- Worldcoin’s negative MVRV ratio suggests a recovery sign despite a 20% weekly decrease and 4.04% 24-hour dip to $4.35.

- The intentional actions of controlling supply inflation and introducing the Layer-2 blockchain World Chain are meant to increase the value and cost of Worldcoin.

With recent data from CoinMarketCap showing a drop to $4.35, down by 4.04% in the last 24 hours, Worldcoin (WLD) is currently seeing a major decline in its market price. The cryptocurrency has dropped 20% in the last week, continuing a long-term gloomy trend.

In spite of this, a few on-chain measurements and past trends indicate that the current negative trend might be paving the way for an encouraging rebound.

MVRV Data Insights: A WLD Recovering Sign?

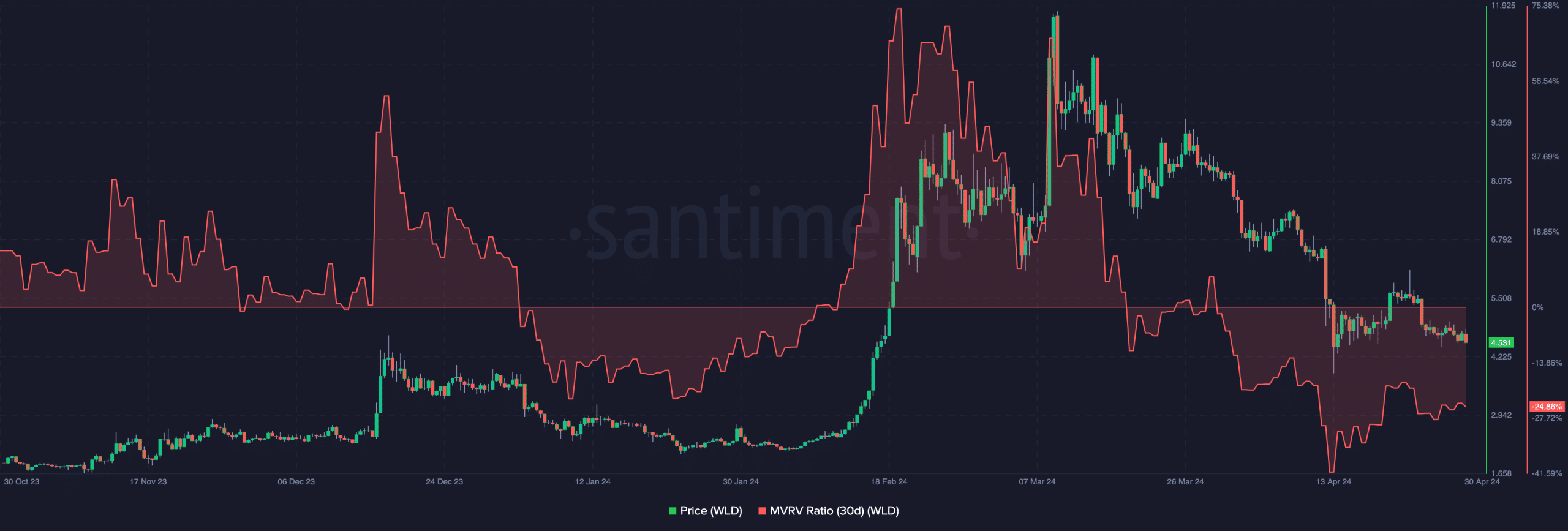

Also, WLD’s 30-day MVRV ratio is -24.86%; this number suggests that the majority of token owners are suffering from unrealized losses.

A negative MVRV ratio would normally indicate a significant sell-off, but historical evidence suggests that this may be a good moment for investors to consider purchasing because similar situations have frequently resulted in strong price recoveries.

For example, WLD’s MVRV ratio dropped to -22.25% in January, but the cryptocurrency made an amazing recovery, rising from $2.50 to $11.88 during the next few weeks.

While it is unclear if WLD will replicate these precise returns, analysts estimate an average return of about 24.57% from present levels, and they suggest that a rebound to $7.42 is achievable.

World Chain and Supply Strategies: New Developments

The launch of Worldcoin’s own Layer-2 blockchain, called World Chain, intended to run on top of the Ethereum network, has increased speculative excitement, as previously reported by ETHNews.

This move is a component of a larger plan to satisfy the growing demand for the project’s orb-verified World ID, in line with what ETHNews previously disclosed. Worldcoin intends to release 0.1% to 0.4% more tokens each week as part of a controlled inflation of its circulating supply to meet this demand.

What’s Next for WLD?

Technically speaking, WLD has been under consistent selling pressure since March 9, when it formed a descending channel. However, there are indications of resiliency, as bulls seem to have fortified their position at $4.43.

Both the Money Flow Index (MFI) and the Relative Strength Index (RSI) point to the token approaching oversold conditions, which might signal a short-term rebound to levels as high as $7.46.

Despite these bullish indicators, investors are advised to remain vigilant. The market’s overall bearish mood and recent decrease in daily transactions, which have fallen to 1.87 million, indicate that fewer tokens are changing hands—suggesting a decline in immediate selling pressure but also a cautious market sentiment.