- Whales deposit $10.6 million in SHIB and PEPE, suggesting possible sales that may influence market supply and prices.

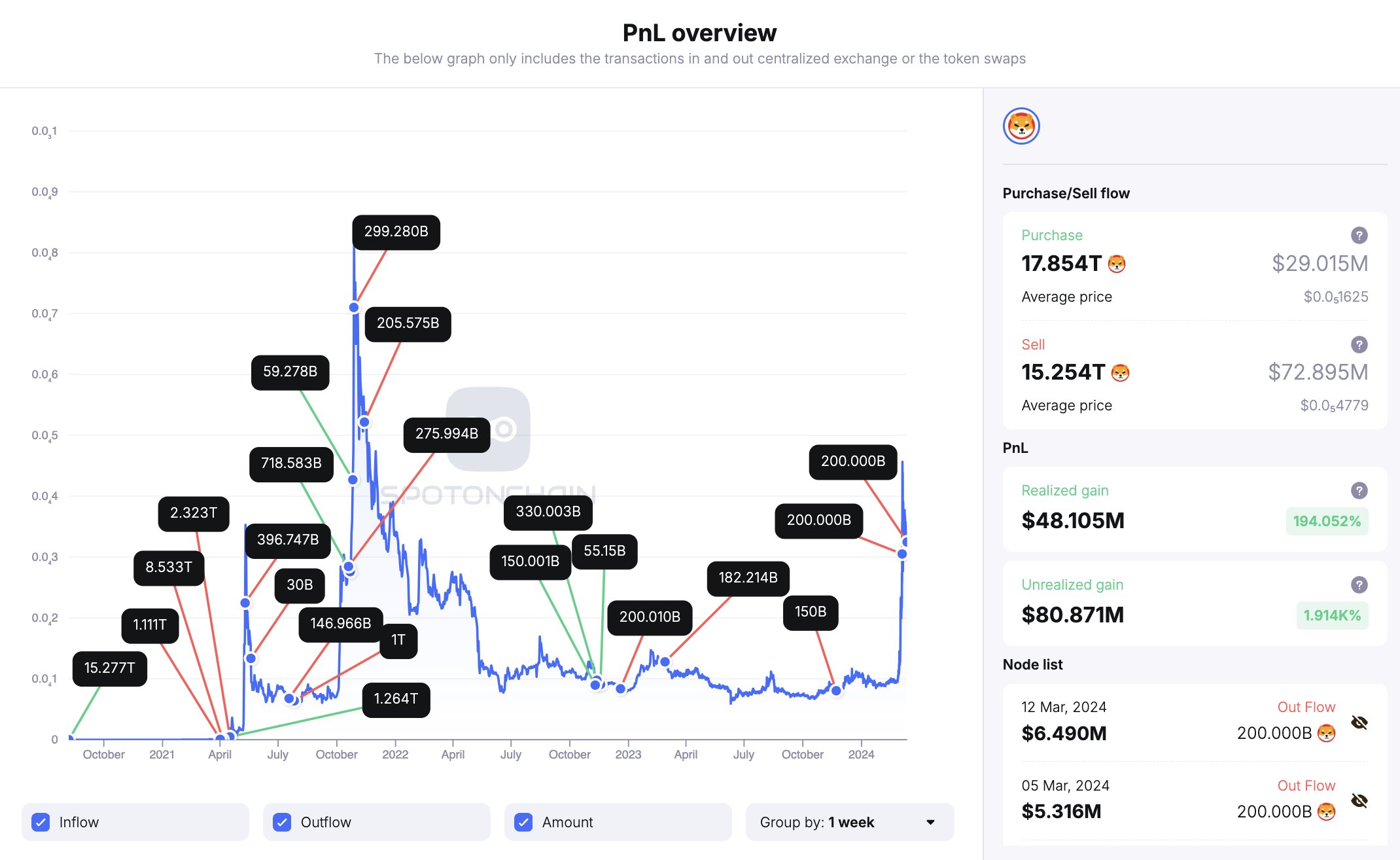

- Transfer of 200 billion SHIB to exchanges, valued at $6.49 million, could indicate a preparation for position reduction.

Dogecoin’s behavior has garnered attention recently due to a downward trend in its trading volume, which is generally interpreted as a harbinger of a possible drop in its value.

With a price oscillating between a support level of $0.1548 and resistance at $0.27, this digital asset is showing signs of a potential price stabilization after experiencing a previous surge.

However, the decrease in trading volume and a possible break below the support level could anticipate a direction towards a negative trend in its price.

On the other hand, Cardano exhibits a double top pattern, which in terms of technical analysis suggests a possible trend reversal to the downside. This formation, characterized by reaching two consecutive highs with a moderate decline in between, points to price resistance near $0.80 and support at $0.580.

If this pattern persists, Cardano’s price could face a slight correction, although institutional analysis bodes well for future ADA projects, so we could see prices above the dollar again.

In a similar context, Shiba Inu is showing signs of a price correction, with resistance identified at $0.00003888 and a key support level at $0.00003286. These figures suggest a possible reversal in the market trend, evidenced by an increase in selling pressure and a decrease in buying demand.

