- Ethereum demonstrates its growth potential by achieving 25% of its supply being staked by 936,849 validators.

- Lido Finance leads as the preferred platform for ETH staking, capturing 31.8% of the market with attractive rewards.

Ethereum has once again demonstrated its ability to attract significant investment. Nearly a year after the Shapella update, 25% of ETH supply has been staked , marking a point of growing interest among investors and validators. This development underscores confidence in Ethereum’s sustainability and long-term growth potential.

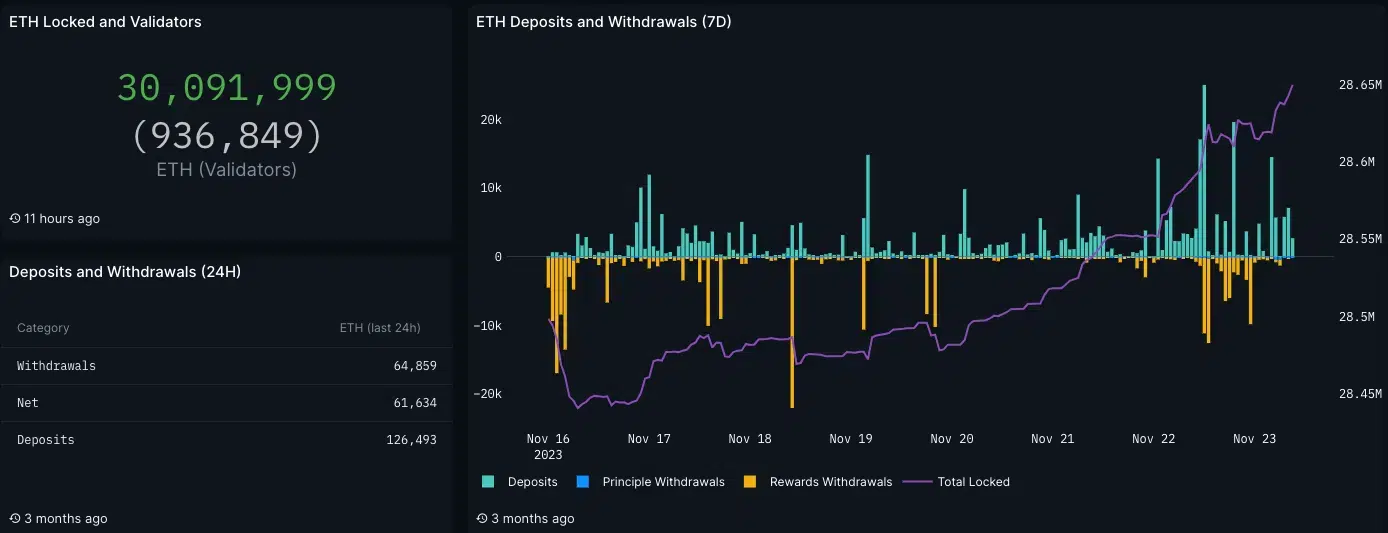

According to recent data, using the Nansen dashboard, it has been confirmed that 30 million ETH, equivalent to 25% of the total supply, is currently in staking. This staking involves 936,849 validators, reflecting a broad base of support and participation in the network.

The 2023 Shapella upgrade marked the beginning of large-scale staking in Ethereum, although this activity was already present since the September 2022 merger. The transition from miners to validators to secure and maintain the network has been a structural change for Ethereum, directly affecting the way transactions are processed and verified.

