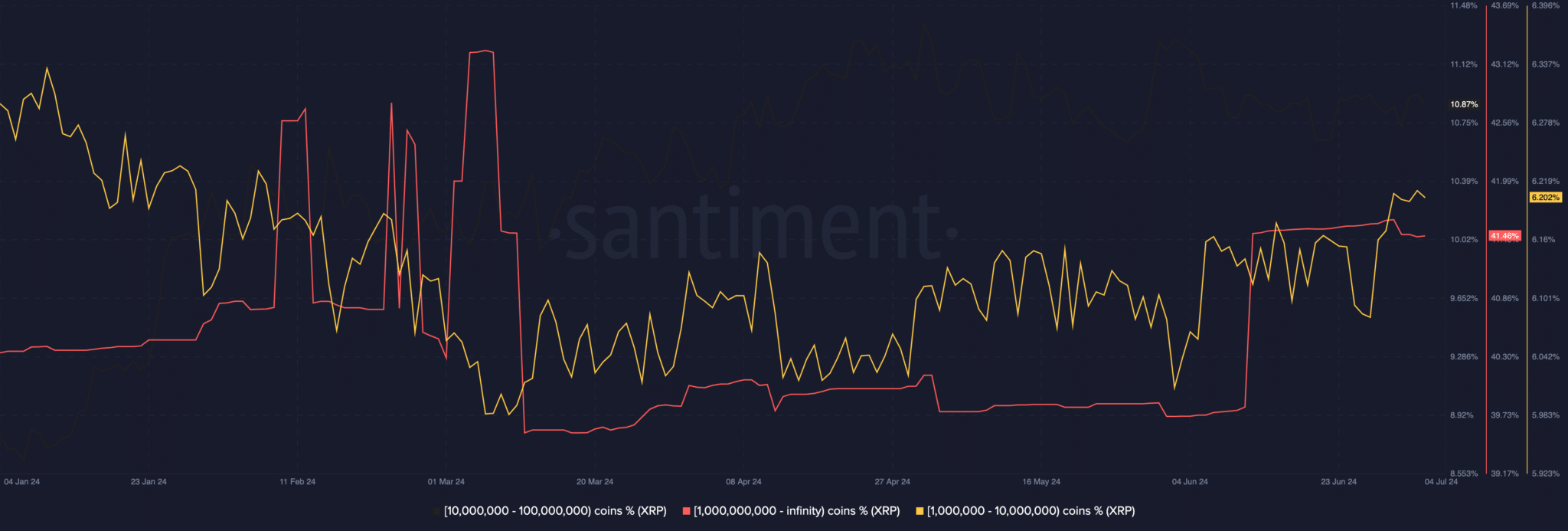

Data from Santiment indicates that the share of XRP held by addresses with over 1 billion tokens increased from 39.81% in mid-June to 41.46% currently.

This trend of accumulation by major holders is often seen as a positive sign for the potential stabilization of the token’s price. Whales can significantly influence market movements, and their increased buying activity suggests a belief in the token’s future value.

However, it’s important to recognize that the actions of whales alone are not sufficient to fully prevent a decrease in price.

For instance, the metric of dormant circulation, which measures the activity of long-held tokens, shows that there has been less movement of these tokens lately. This typically reduces selling pressure, as fewer long-term holders are transferring their assets out of cold storage.

On the technical analysis front by ETHNews, the Relative Strength Index (RSI) for XRP currently stands at 23.96, classifying it as oversold. This technical indicator suggests that there may be a rebound in price soon. According to the Fibonacci retracement tool, if a recovery occurs, the price could reach the 23.6% Fibonacci level, estimated at $0.45.

Despite these potentially positive indicators, the future of XRP’s price remains uncertain. If selling pressure increases or if whales begin to sell their holdings, the anticipated stabilization could be disrupted.

Therefore, while the accumulation by whales presents a hopeful sign, the broader market conditions and investor actions are determining the actual price trajectory of XRP in the near term.

![XRP Ledger (XRP) [09.55.49, 05 Jul, 2024]](https://www.ethnews.com/wp-content/uploads/2024/07/XRP-Ledger-XRP-09.55.49-05-Jul-2024.png)