If Shiba Inu fails to hold above its immediate support, it could begin a downtrend towards deeper support at $0.00002836,which would represent a window of opportunity for optimistic investors to attempt to regain control of the price.

The whale’s move signals the end of the meme currency’s run

According to data from intelligence trackers, two “whales” made transfers of SHIB and PEPE to centralized exchanges. These transactions involved the deposit of $10.6 million in SHIB and PEPE, highlighting not only the volume of the transaction but also the potential impact on the market.

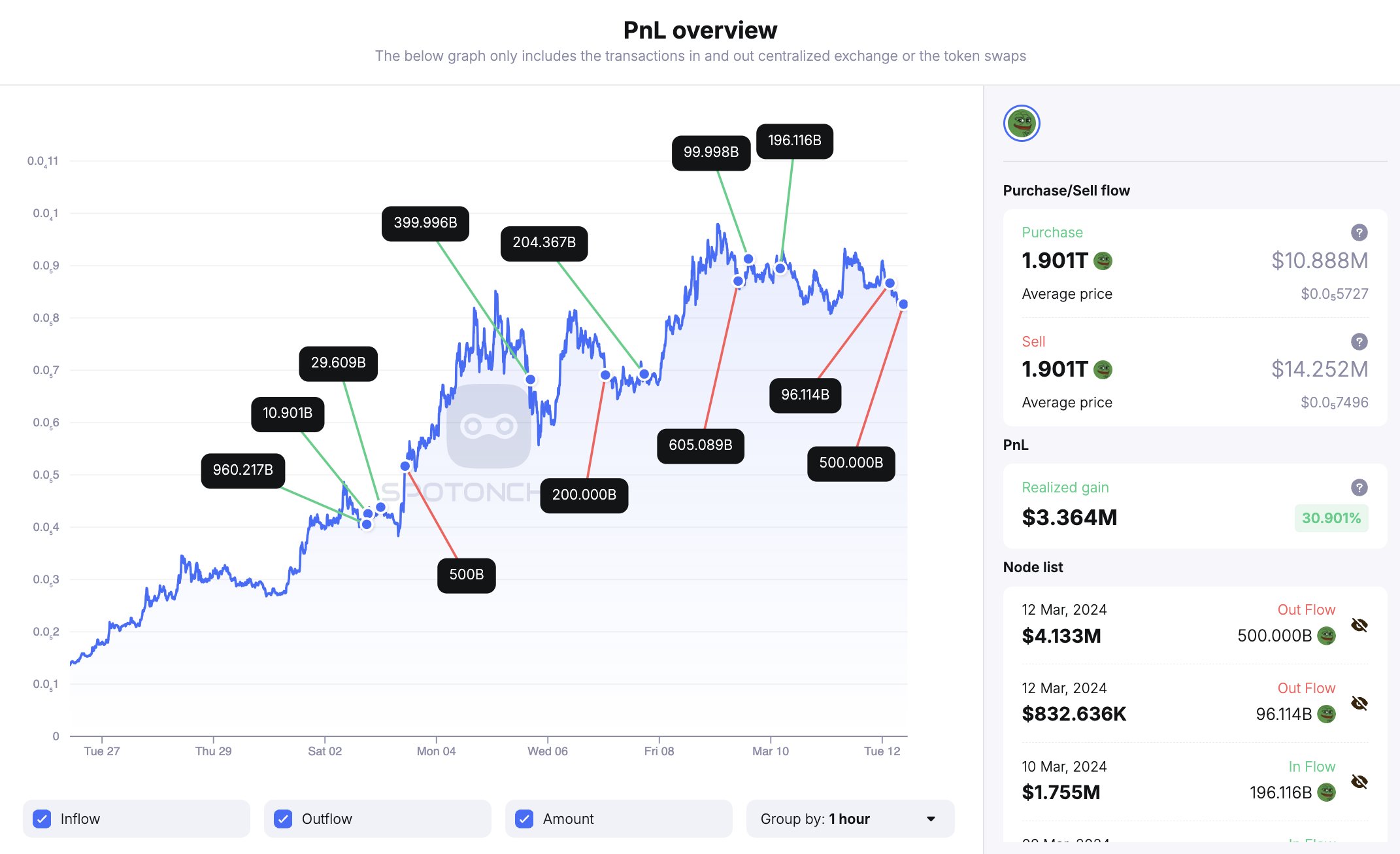

Separately, another whale deposited 500 billion PEPE tokens, valued at $4.13 million, on the OKX exchange on Tuesday. This bulky deposit came from a portfolio management that acquired PEPE less than two weeks ago, showing an unrealized profit of $3.36 million, roughly a 31% gain on its initial investment.

These types of moves highlight the volatility and quick profit opportunities in the cryptocurrency market.

If whales withdraw their assets from exchanges, this may reduce the supply available for sale, possibly driving the price higher due to the perception of scarcity.

These actions can also be signals to other investors, who often interpret whale movements as indicative of future trends, adjusting their investment strategies accordingly.

These movements in the cryptocurrency market reflect how volatile these cryptomemes are and underscore the importance of constantly monitoring technical indicators to make informed investment decisions .