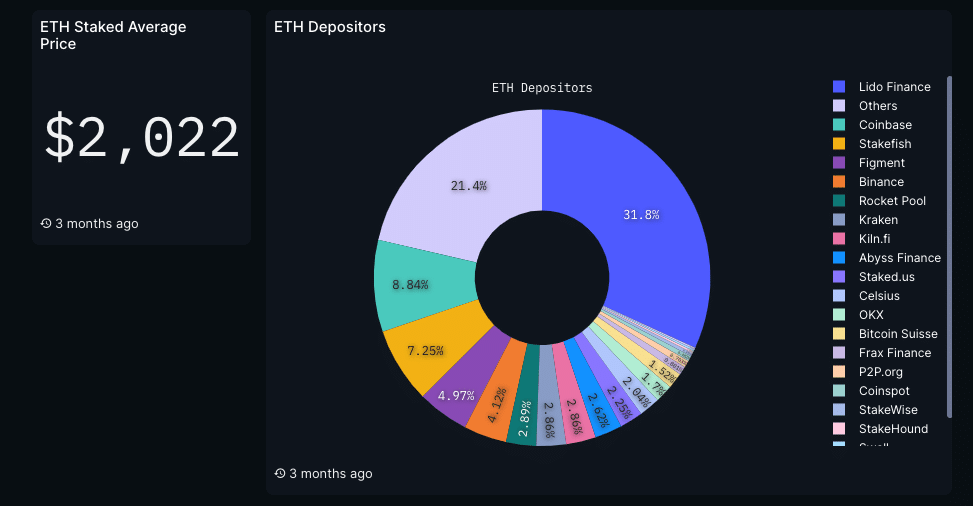

The interest in staking is not only a network security issue, but also an investment opportunity. Validators receive rewards for their participation, with annual interest rates ranging from 6% to 15%. However, there is an entry barrier of 32 ETH to become a validator, which limits this activity to investors with sufficient capital.

Lido Finance has emerged as the platform of choice for ETH staking, capturing 31.8% of the market. This is due to its ease of use and economic incentive, as the average price of ETH in staking is $2,022, providing gains from both the rising altcoin price and staking rewards.

Despite a decline in staking deposits at the start of January, the last week of the month saw a turnaround, with a significant increase in participant interest. This uptick aligns with an increase in the price of ETH to $2,435, coinciding with the time when staked supply reached 25%.

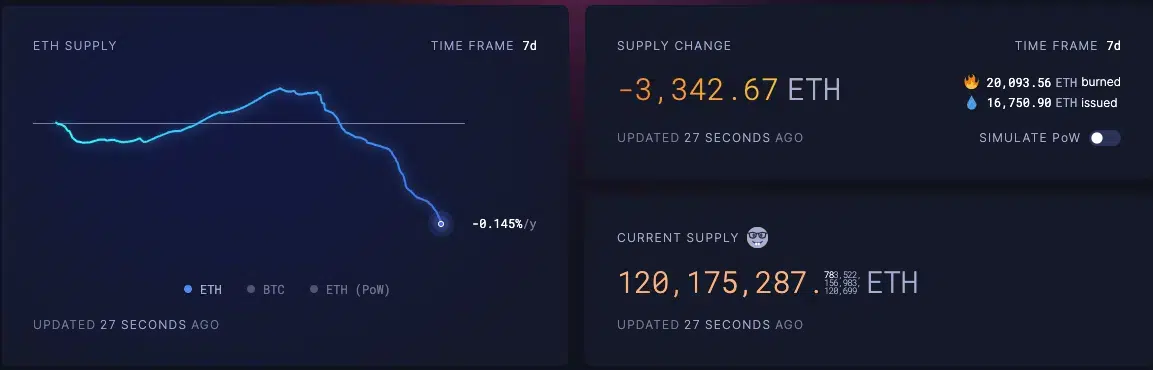

In addition, Ethereum has maintained its deflationary status, with a supply change of -3342.67 ETH, indicating a reduction in the total amount of ETH available. This aspect is essential for the long-term valuation of ETH, as limited supply with increasing demand can propel the price upwards.

Investors and traders should keep an eye on upcoming settlement and resistance levels, with $2,520 and $2,750 as critical points. These levels not only represent investment opportunities, but also indicators of financial health and interest in Ethereum as a long-term investment.

At the moment, at the time of writing the price of ETH is at $2,484.90